Yesterday Eight Capital initiated coverage on PopReach Corp (TSXV: POPR) with a C$2.35 price target and a buy recommendation. This comes after the October 15th news release, where Alibaba Group invested $5 million at $0.72 per share.

Suthan Sukumar, the analyst from Eight Capital, says, “Unlock this reward: A BABA-backed gaming roll-up play; initiating with a BUY, $2.35 target.” He adds, “we view PopReach as a rare gaming roll-up-play focused on consolidating, operating, and revitalizing mature free-to-play (FTP) mobile games with established brands, player bases, and profitability.”

Sukumar lays out the thesis in a couple of points, the first being that the mobile gaming industry has attractive market fundamentals. Mobile gaming has the highest growth rate within the gaming industry. The segment has surpassed PC and gaming console segments and accounted for a $77 billion market in 2020 with expectations to grow past $100 billion by 2023, a +10% compound annual growth rate. Sukumar says, “with the emergence of COVID-19, mobile gaming engagement and spending has only accelerated as the pandemic drives a sustained shift in consumer behavior.”

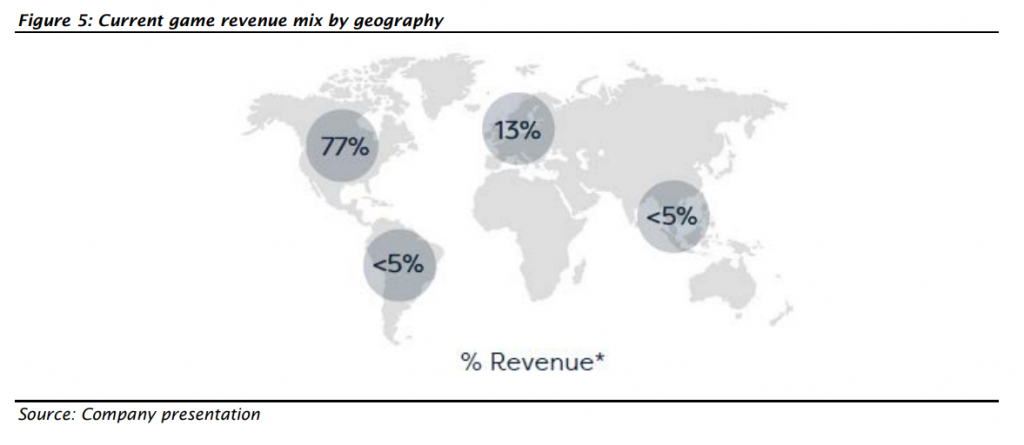

The next point Sukumar hits on is the, “management team with blue-chip track record in gaming, backed by Alibaba Group.” CEO John Walsh and COO and President Christopher Locke are both senior gaming industry people with decades of mobile gaming experience with jobs on the developing side at EA, Activision, Zynga, and Glu Mobile and Capcom. Sukumar adds that the $5 million investment from Alibaba Group “not only helps prime the company’s balance sheet for the next M&A transaction, but more importantly brings on a key strategic partner to pave the way for privileged market access and deal flow in China and the Asian region, an underserved market for the company today (<5% of revenues).”

Sukumar believes that there is a healthy outlook on EBITDA and cash flow growth because initial cost acquisitions have shown progress in helping the company become profitable and have cash returns. He forecasts adjusted EBITDA to grow roughly 40% year over year, with 50% EBITDA growth from $4.2 million in fiscal 2020 to $6.3 million in fiscal 2022.

The last point Sukumar hits on is that there could be a 25 – 60% increase in share price based on additional M&A. Based on management, he believes that PopReach will make a turnaround for possible acquisitions by using their disciplined and data-driven approach.

The company expects to close one to two more acquisitions by year-end and between two and four in 2021. Sukumar says, “Given a highly fragmented industry with motivated sellers, management has a robust pipeline and expects to pay attractive valuations of 1-2x revenues for targets ranging in size from $2-10mm in revenue.”

Three other analysts presently have price targets on the firm, as seen below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.