Delaware has become the center of national attention as a bill allowing Limited Liability Companies (LLCs) to vote in city elections garners controversy. While the focus has been on this proposed legislation, recent investigations reveal that at least 17 Delaware towns already permit LLCs to vote in local elections, and the new bill may even extend voting rights to churches.

Under Delaware’s home rule charter law, towns with over 1,000 residents enjoy significant autonomy in self-governance. This law includes provisions that allow cities and towns to modify the qualifications for voters in municipal elections. Apart from a dozen municipalities where non-resident property owners are permitted to vote, previous reports have highlighted three towns that enable LLCs incorporated within their borders to participate in local elections.

Delaware has a home rule charter law which allows any town with more than 1,000 residents broad leeway for self-governance. Part of this law allows cities and towns to "change the qualifications of those entitled to vote at municipal elections." 2/https://t.co/iaX8UXUlna pic.twitter.com/f4ktW4DBzb

— More Perfect Union (@MorePerfectUS) June 29, 2023

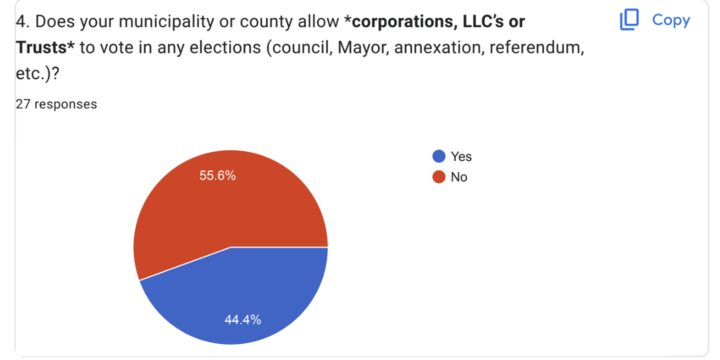

However, the actual number of towns permitting LLCs to vote is higher than previously known. More Perfect Union recently obtained a poll of 27 municipalities in Delaware, revealing that officials from 13 places confirmed LLCs’ voting rights in some elections.

This is not the first time the issue of LLC voting has stirred controversy. A proposal to allow LLCs to vote in Rehobeth Beach was met with strong opposition in 2017, ultimately leading to its demise.

Although the prospect of granting voting rights to businesses has been put on hold in Rehoboth Beach, the city commission is recently considering other changes, including shortening the residency requirement for voting eligibility and reducing the time nonresidents must own property in the city limits. These changes would require amending Rehoboth’s charter, which necessitates approval from the General Assembly and Governor John Carney.

Rehoboth Beach Mayor Paul Kuhns, who co-owns the Arena’s Deli & Bar chain, initially supported the idea of allowing LLCs to vote based on voter feedback he received during his campaigns. However, after listening to public sentiment, he recognized that the proposal faced insurmountable challenges. While he believes the issue may resurface in the future, Kuhns acknowledges the current opposition and the need to respect constituents’ wishes.

In 2018, a developer acting as the registered agent for numerous LLCs in Newark was able to cast 31 votes in a referendum. Following public outcry, city leaders moved swiftly to close the loophole.

Several other municipalities, including Fenwick Island, Henlopen Acres, and Dagsboro, already allow corporations to vote.

Seaford

Seaford, Delaware—already known for its business-friendly environment—is taking its pro-business stance to a new level with a proposal that would allow businesses to vote in local elections. The town, situated on the picturesque Nanticoke River, recently amended its charter to grant voting rights to businesses, including LLCs, corporations, trusts, and partnerships. However, this move has sparked a heated debate over the extent of corporate power in local government.

In Delaware’s seventh-largest municipality, Seaford Mayor David Grenshaw is leading an effort to grant voting rights to “artificial entities.” If approved by the General Assembly, this change could fundamentally alter the nature of elections in Seaford.

Grenshaw has a history of championing corporate interests during his tenure. In 2017, Seaford City Council became the first Delaware municipality to pass a “right-to-work” law, though it was later overturned by state lawmakers.

The council approved a plan in April to allow LLCs to vote, shortly after an election where only 340 individuals cast their votes. According to a report by The News Journal, there are 234 registered businesses in Seaford, suggesting that LLCs could significantly influence entire elections.

Seaford city officials also suggested that nonprofits and even churches could be granted voting rights. During an April 11 meeting, a councilman inquired about churches’ eligibility to vote, and the city’s lawyer confirmed their inclusion in the plan.

The bill was subsequently sent to the legislature and gained approval from a committee comprising House leaders, including Democratic Speaker Pete Schwartzkopf, in May. Schwartzkopf expressed his desire to defer to “small town governments” regarding their local laws. Despite being included on the House agenda twice, the bill was unexpectedly removed both times without explanation following national coverage. However, it has now returned for consideration a third time.

BREAKING: The Delaware House is once again set to vote Tuesday on a bill that would allow hundreds of LLCs to vote in local elections in the town of Seaford, pop. 8,500.

— More Perfect Union (@MorePerfectUS) June 26, 2023

The bill was pulled from the schedule last week after receiving national scrutiny — but now it's back. pic.twitter.com/rSTtdulBig

When asked about the bill’s provisions, a spokesperson for Representative Daniel Short, the legislator from Seaford who introduced the bill, directed inquiries to Seaford leaders who drafted the legislation. The spokesperson also emphasized that the proposed change to allow LLC voting in Seaford was not groundbreaking and highlighted that “more than 10” Delaware municipalities already permit LLCs to vote in some municipal elections.

The legislative timeline is further complicated by a June 30 deadline to pass bills funding the state budget, including a $1.4 billion bond bill requiring a two-thirds majority, which necessitates at least two Republican votes. In parallel, Representative Sherry Dorsey Walker has introduced HB189, a bill aiming to prohibit LLCs from voting in any local election in Delaware. However, this bill has yet to receive a hearing in the House.

Opponents argue that corporations already exert excessive influence over politics and that allowing them to vote would further dilute the voice of residents. Claire Snyder-Hall, executive director of Common Cause Delaware, a watchdog group, expressed shock at the attempt to give voting rights to artificial entities, stating that it would suppress the votes of local residents.

Critics point out that while the proposal prohibits double voting for human residents, it permits out-of-town business owners to vote twice—once in Seaford and once in their primary place of residence.

Delaware is renowned for its corporate incentives, such as allowing LLC owners to remain anonymous and exempting businesses from paying corporate income tax. Most businesses headquartered in the state do not have a physical presence there, including two-thirds of Fortune 500 companies.

For the Seaford proposal to become law, it must be approved by two-thirds of the state legislature and signed by the governor. Although the current legislative session ends on June 30, the amendment could be reconsidered next January when the session restarts.

The American Civil Liberties Union in Delaware has expressed concerns about the constitutionality of such laws, suggesting they could lead to lawsuits and an unfair selection of voters by elected officials.

The “one person, one vote” principle enshrined in the Constitution is being challenged by the persistent push for corporate voting rights. If the Delaware legislature continues to support this dystopian practice, LLCs may soon possess more rights in some Delaware elections than living, breathing citizens.

Information for this story was found via Delaware Online, CBS, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.