FedEx Corp (NYSE: FDX) reported their fiscal fourth-quarter earnings on June 24 after hours. The company announced that revenue came in at $22.56 billion for the quarter, up from $17.36 billion a year ago. The company reported 71% gross margins with an operating margin of 8%. The firm also reported a net income of $1.87 billion, or $6.88 earnings per share.

For the full year, revenues came in at $84 billion and they had a $5.23 billion net income or a $19.45 earnings per share. The company guided earnings per share for 2022 to come in between $18.90 to $19.90.

A few analysts upgraded their 12-month price target on FedEx after the results, bringing the consensus price target to $343.88, up from $333.24. There are 32 analysts covering the stock. Out of the 32, ten analysts have strong buy ratings, 15 have buy ratings, six have hold ratings and a single analyst has a strong sell rating. The street high comes from Loop Capital with a $381 price target and the lowest sits at $198.

In BMO’s note to investors, their analyst Fadi Chamoun says that the results were decent but the outlook, “falls short of delivering a bull case.” FedEx’s stock ended the Friday session down almost 4%.

Chamoun says that the fourth-quarter results came in strong “across all three operating segments.” Adjusted EBIT came in 1% higher than their estimate, while the beat came from the Ground and Freight segments. For the specific segments, Express came in 2.2% above expectations, ADV rose 20.3%, international export was up 31.1%, and U.S packages increased 22.6%. The ground ADV segment rose 14.4% due to a recovery in business-to-business packages.

While Chamoun only has a few things to say about the 2022 guidance, he does that that they are “largely better than anticipated, albeit we sense that they did not meet the bull case framework.” The latter is specifically related to the CAPEX and higher ROIC due to labor cost inflation and not being able to time larger contract renewals. The company guided for a 13-18% earnings per share growth in 2022.

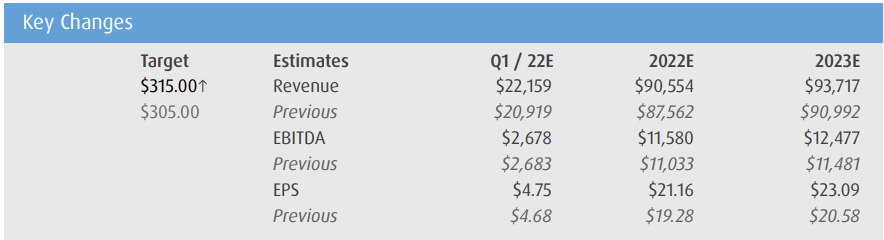

Below you can see BMO’s updated 2022/2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.