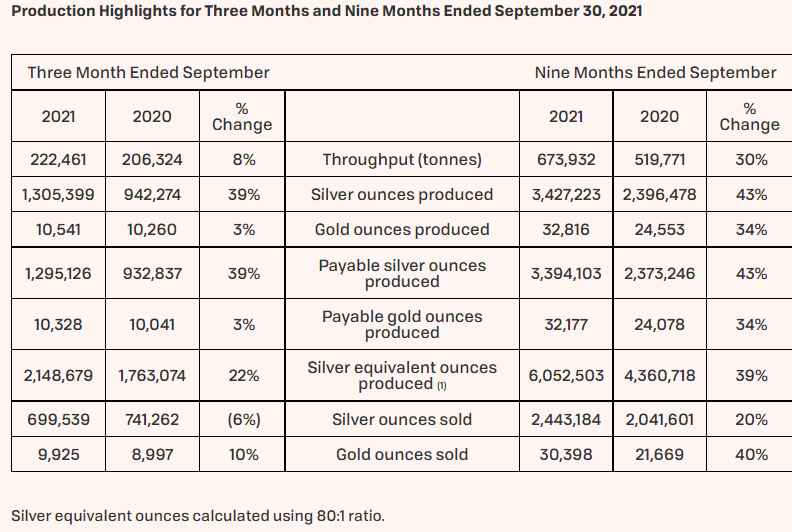

Last week, Endeavour Silver Corp. (TSX: EDR) announced their third quarter production highlights. For the third quarter, ending September 30th, 2021, the company produced 1,305,399 silver ounces and 10,541 gold ounces, up 39% and 3% year over year respectively. Third quarter 2021 throughput also increased by 8% to 222,461 tonnes.

The company also increased management production guidance for 2021 to 7.7 to 8.0 million ounces of silver equivalents due to higher than expected grades and tonnage milled, saying that “Silver equivalent production at each mine is on track to meet or exceed 2021 production plans.”

Endeavour Silver has 7 analysts covering the stock with an average 12-month price target of C$7.05, or a 33% upside. Out of the 7 analysts, 2 have buy ratings while the other 5 have hold ratings. The street high sits at C$8.78 from H.C Wainwright, while the lowest comes in at C$5.25.

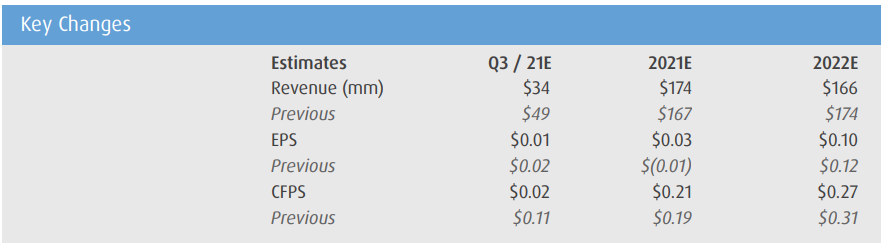

BMO Capital Markets in their note reiterated their C$5.25 12-month price target and Market Perform rating on Endeavor Silver, saying that the third quarter showed solid production numbers out of the Bolanitos and Guanacevi mines.

For the quarter, BMO forecasted silver production would come in at 1 million ounces. Both gold and silver production was beaten by roughly 30%, thanks to higher than expected tonnage, and grades at Guanacevi.

BMO notes that the company selling 699 thousand ounces of silver, is “well below” their production which is forecasted to impact third quarter sales, but BMO believes this will help the company’s fourth quarter results.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.