A soap opera regarding a central bank which holds short-term interest rates at high levels to curb uncomfortably high inflation levels is continuing to play out in Brazil, the world’s tenth largest economy. Predictably, Brazil’s newly elected leader, President Lula, is not a fan of such tight policies, as the country’s economy is cringing beneath the weight of 13.75% short-term interest rates.

According to Bloomberg, the average interest rates on personal and home loans in Brazil are 42% and 11%, respectively. High interest rates have likewise affected businesses; the number of business bankruptcies in Brazil are up 34% in the first four months of 2023 versus the same period last year, per the corporate data analysis firm Serasa Experian.

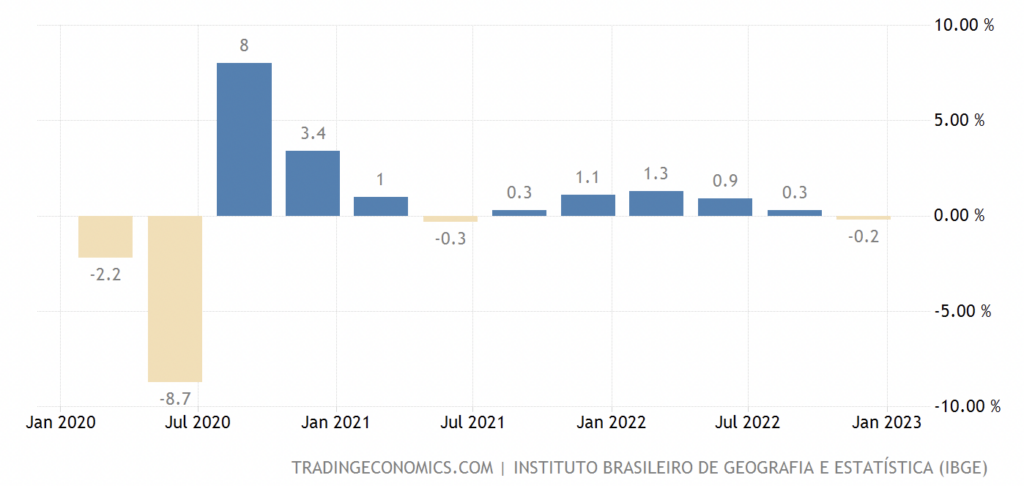

Short-term Brazilian interest rates were 2.0% as recently as early 2021, but the central bank has raised rates twelve different times since then. Brazil’s GDP growth has been essentially zero over the last two quarters.

Brazil’s inflation rate has fallen over the last nine months but is still running hot. Core Brazilian inflation in April 2023 was 7.3% versus April 2022. Interestingly, U.S. core inflation is running at a slower pace than Brazil’s, but the differential (5.5% in the U.S. versus 7.3% in Brazil) is probably smaller than many investors would have expected.

Whether President Lula can pressure Brazil’s Central Bank, which was made independent only two years ago, to relent and cut interest rates (perhaps prematurely) may provide a window into how long other central banks, including the U.S. Federal Reserve, can resist steady pressure from politicians. Note that Brazil’s Central Bank has set inflation targets of 3.25% for 2023 and 3.0% for 2024, well below the current 7.3% core rate.

Of course, another issue is: based on Brazil’s experience, has the U.S. raised interest rates enough (the current Fed funds rate is 5.25%) to bring core inflation down to acceptable levels? Double-digit overnight interest rates in Brazil have only caused core inflation to fall to 7.3% from 9.1% in July 2022.

Information for this briefing was found via Bloomberg, Trading Economics, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.