There’s a common notion, often repeated in grumbled old man tones at country bars and hardware store counters, that, “people just don’t understand personal finance.” That it isn’t taught in schools, and that the widespread financial ignorance of the masses (especially the KIDS!) is the reason the economy is in the sorry state it is, and that goes double for the culture.

Like most conventional misunderstandings, it’s partly true. A mountain of per-capita debt and a lack of per-capita savings indicates that the average consumer does not generally apply personal finance best-practices. But that doesn’t mean they aren’t generally understood. The building blocks are absolutely taught in schools, and have been for some time. We have it on good authority that today’s adults were taught simple and compounding interest in both ninth grade math and the remedial ninth grade math they taught to the reprobates who flunked regular ninth grade math. This author’s high school also offered both accounting 11 and accounting 12.

Personal finance is basically applied arithmetic and, since the average person is of average intelligence, pretty much anyone with a bank account, a credit card, and a GED understands the basic building blocks of personal finance just fine. There are people who can’t read who understand it better than most.

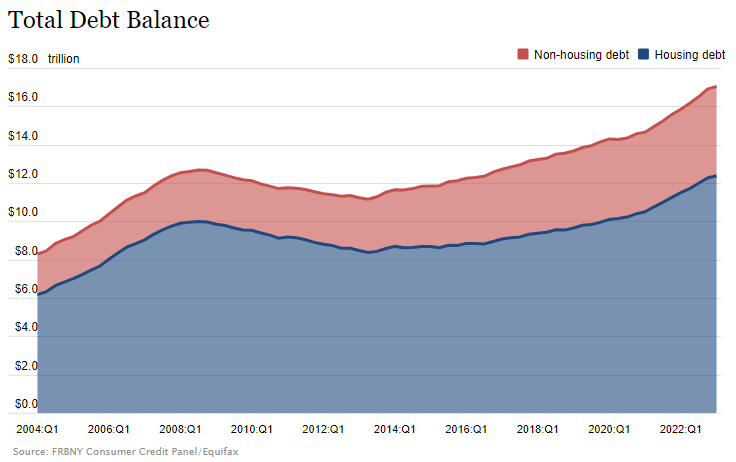

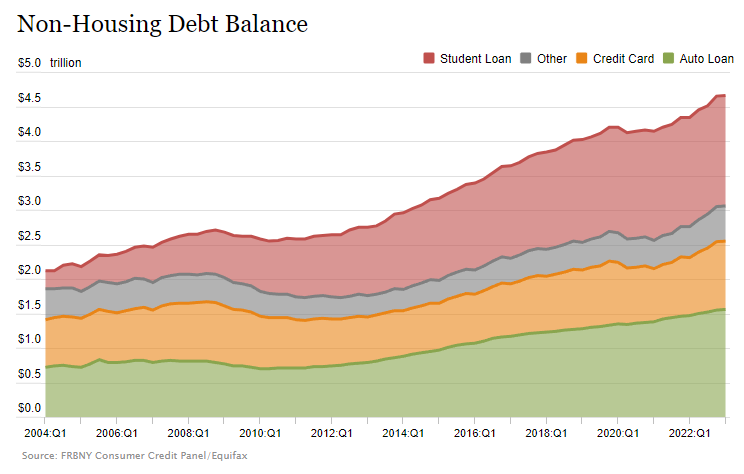

And yet, through the collective American understanding of personal finance, the country has racked up $17.05 trillion in household debt. That includes $12.38 trillion in housing debt, and $4.73 trillion in other debt like student loans, auto loans, credit cards, etc.

The average comes out somewhere around $100,000 per person, varies by demographic, and depends how it’s counted. No matter how it’s counted, it’s on the climb in every category.

Whether this debt load matters or not to the debtors who carry it isn’t a question that can be answered with aggregated or averaged data. The tolerance of any household’s debt load has to be assessed in the context of its debt mix, and the income, assets, and liabilities of the debtor. Getting a read on it isn’t complicated for anyone with grade nine math skills and a spreadsheet.

But if most debtors do understand it, they aren’t doing much to address it. Many debtors just avoid it, and end up getting taken by the star of today’s episode: Dave Ramsey.

