The coronavirus-induced oil price crash has caused the industry as a whole to suffer unprecedented setbacks, with a recovery slipping further and further away from the foreseeable future. Not only has the demand for fossil fuels dropped drastically, but so has the sentiment surrounding business activities in the oil and gas industry.

With many OECD countries ramping environmentally friendly policies in lieu of building more pipelines and non-renewable energy-dependent infrastructure, Deutsche Bank has taken things a step further, and has decided to cut any new financing for projects in the Arctic Region and the oil sands. The German bank has also decided to put an end to financing any sort of projects that impede water supplies with the use of hydraulic fracking. Then by 2025, Deutsche Bank will cease any of its global business activities related to coal mining.

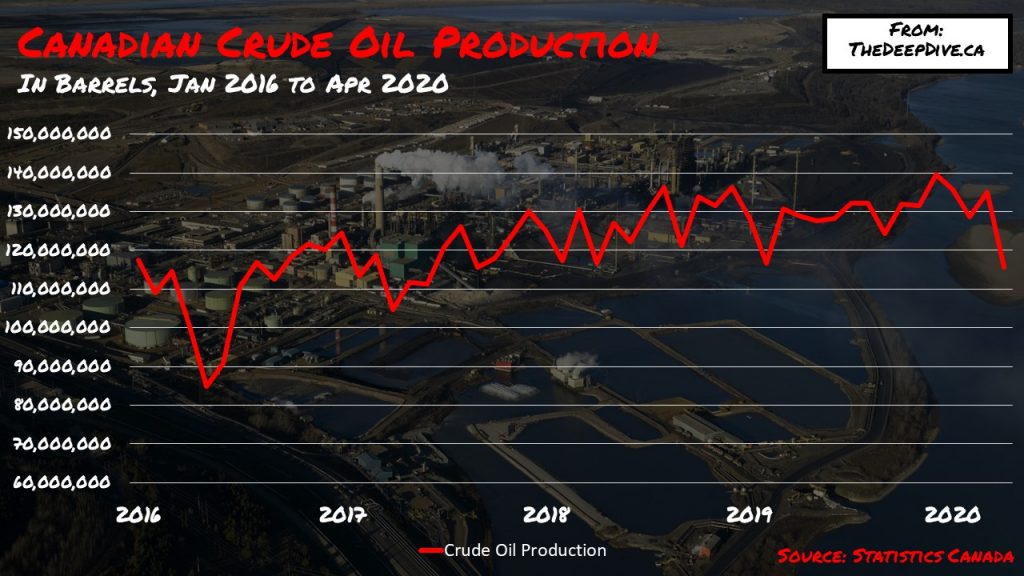

The decision by Deutsche Bank to no longer associate with the extraction of fossil fuels adds a further disastrous blow to the oil industry. A recent report released by Wood Mackenzie, found that Canada’s oil sands have been particularly impacted by the sudden coronavirus economic downturn, with expected cash flows falling by more than US$32 billion. Moreover, upstream investment is projected to decline by US$8 billion in 2020, with capital spending dropping by more than 80% compared to 2013 levels.

In the meantime, oil production in Alaska has been shut-in, with almost all drilling activity suspended indefinitely. 50% of exploration plans for 2020 have been deferred, and nearly US $3 billion of investments have been foregone between 2020 and 2022. The remainder of the US has been rampantly dropping drilling rigs and shutting in wells, as it deals with an oversupply in its storage facilities.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

What keeps hitting the oil industry? I want to know the answer to this question. Nobody is giving me an answer, and I hope that someone will provide the answer to this question soon. I’d be so pleased if that happens.