According to persons familiar with the situation, First Republic Bank (NYSE: FRC) is considering strategic options, including a sale.

The bank, which is also considering options for bolstering liquidity, is expected to attract attention from larger rivals, the sources told Bloomberg. They stated that no decision has been made and that the bank may still choose to remain independent.

Seems like a strategic leak. Possibly elicit outside bids for the process and give seller leverage in negotiations? Especially with sneaking the threat of walking away/remaining independent in there.@GlogauGordon any other plausible goals here from your leaks playbook?

— Matt Vinson (@mattmvinson) March 16, 2023

This comes after the San Francisco-based lender was downgraded to junk status by S&P Global Ratings and Fitch Ratings on Wednesday.

“We believe the risk of deposit outflows is elevated at First Republic Bank despite the actions of federal banking regulators and the bank actively increasing its borrowing availability to mitigate risk associated with the bank failures over the last week,” wrote S&P Global Ratings analysts Nicholas Wetzel and Rian Pressman.

S&P downgraded First Republic’s long-term issuer credit rating from A- to BB+. The BB+ rating is considered “junk” debt, which means it is not investment grade. S&P said all of First Republic’s ratings are on “negative” credit watch, implying that more downgrades are possible.

Additionally, Fitch Ratings cut First Republic’s long-term issuer default rating to BB from A- and placed it and its ratings on negative watch. First Republic’s deposit base was defined as “concentrated,” with a strategic concentration on wealthy and financially sophisticated clientele in some urban coastal locations.

“This not only drives a high proportion of uninsured deposits as a percentage of total deposits but also results in deposits that can be less sticky in times of crisis or severe stress,” said Fitch.

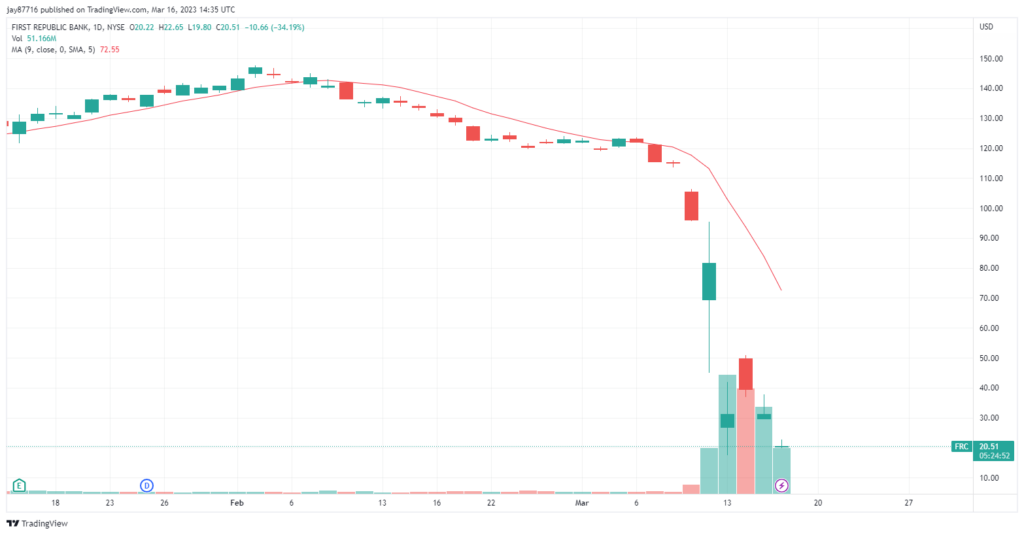

First Republic stated on Sunday that it had more than $70 billion in unused liquidity through arrangements with the Federal Reserve and JPMorgan Chase & Co. to support operations. Yet, its shares plunged 21% in New York trading Wednesday to a low of $31.16, before crashing a further 34% to $20.50 this morning.

“The additional borrowing capacity from the Federal Reserve, continued access to funding through the Federal Home Loan Bank, and ability to access additional financing through JPMorgan Chase & Co. increases, diversifies, and further strengthens First Republic’s existing liquidity profile,” the bank said in Sunday’s statement.

The lender focuses in private banking and wealth management and has attempted to distinguish itself from Silicon Valley Bank, which was seized by US regulators. Unlike the latter, which has a large number of startups and venture businesses as clients, First Republic claims that no industry accounts for more than 9% of total business deposits.

According to First Republic’s most recent 10-K filing, 68% of its approximately $176 billion in deposits at the end of 2022 were uninsurable by the FDIC. Formerly, the FDIC insured deposits up to $250,000, but it guaranteed Silicon Valley Bank’s depositors, as well as Signature Bank’s depositors well over that level.

Information for this briefing was found via Bloomberg, Yahoo Finance, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.