As the coronavirus pandemic continues to shatter the US economy, millions of Americans are finding themselves in serious financial trouble amid soaring unemployment rates and dwindling disposable incomes. According to a recent study conducted by the National Association of Realtors and One Poll, found that 81% of respondents have been the subject of sudden financial stress induced by the coronavirus pandemic, meanwhile 56% of those respondents had reduced their spending habits so they could meet their mortgage payment requirements.

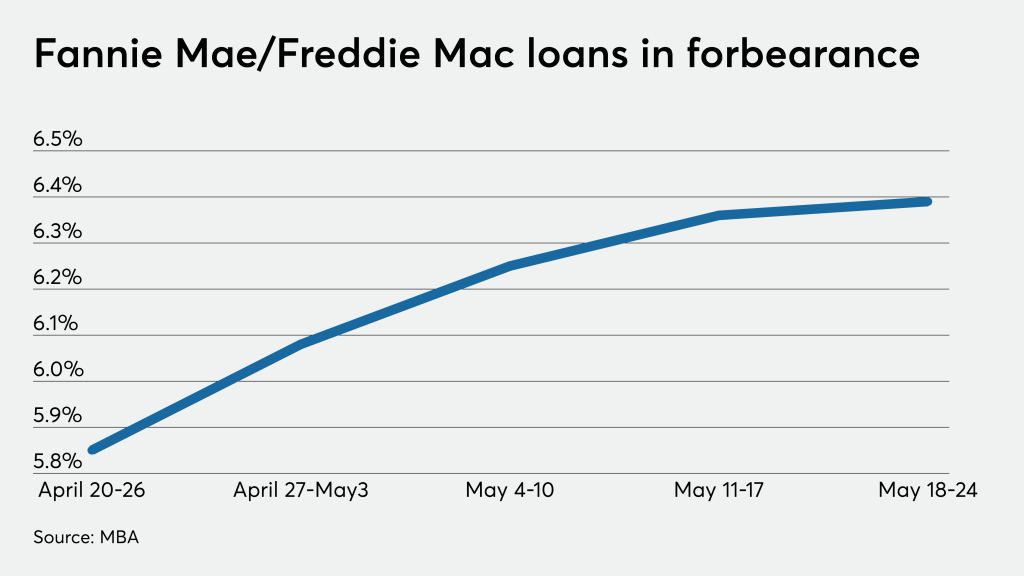

Furthermore, UK-based forecasting firm Oxford Economics reported in its most recent study that as a result of the dire financial stressors implicating Americans, up to 15% of homeowners will fall behind on their mortgage payments. So far, nearly 4 million Americans have entered into some form of mortgage forbearance program, and the number is set to continue increasing if the US economy continues to operate at a reduced output for the remainder of summer.

In a separate poll conducted by rental listing site Apartment List, 31% of Americans had only a portion of their mortgage or rent payment in the first week of May, while some made no payment at all. Luckily, as part of the CARES Act, borrowers that have their mortgages financed through Fannie Mae or Freddie Mac cannot be foreclosed or evicted; however, that is set to expire on June 30. But, according to according to the Federal Housing Finance Agency, a second lifeline has been provided for those homeowners and renters still struggling to meet their housing payment obligations.

The US federal government has decided to extend the moratorium mortgages backed by either Fannie Mae or Freddie Mac until August 31 as a means to protect renters and borrowers during the coronavirus pandemic. Nearly 43% of all new mortgages in the US are backed by either of the two mortgage loan companies, and according to Nations Lending CEO Jeremy Sopko, the foreclosure and eviction protections will most likely need to be extended again, given the growing forbearance requests amid the pandemic.

Information for this briefing was found via Yahoo Finance, National Association of Realtors, Oxford Economics, and Mortgage Bankers Association. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.