The Federal Reserve recently announced it has begun purchasing corporate bond exchange traded funds, and now as a result, its balance sheet has become increasingly large.

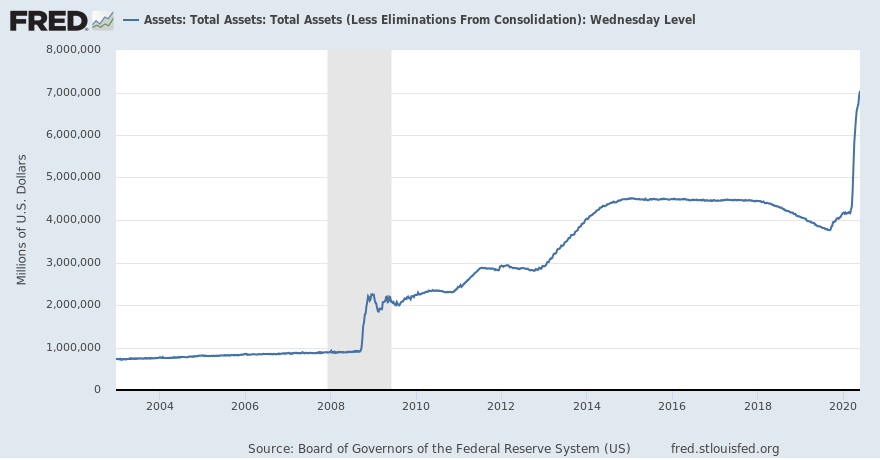

On May 20, the Federal Reserve’s balance sheet was sitting at $7.09 trillion, which has increased by $0.11 trillion since the previous week. In just the central bank’s corporate credit facility, the holdings increased by $1.5 billion to a total of $1.8 billion, in a matter of 6 days.

As a means of providing a backstop for corporate debt markets, the Federal Reserve started purchasing ETFS via its Secondary Market Corporate Credit Facility. Furthermore, through the program, the central bank is also purchasing corporate bonds, asset-class invested ETFS, as well as below investment grade debt. As a result, the Federal Reserve’s balance sheet indicates that total assets have increased to a new record of $7.04 trillion as of Thursday.

Information for this briefing was found via Market Watch, Bloomberg, Zero Hedge, and Federal Reserve Bank of St. Louis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.