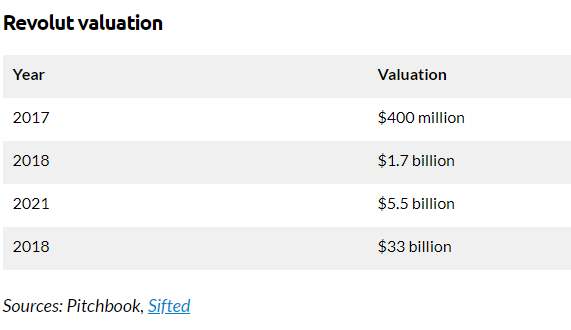

On September 21, the European-based fintech firm Revolut announced plans to offer commission-free stock trading to U.S. clients. In so doing, the formidable private company, which has over 16 million customers across Europe, Japan, India, Australia, and Singapore, and was recently valued at US$33 billion, plans to compete directly with Robinhood Markets, Inc. (NASDAQ: HOOD). Indeed, Revolut’s non-U.S. customers are generally young investors.

If Revolut were to make inroads with U.S. investors, the impact on Robinhood could be significant. In an April 2021 survey of Generation Z (ages 18 to 24) and millennial investors (ages 25 to 40), fully 37% of respondents used the Robinhood app at least once a month.

Robinhood stock rallied 4% on the day of the Revolut announcement, a surprising reaction given the threat that Revolut may pose to Robinhood’s core business. Robinhood’s investors may have been focusing more on a Bloomberg report that Robinhood is testing a new cryptocurrency wallet function that will allow users to spend and trade digital currencies; the wallet would bring its crypto capabilities more in line with those offered by Coinbase. However, the possibility that future (or existing?) Robinhood customers may choose another popular commission-free broker seems to us to be the more important development for highly valued Robinhood shares (The firm trades at roughly a ~95x ratio of enterprise value-to-current annualized adjusted EBITDA).

After a 16-month process, Revolut has secured a U.S. broker-dealer license from the Financial Industry Regulatory Authority (FINRA). Commission-free stock trading will be added to other financial services it currently offers in the U.S., such as small business banking, U.S.-Mexico money transfers and cryptocurrency trading.

Revolut grew to its current size and valuation largely on an innovation which allows debit card users to transfer money in 150 currencies at real-time exchange rates without incurring a fee. Premium Revolut customers are eligible for “double free” ATM withdrawals abroad. Revolut has said it eventually plans to go public in the U.S. and the U.K. through an IPO process.

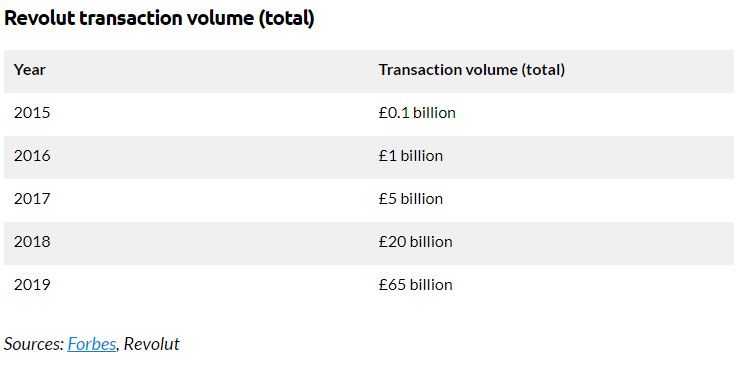

Founded in mid-2015, the company has grown rapidly; 2020 revenues reached £221 million, up 57% from 2019. Its transaction volume has soared the last few years, reaching £65 billion in 2019.

Like Robinhood, Revolut plans to utilize in the U.S. the controversial online brokerage firm practice of “payment for order flow,” or PFOF. PFOF, simply defined, is a practice whereby an online brokerage firm like Robinhood, or now Revolut, directs clients’ orders to market makers in exchange for fees. This technique which allows the broker to charge no commissions, is derided by full-service (commission-charging) brokers, who contend that the practice results is a less favorable transaction price for the online brokers’ clients.

In both 2Q 2021 and the entire first half of 2021, about 80% of Robinhood’s total revenues came from PFOF for equities and options, and similar “transaction rebates” for cryptocurrencies. SEC Chairman Gary Gensler remains skeptical about this practice. In late August, he told Barron’s that PFOF has “an inherent conflict of interest” and that banning it is a possibility.

Financially strong Revolut’s entrance into commission-free stock trading in the U.S. will likely siphon off some of Robinhood’s potential future customer growth. Indeed, Revolut’s focus on the young investor demographic makes it a particular threat to Robinhood. Given all this, it seems surprising that Robinhood investors have not yet reacted to the changing competitive dynamics.

Robinhood Markets, Inc. last traded at US$44.91 on the NASDAQ.

Information for this briefing was found via mining.com and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.