@daveramsey If you don’t go get your income back, it’s going to be your fault. Because I’m going to show you other people who did it. If you don’t go get control of your life again, by getting out of debt and using your income to build wealth, it’s your fault starting today. You’ve spent too much of your life giving your income away to other people. It’s time. Aren’t you sick and tired of being sick and tired? It’s time to do something about it. “I’ve had it!” When you say that, that’s when you change your life. #moneytok #debtfree #moneyproblems #debt #winwithmoney #wealthymindset

♬ original sound – Dave Ramsey

After watching enough of Dave’s show to understand its formula, we were dumbfounded by the fact that this person isn’t consistently laughed at. To the contrary; he has millions of loyal listeners who consider him their no-nonsense financial knowledge guy.

It started to make a lot of sense when we realized how scared these people are.

Ramsey took the grumbling old man sentiment, added a bit of religion, and made it into a popular radio show that serves as the ballast of a broader, cultish empire. He frequently provides counsel to people who are carrying big, scary debt loads, on the air, where the other terrified debtors in his audience can listen and gain what he passes off as insight, but is more like a sort of catharsis.

Ramsey’s method starts with an un-convincing, half-assed imitation of the math-and-context debt assessment method we’ve suggested, and quickly becomes a kind of confession and repentance ritual. To be fair, the conventional method would make terrible radio.

Ramsey berates these people with what he’d surely call knowledge and tough love, but is more like dime-store wit and hard-driving scorn. His chastising for lack of financial common sense invariably comes with instructions to think of one’s financials “spiritually,” and his writings on the matter frequently cite the King James Bible.

TikToks of Ramsey scorning his in-debt listeners and calling it help get a lot of play, and the most popular of those clips makes a fine example.

@daveramsey This couple is a million dollars in debt. #moneytok #broke #debt #debtpayoff #nomoney #studentloans #creditcarddebt

♬ original sound – Dave Ramsey

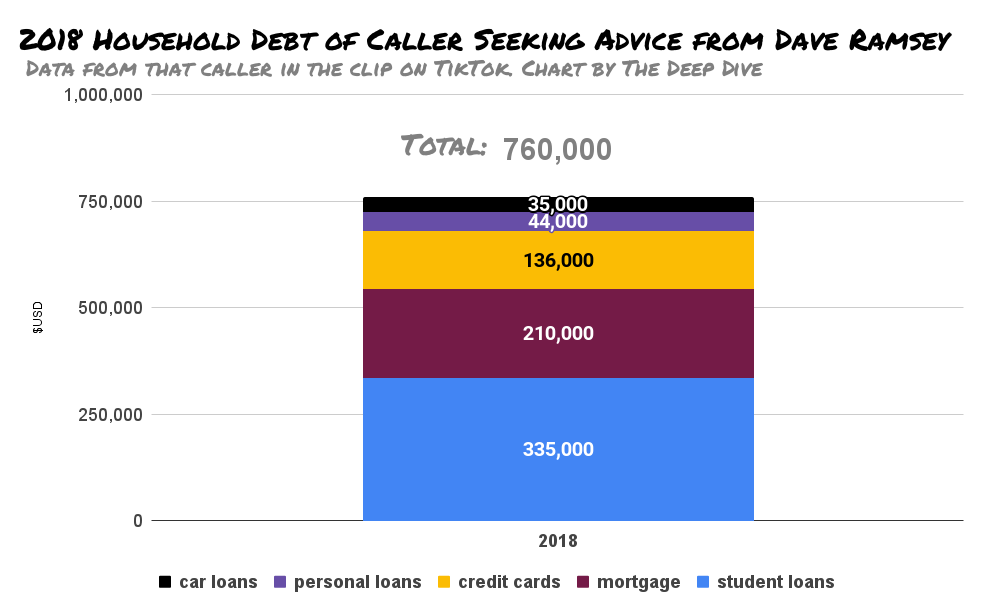

The Washington, DC – based caller tells Ramsey that her and her husband have $760,000 in debt, consisting of $335,000 in student loans, $210,000 in mortgage debt, $136,000 in credit card debt, $44,000 in personal loans, and $35,000 in car loans.

As soon as she’s finished itemizing the debt and totals, the caller lets out the kind of hard sigh one might expect from someone who just put down a crate of rocks they’d been carrying all day. Therapists are familiar with this sigh. It may well have been the first time she’d ever talked about all of this debt, all at once. Let’s draw it up:

Ramsey doesn’t waste any time. His first question is: “What in the world!?” and his second question is whether or not they’re both “on this,” (as if it’s a drug), or whether it’s just one of them who has “completely lost [their] mind?”

