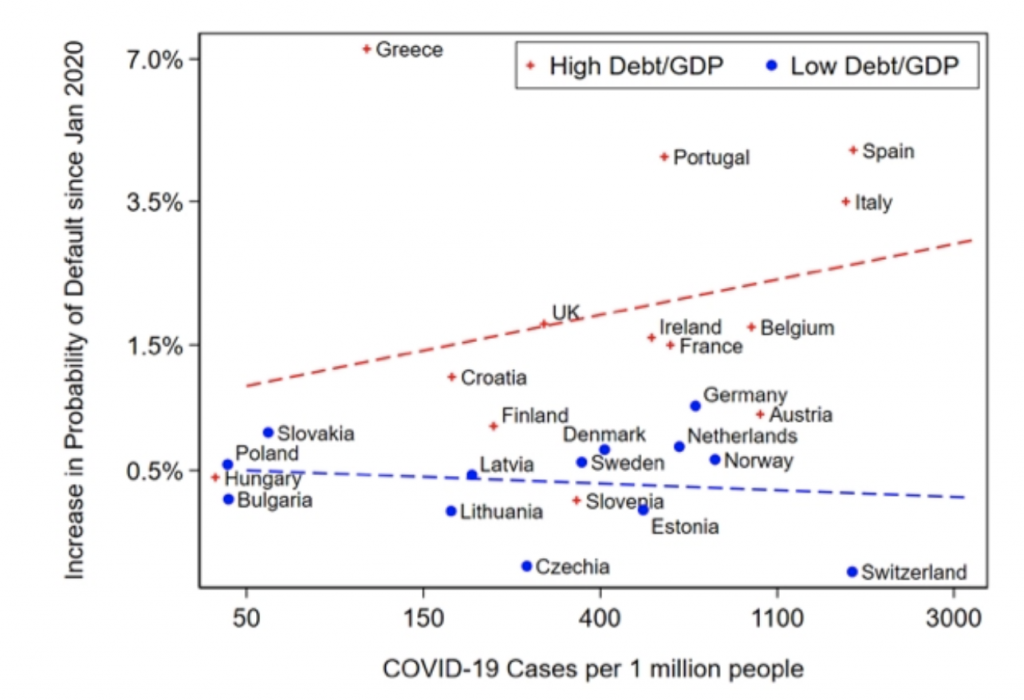

Since the beginning of the coronavirus pandemic, the European Union has been dealing with a severe economic fallout, with countries such as Spain and Italy struggling with a savage recession following a soaring amount of infections and deaths. Some of Europe’s hardest-hit countries are in dire need of financial relief to help boost what is left of their economies, and now after rampant deliberations, European Union leaders have finally agreed on a recovery fund to help rebuild Europe.

According to the European Commission, the EU economy is anticipated to contract by 8.3% in 2020, which is significantly worse than the previous estimate of only 7.4%. As a result, the commission has arrived at a conclusive plan forward after 5 days of fraught deliberations. The EU leaders agreed on a $858 billion recovery fund to rebuild some of Europe’s hardest coronavirus-hit countries; the money is to be borrowed from financial markets, with $446 billion of the funds being redistributed as grants, while the remaining will be issued as loans. In addition, the EU leaders also agreed on a $1.3 trillion budget between 2021 and 2027.

The focus of the deal is to predominantly provide funding for the rebuild of businesses following the pandemic, introducing new measures in order to reform economies in the long run, as well as mitigate the risk of a similar crisis in the future. Prior to a conclusive agreement on the deal, EU leaders were batting irreconcilable differences regarding the overall size of the stimulus fund, the conditions that should be attached, as well as the ratio of loans and grants.

The original proposal presented by the European Commission consisted of $286 billion in loans, and $573 billion in grants; however, Europe’s “Frugal Four” countries – Sweden, Denmark, Austria, and the Netherlands strongly opposed the first suggestion, stating that it would disproportionally burden them with debt accumulated by other governments.

Conversely, a proportion of more loans in favour of grants would mean coronavirus-stricken and indebted countries such as Italy would face even further liabilities, thus hindering them from future economic growth. Nonetheless, the new deal is one for the history books, given the EU’s previously apparent disorganization and rampant bureaucratic disagreements on just about.. everything.

Information for this briefing was found via CNN and Fortune. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.