It isn’t immediately clear whether a chronic overvalued condition in major equities is creating an environment in which overgrown ventures are considered mainstream, or if a groundswell of interest in risk-on assets has pushed the more established tech businesses to valuations that reflect their relative risk, but it’s academic. There’s a get-while-the-gettin’s-good attitude pumping oxygen into this structure fire of a market, and one can expect the sell-side to continue adding fuel as long as it keeps burning. Ultimately, it’s all the same fire.

There was a time when SPACs and their Canadian cousins, the CPCs, were go-public instruments used by the class of pre-revenue companies that investors wouldn’t go anywhere near without the liquidity of a public listing. Today, perfectly functional businesses with excellent margins are being SPACled into the market with all deliberate haste, because holding the company outside a public listing is like leaving bait in the boat while the fish are biting.

AvePoint, a Microsoft cloud data partner, is being taken public via an amalgamation with APEX Technologies Acquisition Corp. (NASDAQ: APXT), a Goldman-Sachs sponsored SPAC holding $350 million in cash, $261 million of which will be paid to the current AvePoint shareholders as part of the acquisition, along with 143,366,077 shares.

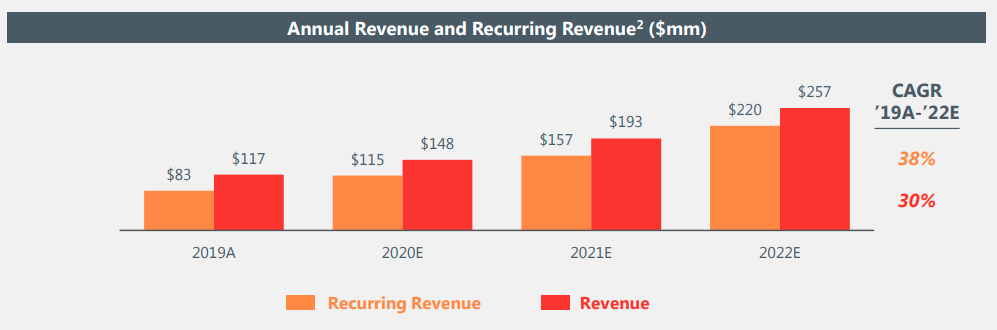

When the dust settles, using today’s share price of $16.54, AvePoint will have a market cap around $3 billion. Based on estimates in the company deck, it will bring in $148 million in revenue in 2020, for a non-GAAP EBIT of $21 million (as per company projections). Functionally, the market has it valued at a 20 times revenue and 150 times pre-tax earnings.

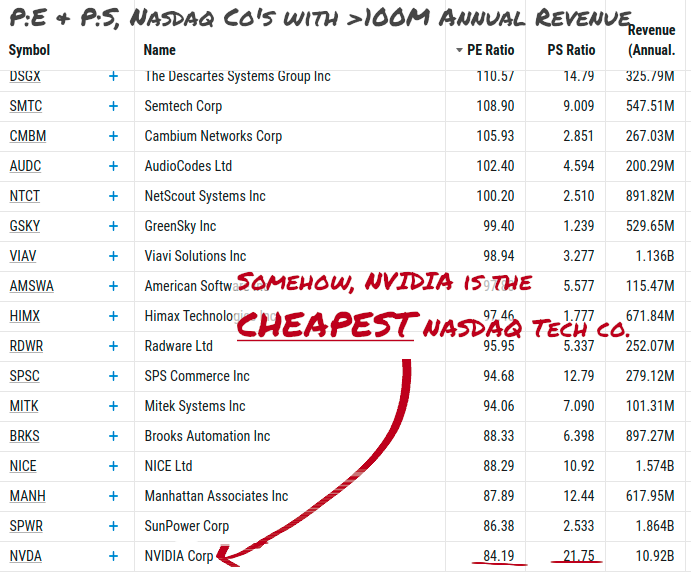

That seems outrageous (because it is outrageous), but it’s practically the going rate. Of all tech companies on the NASDAQ with >$100 million in revenue, NVIDIA (NASDAQ: NVDA) has the lowest price to earnings at 84:1.

Ours is not to judge acceptable valuation, ours is to interpret what the market gives us, and the message may be that institutional capital is willing to pay a sharp premium for established, growing businesses that generate revenue.

Recurring Revenue: The SaaS Premium

The business appeal of SaaS software is its habit of producing recurring revenue by becoming too important to cancel. The US Navy famously used Windows XP right up to the point that Microsoft stopped maintaining it. Switching the OS on the tens of thousands of computers that run a whole fleet of boats, planes and submarines is a monumental undertaking that nobody’s going to be giving out awards for, so organizations tend to hold on to systems that are working until the problems caused by not changing them are liable to be greater than the problems that come with changing them.

Pop biz analysts like to call this type of entrenched advantage a “moat,” and AvePoint has played into investors’ moat fetish by breaking out the recurring revenue from the total revenue in its income projections.

The great expectations that the market has for AvePoint are rooted in the faith that comes with a brand name. It’s a Goldman Sachs deal that calls Microsoft a partner and has clients you’ve heard of:

The prospect that it will be able to live up to the hype it’s set for itself is drawing a crowd as the capital chasing growth in revenue stories, instead of stories about future revenue, crowds in and grabs up the available products.

It wasn’t always like this.

It wasn’t long ago that some of the very best revenue stories were being pulled off the market and taken private by private equity firms who were disgusted by the paltry valuations being given to tech revenue machines by a market that just wasn’t interested.

In 2017, former Lockheed Martin subsidiary NeuStar Inc. was fresh off of booking $1.2 billion in revenue to produce $168.7 million worth of after-tax earnings from a business that had averaged 10% revenue growth year-over-year for three years running. For its trouble, the market of the late 2010s valued NeuStar at 9.4 times earnings and a paltry 1.5 times sales.

Golden Gate Capital took NeuStar private in August of 2017 for $1.86 billion – about two thirds of what this 2021 market is giving AvePoint while it’s still in the blocks.

NeuStar had what might have been the best moat of all time. They were the owner and operator of the National Numbers Portability Database, and the system surrounding it that manages the billing for the world’s telecommunications system. In 2005, the company had built systems that had become essential to the operations of the telecommunications infrastructure, and were starting to make people wonder if that was the sort of thing a defense contractor ought to be in control of.

NeuStar had collected vital databases and built them into the core of the software that keeps track of cell phone numbers, what services are associated with them, what carrier they’re assigned to, and what plan the number is on. It’s the system that allows for users to keep their numbers when they switch carriers, carriers to bill each-others’ users when they’re roaming, and probably a few dozen other things. Its cost is baked into everyone’s phone bill, so nobody really even realizes they’re paying it, but it helped NeuStar crack the $900 million annual revenue mark in 2013, and the $1B revenue mark in 2015.

By then, the company was already a long way into expansion beyond charging the phone companies to handle the interoperability of their businesses. It leveraged the data sets to do proprietary analytics that gleaned insights that they could sell to any number of interested parties. The company was in the domain registry business in innovative ways, building a registry that was sold to GoDaddy this past April for a price that was not disclosed. In its life as a private equity property, NeuStar has focused on the internet identity field, and has likely built or staked out properties in that arena that will become valuable when digital identity is something that enters the public dialogue as a business sector.

Today, that kind of revenue and earnings profile would make NeuStar one of the most valuable companies on the board, and it could be that Golden Gate Capital decides to spin it out anew and find out.

For now, it’s SaaS offerings all the way down, feeding the structure fire that is this runaway tech market until they either dilute into fuel so thin it won’t burn, or come in such a volume that they smother the flames.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.