With arms crossed, he leans back with distain and has the caller explain herself. Once she repents her and her husbands’ “poor financial decisions,” Father Ramsey’s tone becomes a bit more forgiving as, finally, he asks about their income.

The caller doesn’t say whether the $230,000/year joint household income is net or gross, so we’ll treat it as a pre-tax figure. Deductions could bring that figure up, state tax could bring it down, let’s call them a wash and work with $184,900 in annual net household income. Both earners work in government.

The income information softens Ramsey’s face and tone to the point where he’s almost willing to help, but first he wants, “recognition on both of [their] parts about how absurd this is!” The caller gives it to him, and he professes to be, “on [her] team.” Mea culpa secured, Ramsey winds up for the tough-love advice that the caller has been craving, and lets her have it. He gets ready to, “destroy [their] life as they know it,” tells them that they’re living beyond their means, and are going to have to spend like radish harvesters for the next three years.

You’d have more money if you didn’t throw it away on school and medicine!

We commend Ramsey for his showmanship: both the caller and the audience got what they wanted out of this repentance dynamic. But if he understands anything at all about the real-world financial situations experienced by conventional income earners, he certainly isn’t showing it.

Ramsey never gets down to why the caller’s situation is “absurd,” because it isn’t. Government jobs that pay a combined $230,000 / year don’t come without educations, and people without trust funds have to borrow to pay for those educations.

Relatedly, dedicated students earn well below their expenses, and the credit card companies, who see those government jobs coming, are happy to accommodate the necessary, un-necessary, and emergency spending they do in the interim.

It’s likely that this couple has mortgage debt by virtue of a down-payment financed through personal loans from parents or relatives who would rather not watch them flush $10,000 – $20,000 / year down a sewer pipe to the landlord. If that’s the case, it puts them in possession of some DC or Northern Virginia real estate, and puts the interest rate on that personal debt on the low side, with a good chance it goes away once they start popping out grandkids.

America is built around cars, and anyone who doesn’t live in the reasonable urban transit meccas of New York or Chicago pretty much needs one. Anyone without the knowledge, space, and tools to fix a vehicle needs to have a newer one, and that means financing.

If this couple serviced these debts at payments equal to the 2018 interest accruals +40%…

…they’d still have $8,500 per month between the two of them to spend on household expenses, groceries, entertainment, gas, incidentals, etc. Healthcare costs are usually the tipping point here, and the government jobs have those taken care of.

The sheet has them still carrying just under $492,000 in debt in 2026, but that assumes nobody gets a pay raise, and doesn’t account for potential real estate windfalls or grandparent-joy-jubilee which, of course, would also come with childcare expenses, college fund contributions, etc. Life is a moving target.

If everything stays exactly the same (which it won’t) the debt is all paid off by 2033. The caller was 29 in 2018, and would be 44 in 2033: entering her prime years as an income earner, debt free with a paid-off house.

The $230,000 / year in (2018) income wouldn’t be there without the $335,000 in student loans and probably most of the $136,000 in credit card debt. The $210,000 in property debt wouldn’t be there without some kind of generational wealth backing the personal loan that facilitated the down payment. Neither the real estate or the parental lenders are done paying out. This couple is just fine, and will likely continue to be fine, because the economy is built to bleed them at a rate that keeps them alive and bleeding.

America is expensive and, despite Ramsey’s frequent claims that wealth comes from hard work, fiscal prudence, and a devotion to god, the small army of migrant farm workers who facilitate the production and delivery of the food he eats, while each earning less money than he spends on gas, know different. There isn’t a debt problem in America so much as there’s a class problem in America, and the only way up the ladder is to borrow.

There aren’t may DC power couples pulling down serious consulting cake who drive ratty jalopies and don’t spend time in party spots, because they’re busy cultivating a personal brand that projects brokeness. Nobody does that. Not even Ramsey! The guy opens the talks he gives to his adoring seminar flocks in high-end hotels by telling them some dubious Horatio Alger story about how he came up poor, but then goes on for a while about how rich he is now. Nobody would listen if he went on about how he lives humbly and spends little, because being broke sucks.

So Ramsey acts (and is) very rich. He’s getting richer all the time by the rate at which he folds his followers’ earnings into his own. Stay tuned.

Information for this briefing was found via TikTok, Dave Ramsey, a calculator, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.