DraftKings Inc. (Nasdaq: DKNG) released this morning its financial results for Q1 2022, highlighting quarterly revenue of US$417.2 million, beating the consensus estimates of US$404.2 million. However, this is a decrease from Q4 2021’s US$473.3 million but an increase from Q1 2021’s US$312.3 million.

The company’s share price rose by approximately 8% pre-market following the financials release. But when the market opened today, shares plummeted by 5% from the last trading price.

For Q1 of 2022, #DraftKings reported adjusted EPS of negative $0.74 which beat the Nasdaq consensus estimate of $(1.15). DK had revenues of $417M, slightly topping estimates of $404.2M. $DKNG is raising its FY 22 revenue guidance to a range of $1.95B-$2.05 billion. pic.twitter.com/KoCk2b0ESK

— Matt Rybaltowski (@MattRybaltowski) May 6, 2022

Further down the financials, the company incurred operating expenses larger than its quarterly revenue, leading to an operating loss of US$515.6 million compared to the operating losses of US$368.8 million last quarter and US$324.8 million last year.

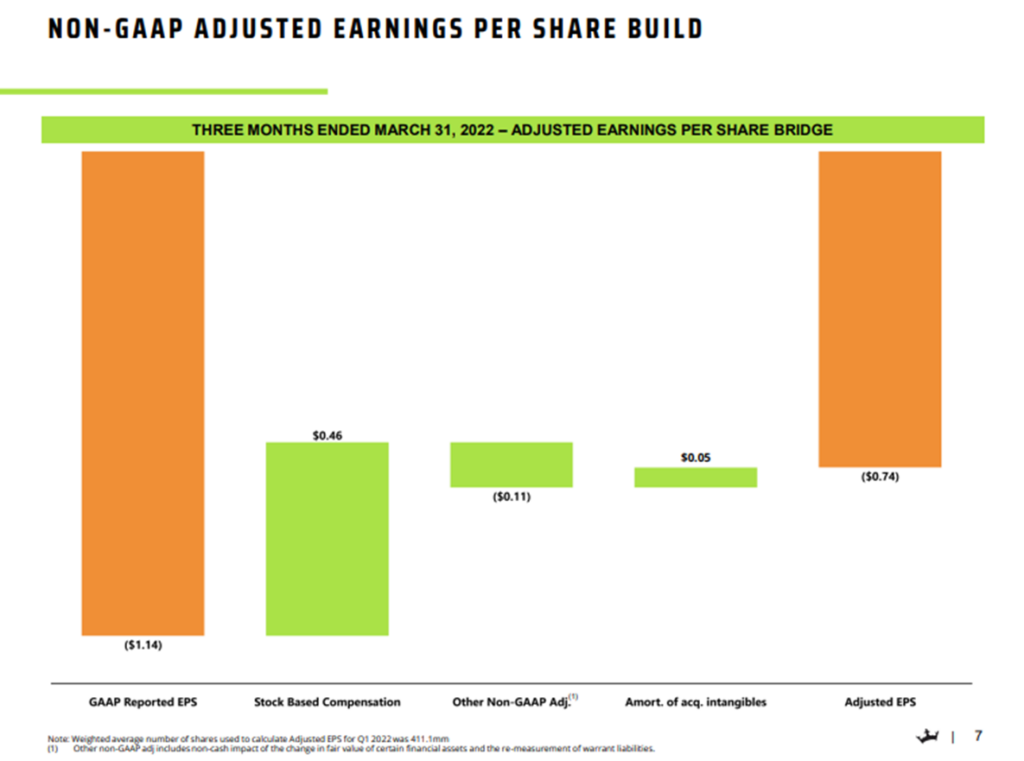

The firm’s net loss ended at US$467.7 million for the quarter, down from last quarter’s net loss of US$326.3 million and last year’s net loss of US$346.3 million. This quarterly net loss translates to US$1.14 loss per share.

On a non-GAAP basis, however, the adjusted loss per share came in at US$0.74, beating the consensus estimate of US$1.15 loss per share.

Meanwhile, adjusted EBITDA for the quarter came in at a loss of US$289.5 million, down from a loss of US$128.0 million last quarter and a loss of US$139.3 million last year.

