A recent report by the Federal Reserve Bank of Philadelphia has shed light on the prevalence of owner-occupancy fraud in residential mortgage originations, uncovering a persistent issue that extends beyond the housing bubble era. The report, entitled “Owner-Occupancy Fraud and Mortgage Performance,” challenges the notion that mortgage fraud was solely a product of the housing bubble, highlighting its ongoing presence in the housing market.

TRILLIONS of dollars in occupancy mortgage fraud discovered by the Federal Reserve.

— Darth Powell 🦈🇺🇲🇺🇦🇵🇱🇫🇮 (@GRomePow) November 5, 2023

Accounting for fraud INCREASES the number of investment properties by 50% and those loans default at a 75% HIGHER rate to the cost of taxpayers

Nothing from the @FBI @FHFA @SenateBanking… pic.twitter.com/jGqQWCdzwP

The study, which used a comprehensive dataset merging credit bureau and mortgage information, delved into the phenomenon of occupancy fraud, where borrowers falsely claim to be owner-occupants on their mortgage applications but do not move into the purchased property. The study suggests that these fraudulent borrowers are often investors in disguise, effectively increasing the size of the investor population by nearly 50%.

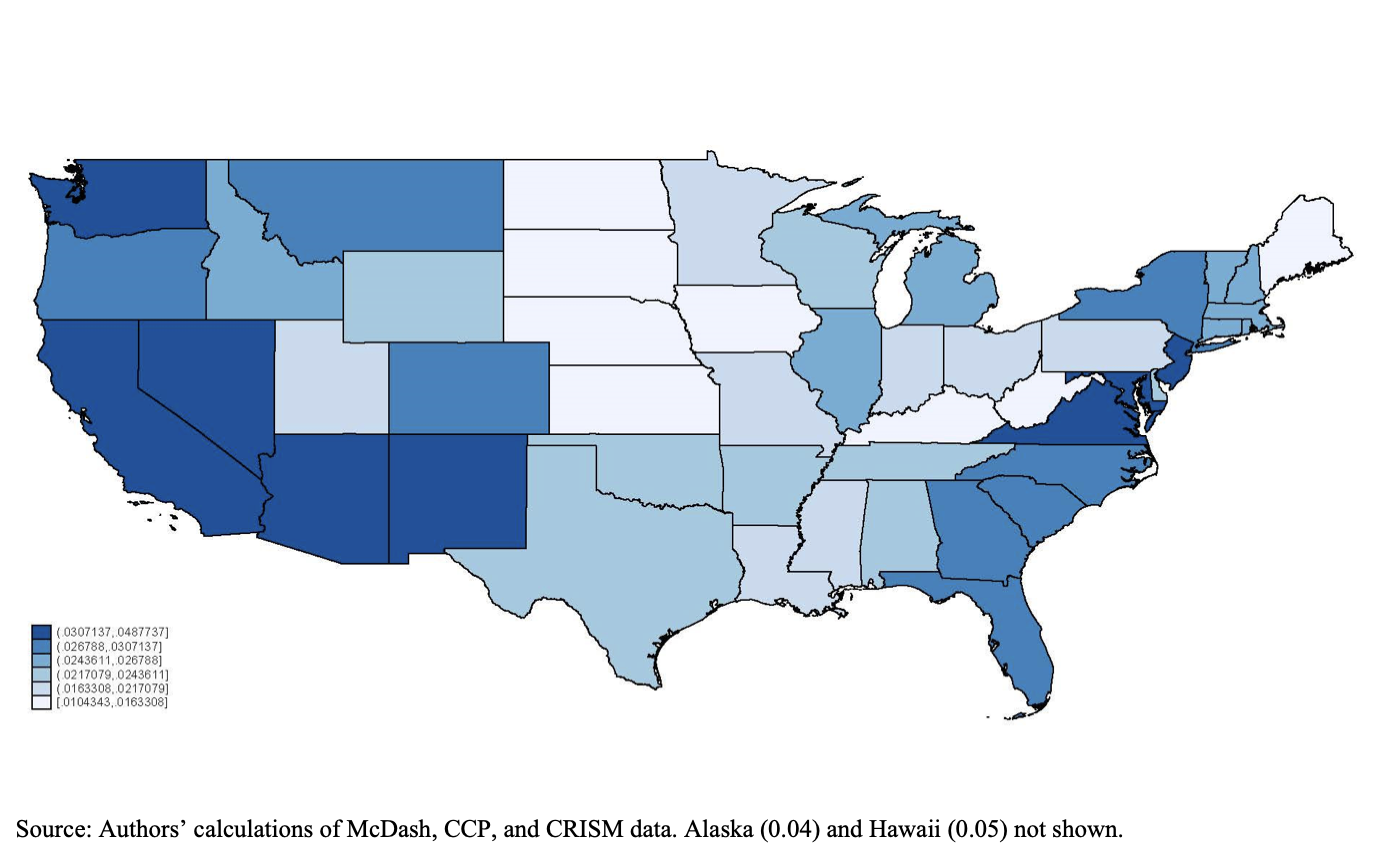

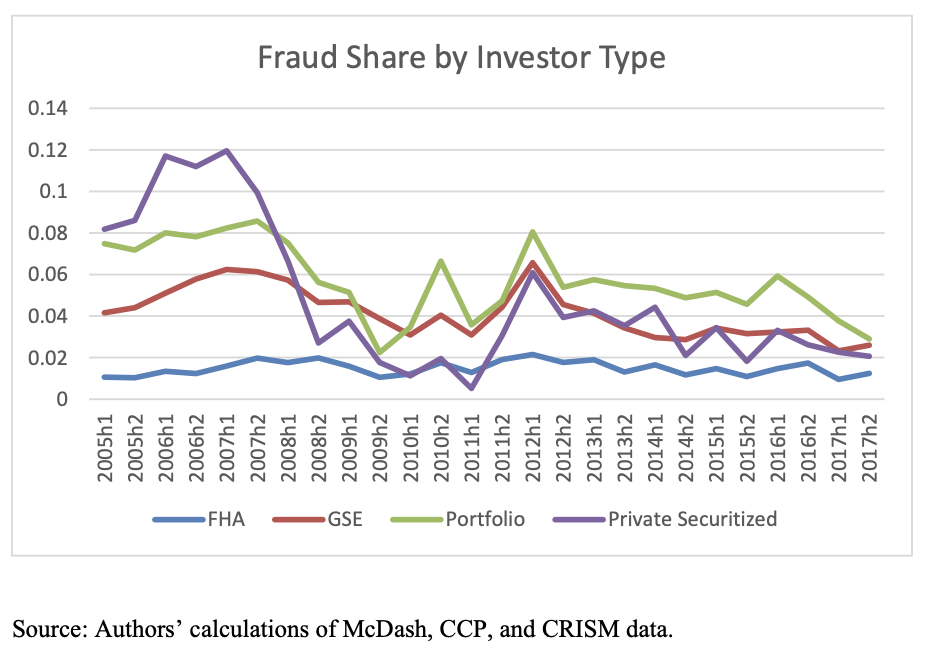

One of the key findings of the report is the widespread and persistent nature of occupancy fraud. Contrary to previous research, it shows that occupancy fraud was not confined to the housing bubble era but continues to be a concern even in more recent mortgage originations. This fraudulent activity was not limited to private securitization but was also evident in government-sponsored enterprise (GSE) guaranteed loans and loans held in portfolio.

“Occupancy fraud allows riskier borrowers to obtain credit at lower interest rates. These fraudulent borrowers perform substantially worse than similar declared investors, defaulting at a 75 percent higher rate,” the report said.

The report further highlights that those engaged in occupancy fraud benefited from favorable loan terms that would have been otherwise unattainable by declaring themselves as investors. This includes higher loan-to-value ratios (LTVs) and lower interest rates. However, these fraudulent borrowers pose a higher level of risk, with a default rate 75% higher than similar declared investors. Their default decisions are also more strategic, making them more susceptible to financial downturns, particularly in the face of declining house prices.

The findings of this report have significant implications for policymakers, lenders, and the housing market as a whole. It calls for a closer examination of the factors that may lead borrowers to engage in occupancy fraud, including behavioral characteristics. Additionally, the report suggests that such fraud may pose a risk in future boom-and-bust cycles, highlighting the need for proactive measures to address this issue.

The report’s authors emphasize the need for continued vigilance in monitoring and addressing occupancy fraud in residential mortgage originations. Recognizing the economic significance of this issue, it is crucial for the industry and regulators to develop strategies to curb fraudulent activity, protect the integrity of the housing market, and mitigate the potential risks associated with owner-occupancy fraud.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.