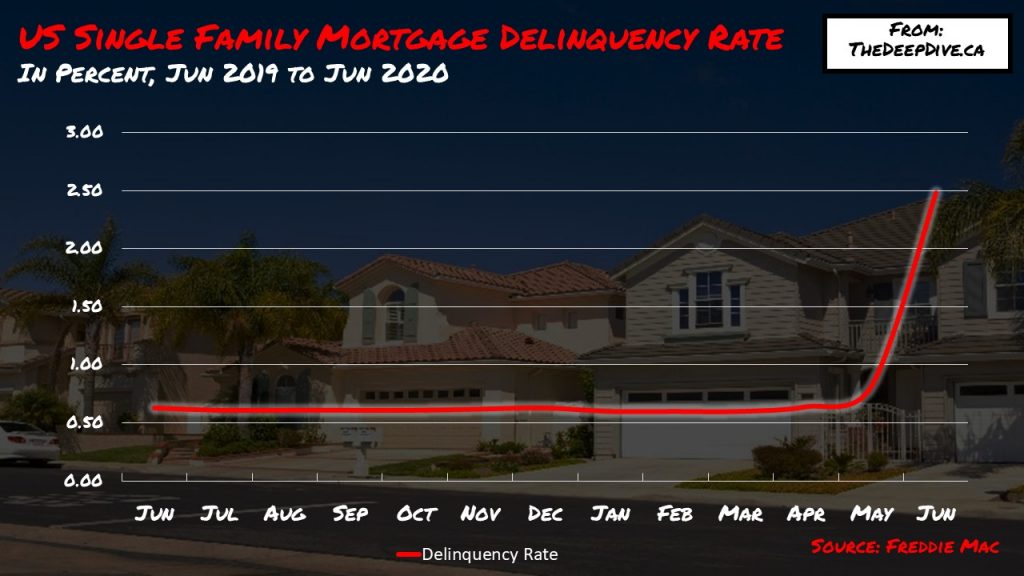

A double-dip recession becomes more and more evident as coronavirus cases continue to soar across the US, initial jobless claims continue to rise despite the easing of restrictions and business reopenings, and Americans continue to struggle with mounting debt. As a result, Freddie Mac’s recently released June data showed a startling 2.48% delinquency rate – which has significantly increased from 0.81% in the month prior.

When a coronavirus response was first initiated by states and the federal government, many banking institutions such as Fannie Mae and Freddie Mac unveiled forbearance payment options for income-strapped homeowners that held federally backed mortgages. The terms on the forbearance programs differ, but all eventually lead to the borrower repaying the payments missed during the forbearance period.

Now that the US economy is several months into a deep recession that does not appear to be subsiding for the long run, lenders are becoming increasingly worried. The delinquency rate for single family mortgages reached 2.48% in June, the highest delinquency rate since February 2010, when it peaked at 4.20%. The mortgage loans contributing to such a startling delinquency rate are either more than three months overdue or have already entered foreclosure. However, the loans that are currently registered in forbearance programs are also counted in the delinquency rate.

Nonetheless, with an end to the coronavirus pandemic nowhere in sight, the delinquency rate for July will most likely be even higher than June’s. As initial jobless claims are once again rising after a short period of declines, many more Americans will be reliant on the federal government’s second round of coronavirus stimulus, and will most likely continue to defer their loan payments.

Information for this briefing was found via Freddie Mac. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.