European natural gas prices soared just over 50% on February 24 in response to Russian President Putin’s orders to begin the invasion of Ukraine — and to the televised nature of the assault which reminded viewers of the horrors of war. The reason: Gazprom, a Russian majority state-owned energy corporation, supplies roughly 40% of the Europe’s natural gas needs, and that supply can no longer be considered certain.

Dutch natural gas futures, the European benchmark — much like Henry Hub futures is the U.S. natural gas price standard — rose 46.1 euros per Megawatt-hour (Mwh) to 135 euros/Mwh. This price equates to a staggering US$43.31 per thousand cubic feet of gas (Mcf). By comparison, March Henry Hub gas futures closed at US$4.67 per Mcf on February 24.

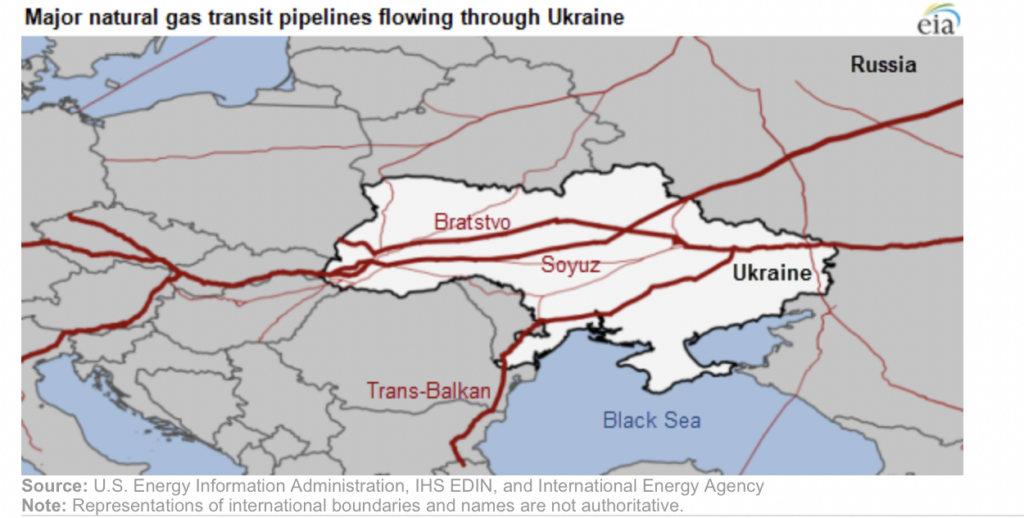

Four major pipelines can carry gas from Russia to Europe, and three appear to be operating normally. Two, the Bratstvo and Soyuz, cross through Ukraine before reaching Poland and Slovakia, respectively. Ukraine receives fees from Gazprom for allowing the pipelines to traverse its country. Those fees have sometimes led to payment disputes between Gazprom and Ukraine. Both pipelines need refurbishment, and Gazprom had planned to use Nord Stream 2 to effectively replace them. Both Bratstvo and Soyuz are apparently operating normally.

The third and fourth pipelines, Nord Stream, which is operating as normal, and Nord Stream 2, which is fully built at a cost of US$11 billion but was denied regulatory authority to operate by Germany on February 22, run under the Baltic Sea from Russia to Greifswald, Germany.

Simply put and in light of Russia’s invasion of Ukraine, Europe seems unlikely to procure any incremental natural gas from Russia for the foreseeable future — even when hostilities end. Furthermore, the quantity purchased could easily decline as the amount delivered by the legacy pipelines traversing Ukraine could fall due to reduced efficiency, and Germany will very likely deny Nord Stream 2 the opportunity to flow for a long time. Also, Russia could decide to curtail gas flows as punishment for the sanctions Europe has levied on the country.

As a result, one of the most reasonable bets in the global energy industry seems to be that Europe will seek to procure increasing amounts of liquefied natural gas (LNG) from almost any source available to temper/replace dependence on Russian supply.

One of the only pure LNG plays is Cheniere Energy, Inc. (NYSE: LNG), a full-service LNG provider headquartered in Houston, Texas. Cheniere provides LNG liquefaction, transportation and delivery services for clients located throughout Europe and Asia.

Cheniere‘s liquefaction facilities are about 90% contracted over the next 15+ years. It has about US$6 billion of revenue fixed via annual fixed-fee or take-or-pay style agreements. Cheniere has delivered LNG cargoes to clients in 35 countries. However, we note that at least some of the company’s potential has been reflected in its stock price; Cheniere’s shares have appreciated about 20% over the last month.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.