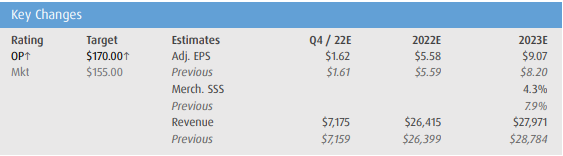

Las tweek, BMO Capital Markets upgraded Dollar Tree (NASDAQ: DLTR) to outperform from market perform and raised their 12-month price target from $155 to $170, saying that the company now offers a favourable risk-reward profile and that they believe that the street has set expectations too low. They believe the company’s recent change to $1.25 at Dollar Tree supports potential upside to potentially better than expected 2022 guidance, and the street has low expectations on the gross margin percent this change impacts the company.

They add that if they are wrong and Dollar Tree provides weak 2022 guidance, it would increase the possibility of an activist investor-led management or board change, which could potentially be a positive catalyst.

A number of analysts raised their 12-month price target on Dollar Tree in February, bringing the average 12-month price target to US$155.24, which represents a 9% upside to the current stock price. Dollar Tree currently has 29 analysts covering the stock, of which 4 analysts have strong buy ratings, 10 have buy ratings, 14 analysts have hold ratings and 1 analyst has a sell rating. The street high sits at US$197, which is a 40% upside to the current stock price.

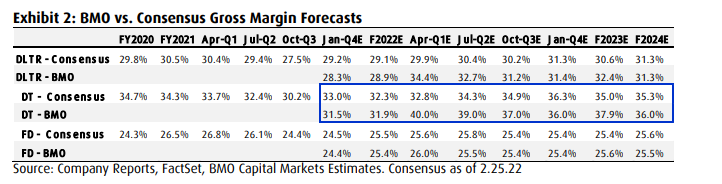

BMO has raised their earnings per share estimates for 2023 and 2024 to $9.07 and $9.02 respectively, their prior estimates were $8.20 and $8.74, respectively. The firms current estimates expect that the company will report 40% gross margins in the first fiscal quarter of 2022, assuming that 50% of the stores have rolled out the new $1.25 base price. They write, “A strong DT GM% should support earnings while the company merchandises against its new price point over time. This GM% tailwind should help DT absorb other inflationary incremental cost pressures while still protecting earnings.”

Due to BMO’s channel checks, which show that Dollar Tree’s $1.25 price increase happened overnight in some stores, they believe that the company will be in a comfortable position to manage the challenging environment of rising wages, inflation, and supply chain issues. They are modeling that operating expenses will grow 9% in 2022. They expect that Dollar Tree will complete its rollout of the $1.25 base price at all stores by the first quarter of 2022 in-line with company guidance.

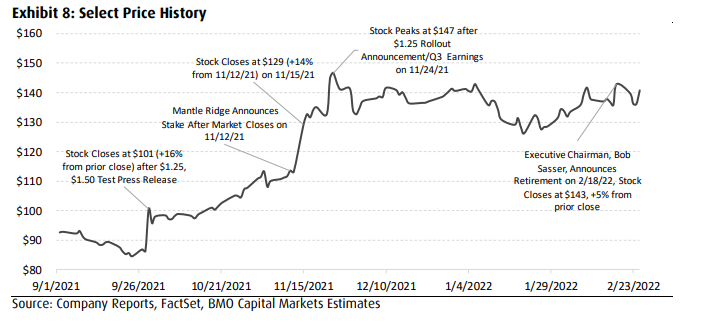

BMO comments that a significant reason for their newfound bullishness is the Mantle Ridge involvement, in which they are pushing for a complete overhaul of the companies Board of Directors. BMO believes that due to the lack of a quick settlement, the idea of a proxy fight seems to be the next step. With Dollar Tree’s annual general meeting in June, it only gives the company two quarters to show growth to investors.

BMO adds that after Mantle Ridge announced its stake, the company traded at 21x the forward 2-year earnings per share. The last time this happened was in 2016, pointing to investors being favorable to this announcement.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

I would agree that the price change to $1.25 is significant. Also, of all the discount stores, Dollar Tree appears to have the best run stores. Inflation and the end of helicopter money will bring more customers into their stores. Activist investor involvement probably does not hurt either.