The Federal Reserve is in a position to hike borrowing costs by more than 50 basis points come its policy meeting this week, after latest inflation data showed an economy that continues to grapple with out-of-control price pressures that have yet to subside.

The ongoing string of alarming inflation data from the Labour Department has backed the Fed into a corner, where officials will have no choice but to sharply raise interest rates despite tell-tale signs of an economy barreling towards a recession. Previously, Fed Chair Jerome Powell signalled the central bank was prepared to increase rates by half a percentage point at the June 14-15 meeting, followed by another 50 basis-point hike come their meeting in July.

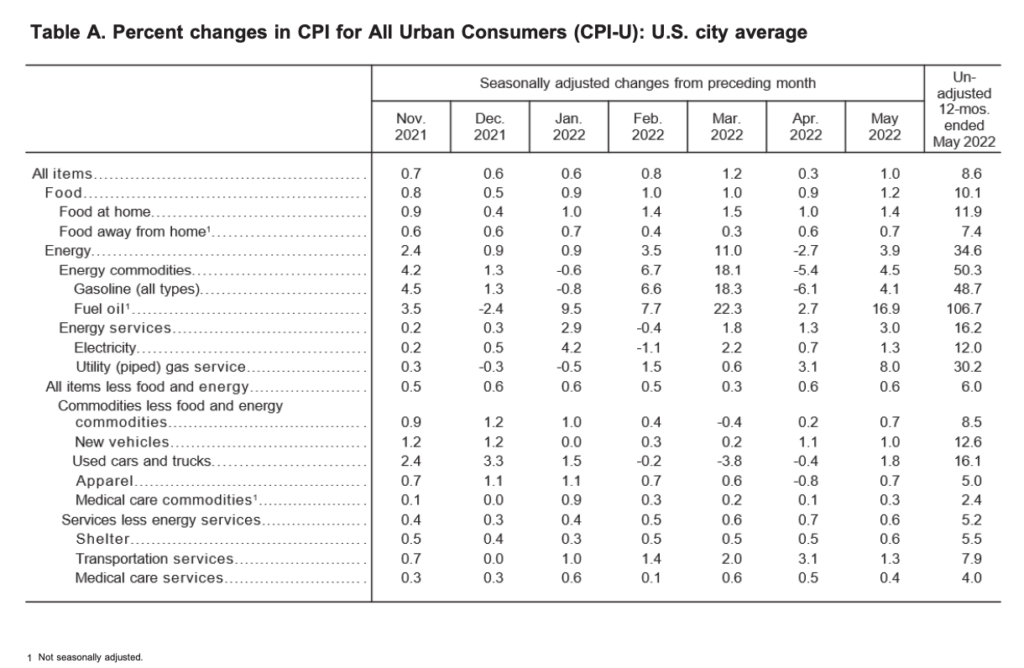

However, May CPI data showed an eye-watering 8.6% increase in consumer prices, substantially higher than officials’ expectations and even more evidence that inflation is becoming rooted across all sectors of the economy. At the same time, the Fed is losing its credibility with the American public, as consumer sentiment dips to a record-low and markets offload riskier assets ahead of what appears to be a forthcoming economic downturn simultaneously alongside a stagflationary environment.

As such, major investment banks, including Barclays, JPMorgan Chase, and Goldman Sachs are now pricing in a 75-basis point interest rate increase this week, as rising energy prices and ongoing supply chain disruptions stemming from the Ukraine conflict cement the notion that elevated price pressures are here to stay. “We believe that risk-management considerations call for aggressive action to reinforce the Fed’s inflation-fighting credibility,” said Barclays economists, as cited by the Wall Street Journal.

Should the central bank maintain is current 50 basis-point path of price taming during the current and subsequent policy meetings, its overnight rate would hit a range between 2.25% and 2.50% come September, and then sit between 3.25% and 3.50% by December. But, if officials do acknowledge they may have made a policy error by not acting on inflation sooner, then borrowing costs could end up being aggressively higher, ultimately sending the debt burden on already-income-strained households to unmanageable levels.

Information for this briefing was found via the WSJ and the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.