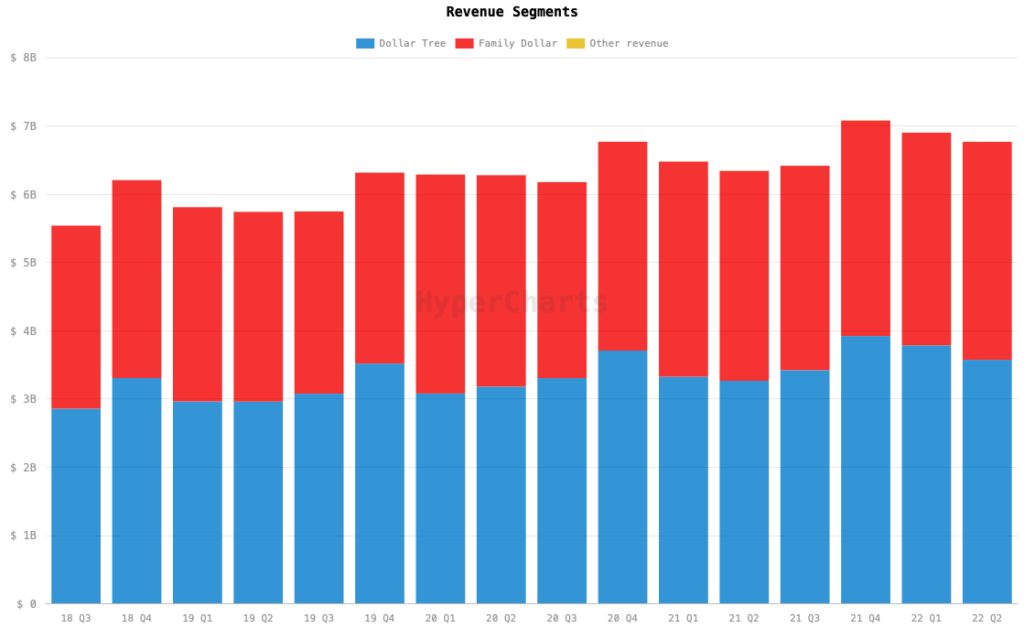

Dollar Tree, Inc. (Nasdaq: DLTR) released on Thursday its financials for the three-month period ended July 30, 2022. The store chain recorded revenue of US$6.77 billion in fiscal Q2 2022, down from Q1 2022’s US$6.90 billion but up from Q2 2021’s US$6.34 billion. It also missed the consensus estimate of US$6.79 billion.

“Our second quarter performance reinforces the relevance of our brands for millions of households pressured by higher costs for food, fuel, rent and more,” said CEO Mike Witynski.

Dollar Tree chain contributed US$3.57 billion in net sales while Family Dollar added US$3.19 billion.

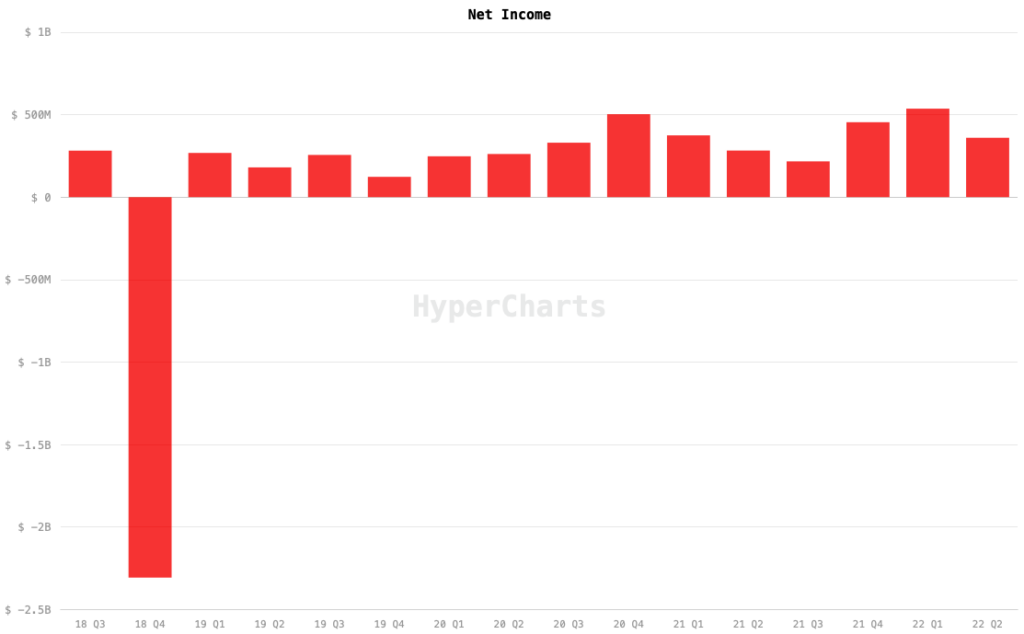

Further down the financials, net income came in at US$359.9 million, down from US$536.4 million in the previous quarter but up from US$282.4 million in the year-ago period. This translates to US$1.60 earnings per diluted share, still within the analysts’ estimates.

However, the retail chain is cutting down its earnings guidance for the year as it plans to lower the prices on the Family Dollar shelves to compete with the market, claiming the move is “an investment in pricing.”

“We expect the combination of this pricing investment at Family Dollar and the shoppers’ heightened focus on needs-based consumable products will pressure gross margins in the back half of the year. We have therefore reduced our EPS outlook accordingly,” Witynski explained.

The firm now expects earnings per diluted share for the year is anticipated to be US$7.10 – $7.40 per share, down from the previously announced US$7.80 – $8.20 per share. Full-year revenue, however, is still expected to land between US$27.85 and US$28.10 billion, with the firm already generating US$13.67 billion for the first half of the year.

In Q3 2022, the Virginia-based chain is looking at notching a quarterly revenue of US$6.75 – $6.87 billion compared to its Q3 2021 revenue of US$6.42 billion. Diluted earnings per share is also expected to land between the modest estimate of US$1.05 – US$1.20 per share.

Following the earnings release, the firm’s share price dropped by as much as 12% after opening bell.

The company also ended the quarter with US$688.9 million in cash and cash equivalents and US$5.42 billion in inventory, compared to its respective counterparts at the start of the fiscal year: US$984.9 million in cash and cash equivalents and US$4.37 billion in inventory.

Total current assets landed at US$6.38 billion while current liabilities ended at US$4.38 billion.

Dollar Tree last traded at US$152.45 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.