It appears that the federal legalization of cannabis in the United States might not be in the best interest of cannabis investors. That is, if the Democrats get their way as proposed legislation is currently written. In fact, investors might be better off under the current federally illegal status, believe it or not.

The reason for this is that it appears that the Democrats have taken aim at not just “Big Tobacco” and “Big Alcohol” in their proposed legislation under the Cannabis Administration and Opportunity Act, but “Big Cannabis” as well – and this is bad for investors in the space.

In terms of Big Tobacco and Alcohol, as Natalie Fertig at Politico points out, “groups from both sides of the aisle proposed banning big tobacco in a future cannabis industry.” While she directly mentions Big Tobacco, the screenshots enclosed in her accompanying tweet, actually highlight the involvement of Big Alcohol as well.

One thing I found interesting from the Schumer-Wyden-Booker cannabis decrim bill comments: groups from both sides of the aisle proposed banning big tobacco from involvement in a future cannabis industry. pic.twitter.com/bhXMk0yjbX

— Natalie Fertig (@natsfert) September 7, 2021

This tidbit is worrisome for, well, any major name in the cannabis space today. If equity ownership or partnership with an alcohol name or tobacco name excludes one from the US industry, well then, Canadian cannabis co’s that have been finagling to get into the space might be in trouble. Between the two major industries, here’s a quick rundown of those who may be excluded, or whom may have to give up their largest financial partner, in no particular order:

- Canopy Growth Corp (TSX: WEED) – Constellation Brands

- Tilray (TSX: TLRY) – SweetWater Brands (wholly owned)

- Hexo Corp (TSX: HEXO) – Molson Coors (US/Canadian partnership)

- Cronos Group (TSX: CRON) – Altria

- Auxly Cannabis (TSX: XLY) – Imperial Brands

- Organigram Holdings (TSX: OGI) – British American Tobacco

Moving on to “Big Cannabis,” certain text included within the proposed legislation might be viewed as heavily problematic by current multi-state operators in the space that feature billion-dollar market values. Especially if they operate in limited licenses states, where vertical integration is a must.

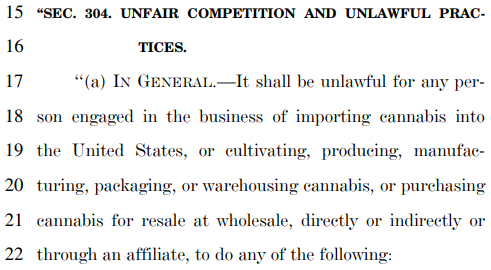

That’s because Section 304 of the proposed act – the section on unfair competition and unlawful practices – poses quite the problem as currently written. That’s because there are a number of items that the Democrats want to prevent persons engaged in importing as well as, “cultivating, producing, manufacturing, packaging, or warehousing cannabis, or purchasing cannabis for resale at wholesale,” from doing.

The first such item, is “Exclusive Outlet”, meaning that a retailer must be allowed to purchase cannabis from other vendors as per the proposed federal law. The text outlines that the “exclusivity” cannot be in whole, or in part – meaning no quotas are allowed to be formally set on just how much one company’s products is stocked in a store.

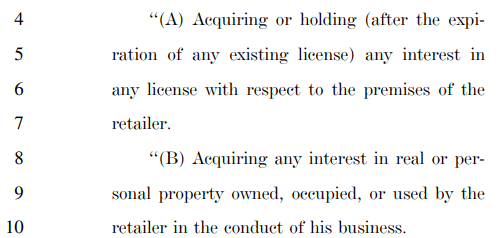

The second item however, under Section 304 (2) is perhaps the most damaging – referred to as “Tied House”. The legislation, under section (A), states that it is unlawful for the above listed persons or entities to, “Acquiring or holding (after the expiration of any existing license) any interest in any license with respect to the premises of the retailer.” In plain English, this means that retailers cannot be included in vertical integration – which is the source of much of the topline revenue recorded in the space.

Furthermore, legislators have evidently been studying the structure and workarounds currently being used in the industry. Under Section 304 (2) (B), the Act also prohibits those same persons or entities from “Acquiring any interest in real or personal property owned, occupied, or used by the retailer in the conduct of his business, while section (C) outlines that the renting of equipment is prohibited.

Restrictions continue to pile up from here, with payment for advertising or distribution, guaranteeing any loan or repaying financing obligations, extending excessive credit, or quote requirements, all restricted under the proposed legislation as well.

Effectively, the Democrats have taken direct aim at Big Cannabis, and have attempted to limit their ability to capture revenue in the space via vertical integration. The proposed legislation effectively outlines a scenario where “Big Cannabis” will consist of two camps – the growers, and the retailers. Whether the legislation goes into effect as it stands however, is anyone’s guess.

The full proposed legislation under the Cannabis Administration and Opportunity Act can be found here.

Information for this briefing was found via Senate.gov. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.