On April 13, Energy Fuels Inc. (TSX: EFR) announced that during the week of April 4-10, it shipped commercially for further processing a unique combination of commodities — natural uranium concentrates, vanadium pentoxide, and high-purity mixed rare earth element (REE) carbonate. Clearly, this delivery feat represents an important milestone for the company.

However, a passage near the bottom of the release may have even greater positive implications for uranium demand and prices. Energy Fuels noted “a marked uptick in interest from nuclear utilities seeking long-term uranium supply.” As a result, Energy Fuels “is now actively engaged in pursuing selective long-term uranium sales contracts.”

Such active negotiations would represent a welcome departure in stance from utilities which own nuclear generation facilities, as well as a potential additional catalyst for uranium prices. For years, nuclear utilities have bought spot uranium and avoided signing long-term agreements. The utilities have largely been rewarded for such a strategy, as spot uranium held at very low levels for the 5+ years ending in early 2021.

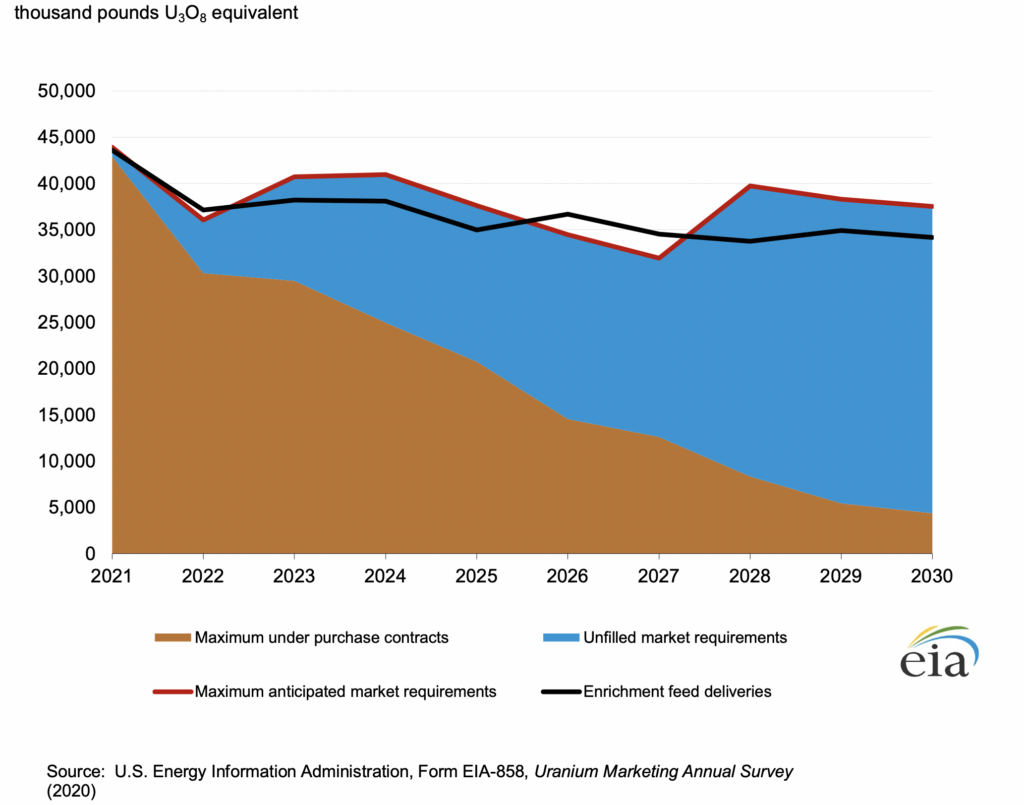

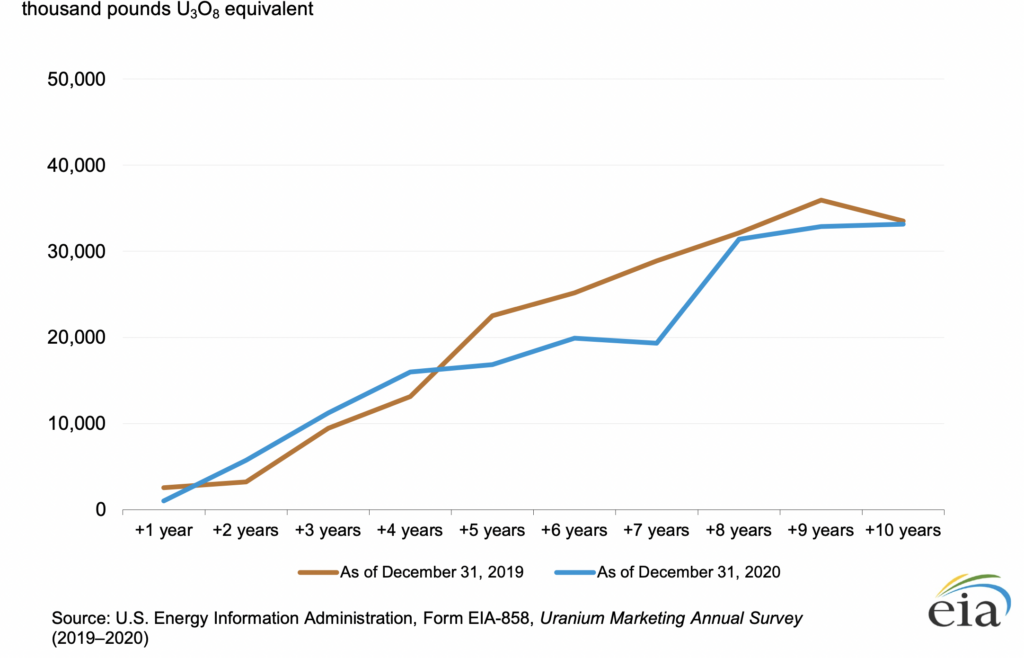

The flip side of this practice is the unprecedented – and really unsafe — degree to which the nuclear industry has become uncontracted. This differential may have played a role in the sharp increase in uranium spot prices since last summer. The figures below depict the widening gap between the contracted and uncontracted fuel needs of U.S. utilities.

An open question is what long-term price would a North American uranium miner require to re-open a uranium mine and agree to supply a nuclear utility. Many analysts believe that prices around US$60 per pound would prove economic to the miner. Perhaps coincidentally, spot prices seem to have settled in that range.

Uranium prices may also be bolstered in the long term by the UK government’s official publishing of its energy strategy. That blueprint, which was released on April 7, moves the country away Russian oil and gas in favor of renewable energy sources, including nuclear energy.

Specifically, Great Britain expects its nuclear generating capacity to reach 24 gigawatts (GW) by 2050, enough to cover 25% of its demand. Currently, 15 nuclear reactors are operating which supply 20% of the country’s electricity needs. A total of 13 plants are in various stages of development, and a new government body, Great British Nuclear, will be formed to ensure these plants are constructed.

The price of uranium jumped in February 2022 on shortage fears related to the Russia-Ukraine war. It now appears this jump may be justified — and prices could continue to move higher — based on fundamental developments prompted by the price increase. A key such catalyst could be an announcement of a significant new long-term supply contract between a nuclear utility and a uranium miner.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.