Along with other cobalt miners, First Cobalt Corp. (TSXV: FCC) faces a fundamental risk related to engineering and technical advances: the possibility that electric vehicle (EV) battery tech evolves to the point where the batteries can be made without using the toxic element cobalt. An important shot in this battle was fired on Oct. 1, 2020 when Tesla introduced a cobalt-free, lithium iron phosphate (LFP) battery in its standard-range Model 3 sold in China.

On a worldwide basis, the majority of cobalt is mined in the Democratic Republic of the Congo, which has a long history of human rights violations during mining operations. First Cobalt’s cobalt project is located in the state of Idaho in the U.S.

Cobalt, the most expensive material employed in a battery, comprises about 20% of the material in the cathode of a lithium-ion battery; it has a stabilizing effect on the battery and prevents cathode corrosion that could cause the battery to catch fire. If some or all of the cobalt in a battery were to be replaced, the current thinking in the engineering community is that replacement could reduce the life of the battery; and, since the warranty for an EV generally specifies that the battery retains 80% of its charge over an eight-year period, any cut in battery life could be very costly.

In addition, less cobalt in the battery is theorized to increase the chance that a battery cannot cool itself sufficiently, which in turn increases the possibility of combustion. The Tesla announcement could indicate that it and perhaps other EV manufacturers are closer to surmounting these issues.

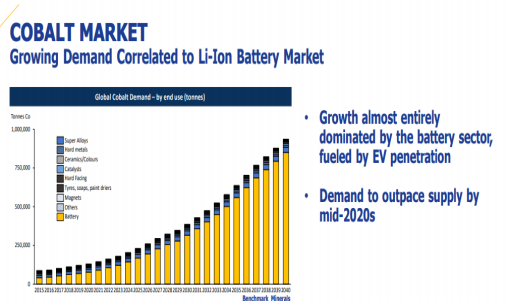

Note that forecasts of growing demand for cobalt are all predicated on its use in the EV sector. This can perhaps best be summarized by a graph, including bullet points, from First Cobalt’s current investor slide deck. If the technical issues regarding cobalt-free, LFP batteries can truly be solved, the true slope of the below graph might prove to be quite different.

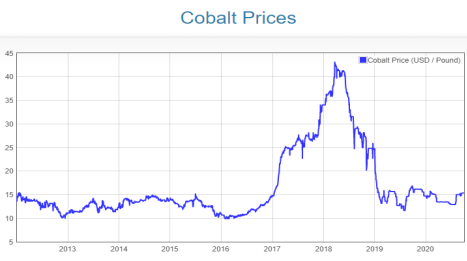

Since spiking in 2017 and early 2018 on extreme EV optimism and then crashing over the last nine months of 2018 as the enthusiasm waned, the price of cobalt has been little changed since the start of 2019. This price action for cobalt does not match the ebullience of the sharp upward slope of forecasted long-term demand for this material.

Perhaps the market has been anticipating the possibility of diminished usage of cobalt of EV batteries. To be fair, we note the price of lithium, another key element in EV batteries, has also declined significantly since spiking in 2017 and early 2018.

A Pattern of Significant Negative Operating Cash Flows and Dilution

First Cobalt is a pre-revenue company, so it will by definition generate losses and negative operating cash flow. However, its operating cash flow has averaged about negative $2 million per quarter, or more than 3% of the company’s enterprise value each quarter, over the last year, and these cash flow losses should continue for some time. To fund these shortfalls, the company issues significant quantities of new shares each quarter, diluting existing shareholders. The share count totaled 387.3 million on June 30, 2020, up around 7% in a year.

| Q2 2020 | Q1 2020 | Q4 2019 | Q3 2019 | Q2 2019 | |

|---|---|---|---|---|---|

| Operating Income | ($1,469) | ($1,772) | ($2,274) | ($1,628) | ($1,721) |

| Operating Cash Flow | ($2,910) | ($1,508) | ($2,077) | ($2,616) | ($1,851) |

| Cash – Period End | $3,581 | $4,637 | $4,420 | $6,368 | $449 |

| Debt – Period End | $6,973 | $7,001 | $6,318 | $6,239 | $0 |

| Avg. Shares Outstanding (Millions) | 387.3 | 381.4 | 376.8 | 372.2 | 362.6 |

First Cobalt’s balance sheet is not excessively levered. The company had a cash balance of $3.6 million as of the quarter ended June 30, 2020. At the same time, its debt totaled $7.0 million. The debt is held by Glencore, accrues at an interest rate of LIBOR plus 5%, and First Cobalt has the right to pay the interest on the loan in-kind, by accruing it to principal each quarter and paying it on the loan’s maturity date of August 23, 2021.

The company has so far chosen to employ this payment in kind option. If First Cobalt had instead chosen to pay the loan interest in cash, its operating cash flows shown above would have been degraded further.

It is entirely possible that an EV battery designed with little to no cobalt will result in diminished battery life, an unacceptable increased risk of fire, and/or a shorter driving range – although Tesla announced an increase in driving range to 468 kilometers from 445 kilometers on the updated Model 3 in China with the cobalt-free LFP battery. After all, cobalt’s properties positively affect all three of those areas. If so, First Cobalt could indeed become a chief beneficiary of the demand for EV’s powered by conventional battery technology.

Conclusion

First Cobalt is a pre-revenue company which in time could mine and sell many tonnes of cobalt to EV manufacturers. However, Tesla, the EV industry leader, just introduced a cobalt free battery which will be installed on production vehicles in China.

If this new technology, which eliminates a material which is toxic to the environment and potentially to the health and well-being of miners in an impoverished country (although we underscore not to miners employed by First Cobalt), proves to be successful, First Cobalt’s business prospects and potential could be significantly affected. In turn, its $50 million valuation would potentially have to adjust lower.

First Cobalt last traded at $0.12 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.