The company ended the quarter with cash and cash equivalents balance of US$1.77 billion. Current assets and current liabilities came in at US$2.40 billion and US$912.9 million, respectively.

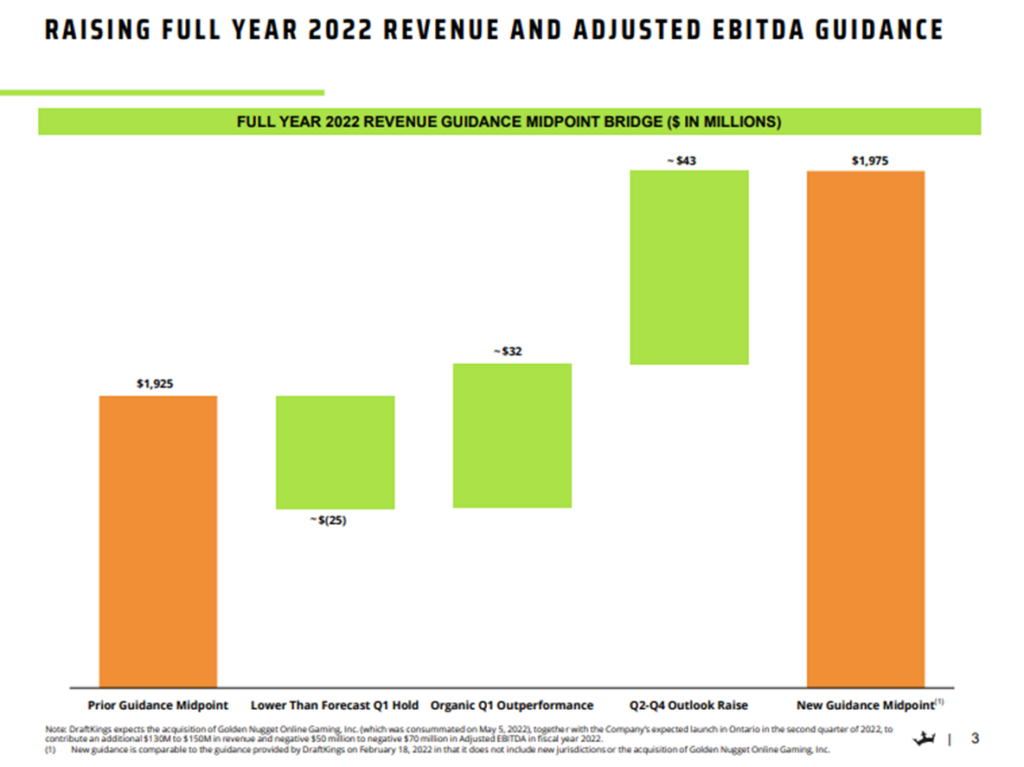

The firm also raise its 2022 guidance, from the previously announced US$1.85-US$2.0 billion to US$1.95-US$2.05 billion in revenue. It also increased its adjusted EBITDA guidance for the year from a projected US$825-US$925 million loss to US$760-US$840 million loss.

$DKNG is also improving its fiscal year 2022 Adjusted EBITDA guidance from between a loss of $825 million and $925 million to between a loss of $760 million and $840 million.

— Michael Winter (@michaeljwinter6) May 6, 2022

What an improvement!? pic.twitter.com/JzQkjQ6UC6

The firm has previously announced that the first positive adjusted EBITDA quarter is expected in Q4 2023. Part of the strategy to achieve this is synergizing the acquired Golden Nugget Online Gaming.

$DKNG CEO Jason Robins on acquisition of Golden Nugget Online Gaming: “We are well prepared to integrate our respective businesses, begin executing on our multi-brand strategy, and capture Adjusted EBITDA synergies which we expect to reach approximately $300 million long-term.” pic.twitter.com/bjfjBhN2Hd

— DraftKings News (@DraftKingsNews) May 6, 2022

The online sports gaming platform relayed that it engaged an average of 2.0 million unique paying customers monthly during the quarter, a relative plateau from last quarter and an increase from last year’s 1.5 million monthly users. The average revenue per user came in at US$67 for the quarter, down from US$77 per user in the last quarter but up from US$61 per user last year.

DraftKings last traded at US$14.44 on the Nasdaq, then down 5% when the market opened.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.