FULL DISCLOSURE: First Majestic Silver is a sponsor of theDeepDive.ca.

First Majestic Silver (TSX: AG) (NYSE: AG) has seen continued exploration success at Santa Elena, with the company on Monday evening providing an update on recent developments, while also announcing certain senior management updates.

Continued exploration at the Santo Niño and Navidad discoveries have led the company to start preliminary mine planning studies for both of the new zones. The studies are said to consist of internal scoping-level studies to assess potential underground mining scenarios for the two new discoveries, potentially adding further mine life to the Santa Elena complex.

“The continued success of the exploration program at Santa Elena has prompted the launch of an early-stage scoping level study aimed at defining optimal material handling methods, access to mineralization, mining methods, mining rates, ventilation and dewatering requirements, and ultimately integrating Navidad and Santo Niño to the district’s Life of Mine,” commented Keith Neumeyer, CEO of First Majestic Silver.

Studies conducted to date at Navidad suggest that the best route to access the discovery is a straight 3 kilometre long underground ramp, with the portal placed adjacent to the Santa Elena processing plant.

At Santo Niño, the mineralization is said to present more options for additional access, which include a crosscut from the ramp to Navidad, or a new portal placed near the deposit where high grade silver and gold are found within 100 metres from surface. Additionally, metallurgical studies conducted on mineralization from Santo Niño suggest that expected recoveries from this deposit exceed 95% for both gold and silver.

Mineralization from both new deposits are also said to be compatible with the Santa Elena processing plant.

“The district continues to demonstrate exceptional potential. In alignment with our organic growth strategy, and partially driven by the increase in available mineralization, the Company has initiated the plant expansion project with the goal of increasing throughput from approximately 3,200 tonnes per day to approximately 3,500 tonnes per day by the end of 2026. This initiative underscores our confidence in the long-term future of the operation,” continued Neumeyer.

New President Appointed

In addition to reporting on exploration success at Santa Elena, the company on Monday also indicated that they have promoted current Vice President of Corporate Development & Investor Relations, Mani Alkhafaji, to the new role of President & Chief Corporate Development Officer.

The appointment, which is effective as of January 1, 2026, is said to be part of a continued growth strategy and ongoing succession planning. Keith Neumeyer will continue to serve as Chief Executive Officer of First Majestic moving forward.

“I am pleased to announce the promotion of Mani to President & Chief Corporate Development Officer. I believe it is another important step in First Majestic’s transition into a more mature and globally leading primary silver-producing company. Mani’s leadership and expertise were instrumental in First Majestic’s acquisition of Gatos Silver in January 2025, and he is well-positioned to drive our continued growth and success,” commented Neumeyer on Alkhafaji’s appointment.

“With over a decade of experience at First Majestic, Mani has held several senior roles at the Company including Director, Operational and Cost Analysis, General Manager – Jerritt Canyon, Director, Internal Audit, Vice-President, Business Planning & Procurement, and most recently, Vice-President, Corporate Development & Investor Relations, and as a result, Mani has significant experience and knowledge regarding the key areas of First Majestic’s business.”

Exploration Success At Santa Elena

Exploration at Santa Elena in 2025 saw a total of 64,000 metres planned, resulting in 66,800 metres being drilled to date with the expansion of those metres being conducted where exploration success was found. Highlight assay results from the drill program can be found here.

15,307 metres of drilling was conducted across 32 holes at Santo Niño, with the deposit now said to measure 1,100 metres by 400 metres in strike and dip. True thickness of mineralization is said to be in the range of 2.5 to 5.0 metres, with an inferred mineral resource estimate expected to be released in the first quarter of 2026.

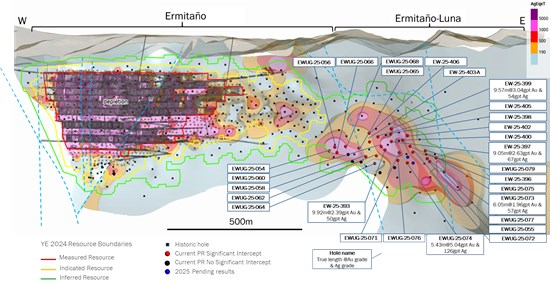

Navidad meanwhile has seen 10,161 metres across 8 holes conducted this year, with significant intercepts said to have been made to the east of the current resource boundary. Gold and silver mineralization has been identified over a footprint of 1,200 metres by 400 metres in strike and dip, with the true thickness of mineralization average between 3.0 and 4.0 metres.

Finally, 11,190 metres of drilling was conducted at the Luna zone, with a total of 33 holes being drilled. Drilling here focused on converting inferred resources to indicated, while refining the geologic understanding of the Ermitano and Aitana veins in the area.

First Majestic Silver last traded at $22.09 on the TSX.

FULL DISCLOSURE: First Majestic Silver Corp. is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of First Majestic Silver Corp. The author has been compensated to cover First Majestic Silver Corp. on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.