On February 24, American Car Center, a used car retailer which targets subprime borrowers, abruptly ceased all operations, according to media reports. The Memphis, Tennessee-based private company fired all 288 of its headquarter-based employees and closed its offices and 40 dealerships across ten U.S. states.

If the immediate closure of a sizable firm late on a Friday afternoon were not unusual enough, American Car Center management apparently sent a message to its staff the previous day that it was working with its lenders to improve liquidity and continue operations. American Car Center is owned by the U.S. hedge fund York Capital Management.

The reason for American Car Center’s actions seems is almost certainly linked to the deteriorating state of the subprime auto loan market. Cox Automotive, the automotive data analytics firm, reports that 7.11% of subprime loans were severely delinquent in December 2022, up from 6.75% in November 2022 and from 5.48% in December 2021.

READ: Lucid Motors Reservations Dwindle As Production Comes Up Short

Even more concerning, the 7.11% December 2022 severe delinquency rate was the highest monthly figure since Cox began tracking the data in 2006. A seriously delinquent auto loan means the borrower is more than 90 days behind on payments.

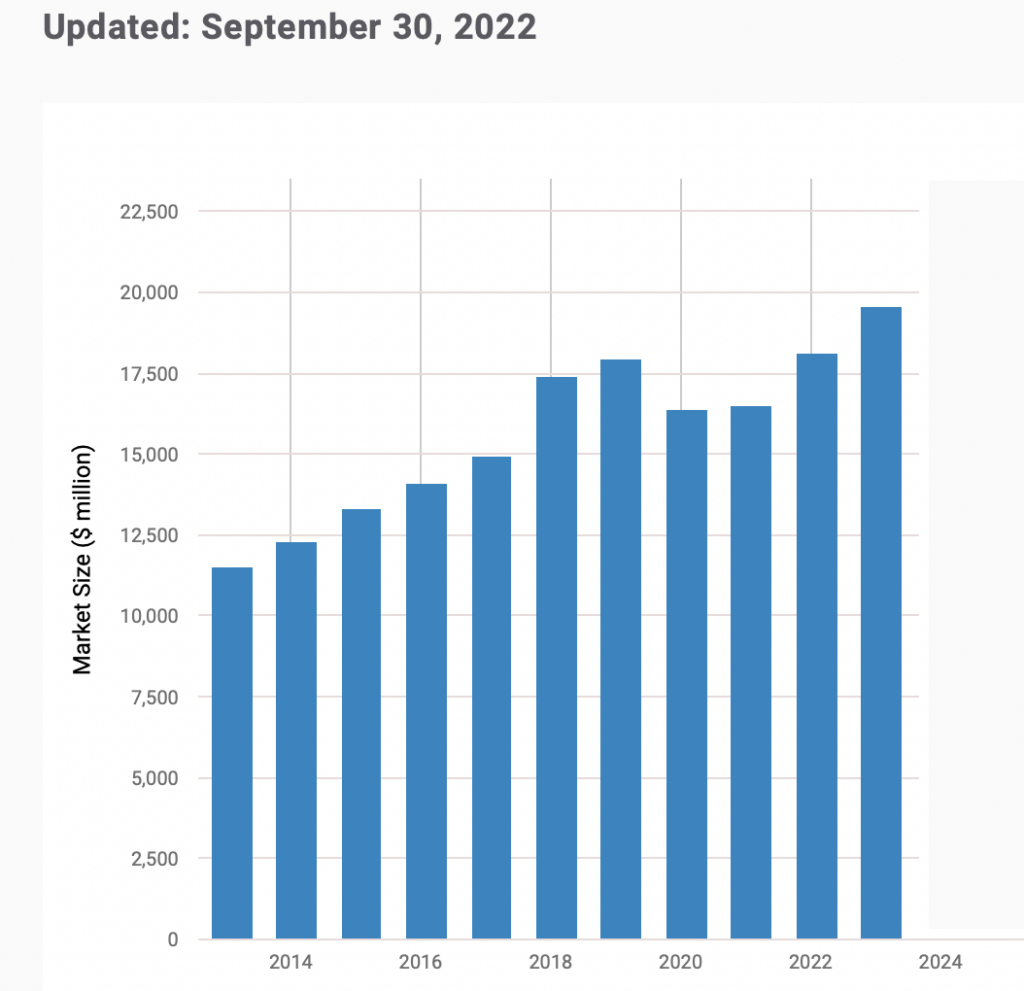

