On November 29th, Emerge Commerce (TSXV: ECOM) announced its third quarter financial results. The company reported quarterly revenues of $6.1 million, up from $2.2 million a year ago. Additionally, the company reported gross merchandise sales of $9.2 million, up from $7.74 million last year. Adjusted EBITDA dropped from $0.06 million last year to negative $0.5 million this quarter. The company reported a net loss of $1.01 million, or earnings per share of negative $0.01.

Emerge Commerce currently only has 2 analysts covering the stock with an average 12-month price target of C$1.73, or a 158% upside to the current stock price. Out of the 2 analysts, 1 has a strong buy rating and the other has a buy rating. The street high sits at C$2.25 from Raymond James while the lowest comes in at C$1.20.

In Canaccord’s third quarter review, they reiterate their buy rating and C$1.20 12-month price target, saying that the company is showing positive signs to close out the year, but the execution is the key for 2022.

For the results, the company came slightly below Canaccord’s revenue estimates of C$6.8 million while adjusted EBITDA came exactly in line with their estimate. Canaccord says that proforma, the company saw revenues decline 15%, primarily due to conditions impacting Underpar. Though, management noted that Underpar has since seen a recovery during the fourth quarter.

As for the dip back into negative adjusted EBITDA, Canaccord says this is primarily due to increased investments “to bolster the team ahead of key acquisitions like BattlBox and WSP.” As for the companies balance sheet, Canaccord believes that Emerge will exit 2021 with $18.6 million in net debt and expect a few deferred payments, retention payments and earnouts happening during 2022. So they remain focused on the companies balance sheet health.

Canaccord provided some operating outlook for 2022, saying that management noted Underpar saw revenues recover during the fourth quarter and that Black Friday saw gross merchandise sales up roughly 3 times year over year. This coupled with new truLOCAL divisions driving new initiatives and Carnivore Club providing potential cross-selling synergies. Because of this Canaccord expects better organic returns in 2022.

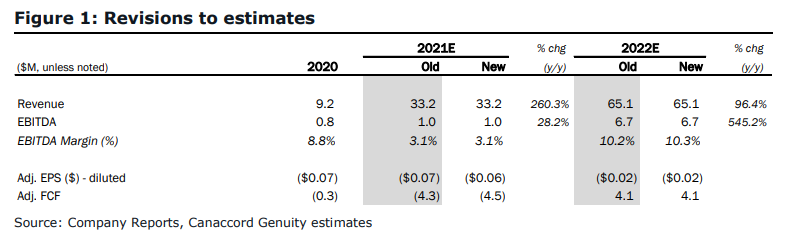

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.