China Evergrande Group, the world’s most debt-laden property developer (astonishingly, more than US$300 billion in liabilities), may collapse in a matter of days or weeks, which could in turn represent the biggest challenge faced by the world’s second biggest economy in years, but no investor outside China seems to care.

To put this US$300 billion figure into perspective, the aggregate debt of investor-owned U.S. electric utilities, one of the most debt-intensive of all industries, is around US$79 billion. According to Bloomberg, China’s major banks have been told by the country’s housing authority that Evergrande will not make a US$84 million interest payment due September 23.

Evergrande’s core business is real estate development, but it is involved in many other aspects of China’s economy. Specifically, Evergrande owns more than 1,300 residential projects in 280 cities across China. It employs around 200,000 people. The company also develops electric vehicles, owns a soccer team, has a large theme park unit, and sells bottled water, dairy products, and other products across China.

Evergrande’s financial issues appear to be snowballing. Reuters reports that Hong Kong banks like HSBC and Standard Chartered are refusing to extend mortgage loans to buyers in two uncompleted Evergrande Hong Kong residential properties.

Perhaps more ominous, Evergrande has announced that its property sales will decline “significantly” in September, continuing a recent pattern of declines which will further crimp its cash flow. Bond rating agencies have repeatedly downgraded their ratings on the company, limiting its chances to raise new financing and to restructure its debt.

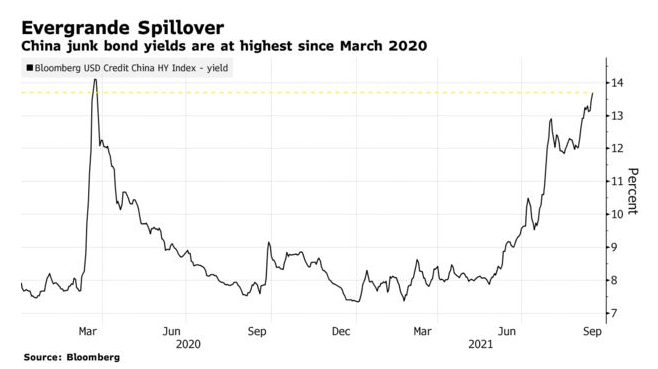

Chinese junk bond yields have soared to nearly 14% on the Evergrande uncertainty. U.S. high-yield bond yields, which were about the same as China’s at the March 2020 start of the pandemic, are now nearly ten full percentage points lower.

Importantly, the company’s problems are rippling through China’s broader economy. Homeowners and investors are being forced to sell properties quickly and incur losses.

S&P reports that Evergrande may be trying to convince contractors and suppliers to accept physical properties as payment as opposed to cash to preserve some degree of liquidity. Investors publicly protest the company’s overdue payments to them. Bloomberg reports the company has fallen behind on payments to 70,000 investors.

For now, most investors do not expect Evergrande’s potential default and the resultant depressing effect it would have on China’s economy to have much effect on North American securities markets. Generally, investors expect China’s government to intervene to save the day before signs of contagion become too powerful.

We will see if China can avoid a “Lehman-like” event which would significantly damage this economy. However, on September 16, the editor-in-chief of the state-backed Chinese newspaper Global Times warned that Evergrande should not bank on a government bailout on the notion that it is “too big to fail.” We note that the views of the Global Times do not necessarily reflect the official policy of China’s government.

It does seem that investors are giving little weight to the possibility that an Evergrande failure could spark a financial crisis on a global basis. It may not, but we advise investors to closely monitor this situation.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.