The growing popularity of cryptocurrencies could potentially disrupt the stability of global financial markets in the event that regulators do not take proactive action.

The Financial Stability Board (FSB), which oversees financial systems across 24 countries, recently published a report outlining concerns and risks stemming from crypto markets, and the potential of widespread disruptions to the global economy if regulators do not take action. “If the current trajectory of growth in scale and interconnectedness of crypto assets to these institutions were to continue, this could have implications for global financial stability,” said the report.

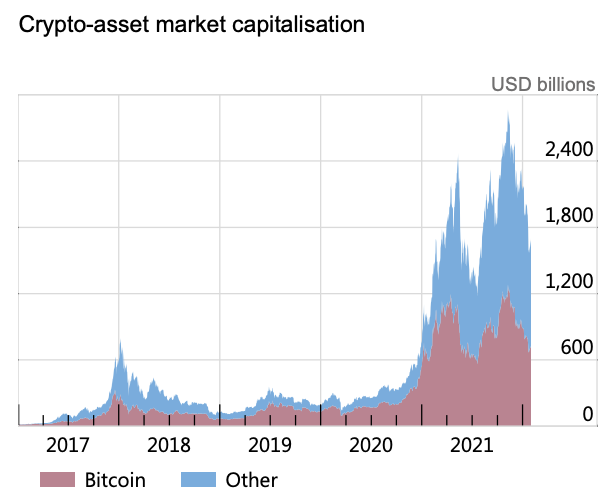

The Swiss-based watchdog estimates the market capitalization of global crypto markets ballooned 3.5 times last year to a combined value of $2.6 trillion. The report acknowledged that although crypto assets do not account for a significant portion of the global financial system, their inherent exposure risk is similar to that of the sub-prime mortgage crisis of 2007/2008. “If financial institutions continue to become more involved in crypto asset markets, this could affect their balance sheets and liquidity in unexpected ways,” warned the FSB.

“As in the case of the US sub-prime mortgage crisis, a small amount of known exposure does not necessarily mean a small amount of risk, particularly if there exists a lack of transparency and insufficient regulatory coverage.” the report continued.

The FSB particularly singled out stablecoins as posing a substantial vulnerability to consumers, as they can create a liquidity mismatch and abrupt runs on reserves. Other considerations also include the negative effects on the environment stemming from the mining of cryptocurrencies, as well as the legal ramifications of crypto assets being used for money laundering, cybercrime, and ronsomware.

Information for this briefing was found via the FSB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.