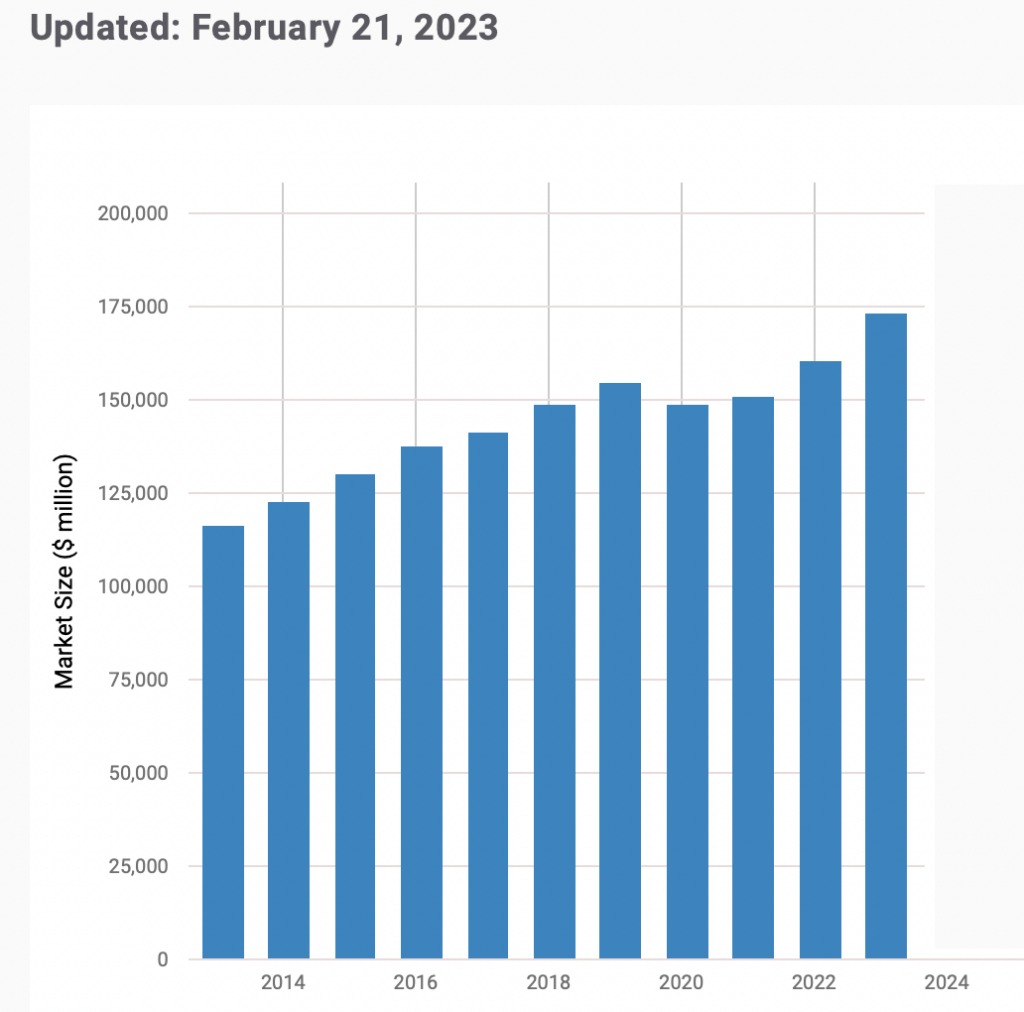

According to IBIS World, about US$19.6 billion of subprime auto loans are expected to be written in the U.S. in 2023. This amount represents only about 11% of the overall U.S. auto market of US$173.2 billion, but the sharp increase in delinquencies among the riskiest auto borrowers could very well be a leading indicator of broader auto loan problems and perhaps for the overall economy.

The severe delinquency rate for all auto loans was 1.84% in December 2022, up from 1.74% in November 2022 and the highest level recorded in any month since February 2009, in the depth of the Financial Crisis. The annualized loan default rate for all auto loans was 2.56% in December 2022, lower than the 2.98% figure in December 2019, the last December before the COVID pandemic hit.

The disconnect between rapidly deteriorating monthly severe delinquency data and not-as-negative default rate figures is somewhat surprising. One possible explanation is that lenders do not consider a borrower to be in default until payments are 90 to 120 days late. Based especially on subprime loan information, many borrowers may unfortunately be approaching that threshold. If so, a substantial increase in auto loan defaults could occur over the next few quarters.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.