FULL DISCLOSURE: This is sponsored content for ESGold.

ESGold (CSE: ESAU) is a Canadian Securities Exchange-listed issuer with a bit of a different business model – and one that makes a lot of sense. Their plan, in simple terms, is to quickly get into production via the reprocessing of tailings, which will then fund further exploration once cash flow positive.

This of course makes things a bit confusing in terms of the famous Lassonde Curve, which identifies valuations based on where a company is within the development life cycle. So, where might one place ESGold on the famous Curve? The best answer here is perhaps a bit of a hybrid spot – somewhere between the exploration and construction stages.

A near-term producer

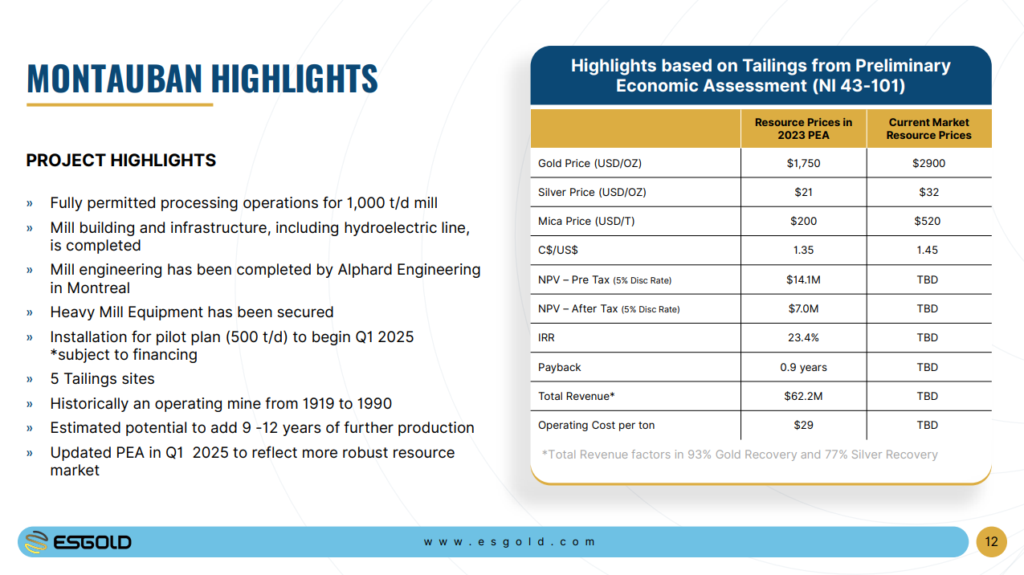

The official estimate is that ESGold is approximately six months from production at their Montauban, Quebec mill. Montauban is fully permitted to operate at a rate of 1000 tonnes per day for 300 days a year using a closed-circuit system to process tailings.

The 16,000 square foot mill building and infrastructure, including a hydroelectric line, have been completed. Access roads are in place, as is the mill engineering and heavy mill equipment. The processing circuit is set to take roughly 6 months to construct.

While funding is still needed, the expectation is that it will come from a C$6.0 million non-dilutive structured construction financing. The company notably on Friday also completed a C$3.38 million financing, which should cover any other capital needs in combination with a $2.0 million operating line of credit presently in place.

Revised PEA on the horizon

The most recent preliminary economic assessment completed on the Montauban project was released back in 2023. While a revised study is currently in the works, ESGold in the interim has provided a sort of comparison between figures used within the 2023 PEA, and where they sit today. Among the highlights are a substantially higher gold price (the PEA uses $2,900 an ounce gold), as well as a mica price that has nearly tripled.

The revised model of course will also incorporate revised costing from suppliers and contractors, however it’s not expected that this will have much of an impact relative to the impact of dramatically higher metals pricing.

There are significant amounts of gold, silver and mica in the historical tailings, from which they plan to have production. Going by the 2023 PEA there are 12,000 ounces of gold, 989,450 ounces of silver and 57,200 tonnes of mica within those tailings piles.

The history

The Montauban mine operated over three stints from 1919 to 1990. At the time of closure, the average price for gold for the year was $383.73. The mine was predominantly a zinc and lead operation in its first two production stints, before its third round of operating focused solely on gold and silver, pulling 92,553 ounces of gold and 323,376 ounces of silver out of the ground before closing in 1990 and seven years of operation.

Given the price of both precious metals the last time this operation was in production, higher grades were required to make the effort worthwhile. Given the fact that the value of gold has nearly 10x since the last time things were in operation, dramatically lower grades could now be economical. The other piece of this puzzle, is that recovery methods have also improved – which makes the tailings a viable source of metals in the interim, while ESGold uses that cash flow to find further gold in the ground.

According to the ESAU Corporate Presentation, “Based on historical information, the company estimates it could add up to 9-12 years of further production with a significant increase in the grade of the resource.”

Regarding its future drilling potential, the company has hundreds of historic holes to go through. Documents such as a 2009 report point to a lot of near-surface tonnage. And they have also put it on record that the Montauban Project may be an analogue of Australia’s Broken Hill. That is something we will unpack in a future piece.

ESG isn’t a dirty word

The other aspect of this operation, is that given ESGold intends to reprocess old tailings, it’s basically an environmental clean up job. The tailings piles exist on site from nearly a century of mining – and they’ve been an eyesore to the region for decades. With new technologies and a commitment to the community, the company plans a complete reclamation program.

ESGold is a vibrant, feel-good story – and the rise in the stock price tells the tale. They have it all: money in the bank, a PEA dropping, coming production, a good chance at building the resource – and a town revitalized by jobs and future land reclamation. Now we just need to see them pull it all together.

FULL DISCLOSURE: ESGold is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover ESGold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.