On March 22nd, Equinox Gold (TSX: EQX) Gold announced a positive feasibility study for their castle mountain phase 2 expansion. The company said phase 2 should produce 3.2 million ounces of gold with an all-in sustaining cost of $858 per ounce of gold.

Equinox Gold currently has nine analysts covering the company with a weighted 12-month price target of C$19.62. This is down from last month, which was C$20.50. One analyst has a strong buy rating while the majority, seven analysts have buy ratings and one analyst has a sell rating. Cormark Securities has the street high price target with a C$24 target.

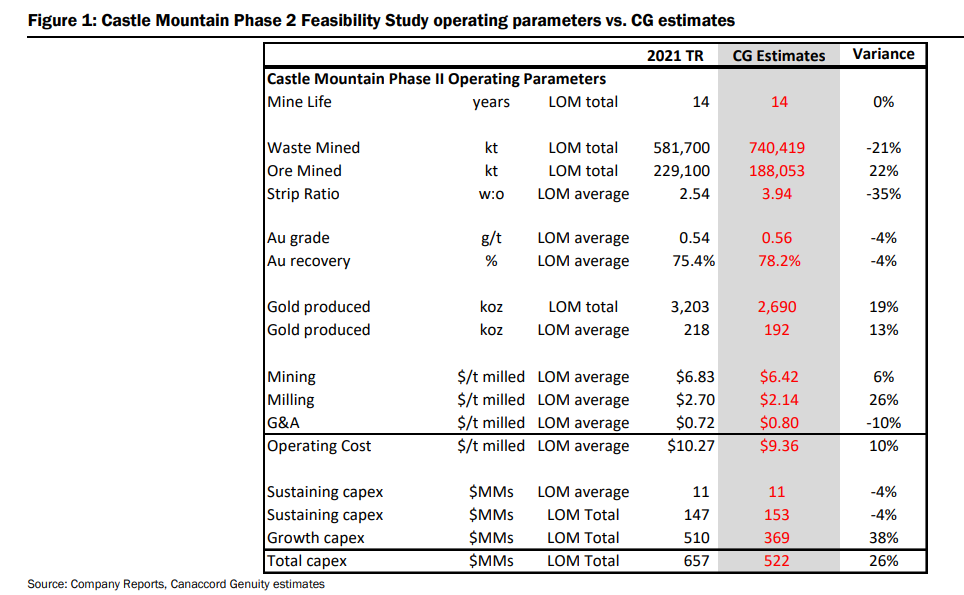

Canaccord Genuity decreased its 12-month price target from C$14.50 to C$14 off the back of this news. Dalton Baretto headlines, “Castle Mountain Phase 2 – California dreamin’ or CAPEX nightmare?” The reason for the price reduction is based on them updating their estimates. In their estimates, they include a one-year delay to the companies timetable to factor for any potential permitting delays and a 10% increase to their estimated capital and operations costs.

You can see below how the companies feasibility study panned out versus Canaccord’s estimates.

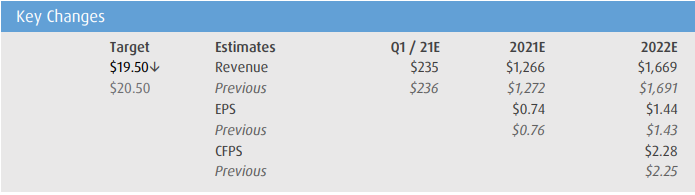

BMO Capital Markets also slightly decreased their 12-month price target to C$19.50 from C$20.50. Their analyst Ryan Thompson says that the primary reason for the price target reduction is due to them dropping their net-asset values on different parts of the company.

BMO has dropped their Castle Mountain net asset value 30%, down to $522 million, which brings down their consolidated net asset value 5% to $4.3 billion. They also forecasted a lower all-in sustaining cost, which was $798/ounce previously.

You can see BMO’s updated 2021 and 2022 estimates below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

very good.