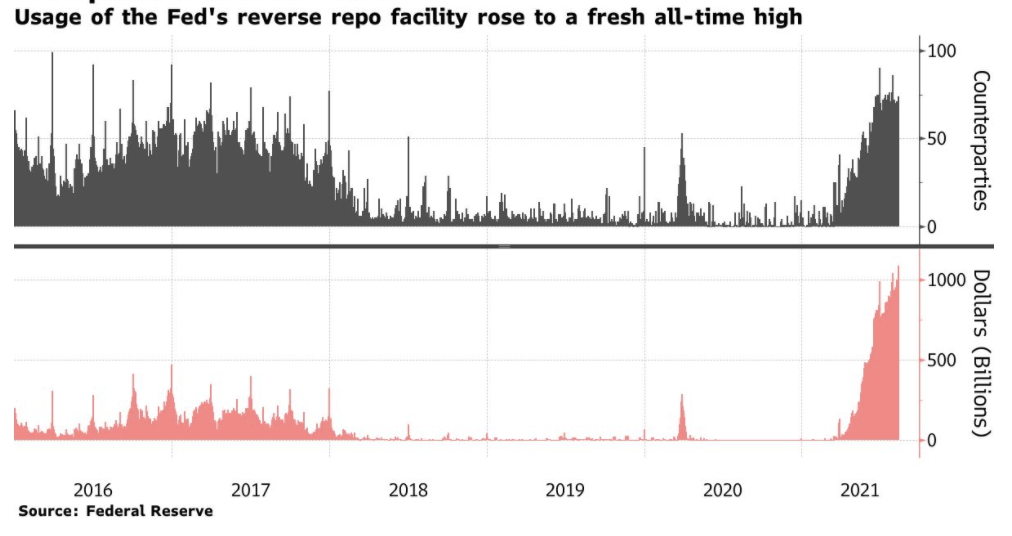

A consistent oversupply of US dollars has prompted investors to park excess cash in the Federal Reserve’s repo facility, causing it to soar above $1 trillion once again.

According to data from the New York Fed, a total of 74 financial institutions have placed a combined all-time high of $1.087 trillion in the Fed’s overnight repo facility as of Thursday. The latest figures exceed the previous record of $1.04 trillion noted at the end of July.

The new record-high of deposits was for the most part anticipated, but does suggest that the divergence in front-end markets is widening, and thus putting added downward pressure on short-term interest rates. As Bloomberg notes, the the Fed’s popular reverse repo facility will likely balloon even more, particularly as the Treasury continues to dispose of its cash pile in an effort to avoid exceeding its debt ceiling.

Information for this briefing was found via the NY Fed and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.