Fisker Inc. (NYSE: FSR), a well-funded start-up electric vehicle (EV) manufacturer, plans to commence production of its Fisker Ocean mid-sized SUV model in November 2022. Fisker originally revealed the design for the all-electric Ocean, a five-passenger vehicle with a 250-350 mile range, at the Consumer Electronics Show in early 2020. One of Fisker’s key attributes is its Chairman and CEO Henrik Fisker. Mr. Fisker in the past led the design of such famous cars as BMW’s Z8 sports car, the Aston Martin DB9 and V8 Vantage.

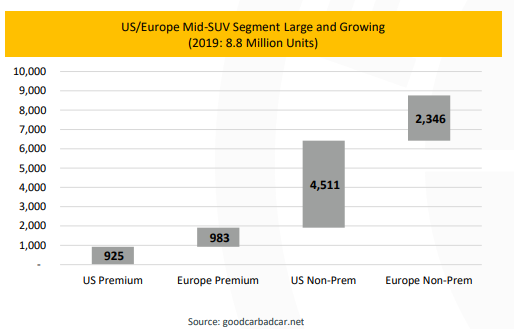

Fisker expects to sell 200,000 – 250,000 vehicles annually by 2025. Such a sales level would represent about 2.5% of the total addressable mid-sized SUV market of the United States and Europe combined.

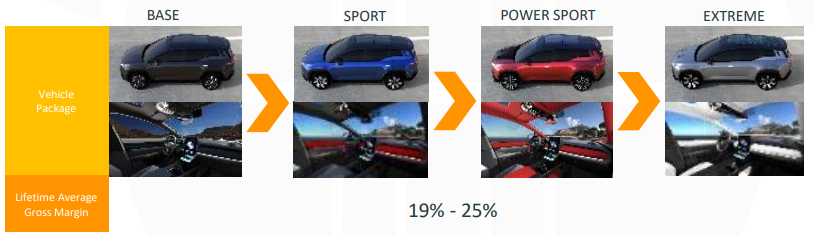

The Fisker SUV is expected to have a sales price range of US$37,499 to US$69,900 depending on the options selected in the vehicle. This range is before the effect of any EV credits in the United States (currently US$7,500 per vehicle). Fisker also plans to offer an innovative leasing program where the down payment, mileage allowance and other features compare favorably with other EV competitors.

Fisker has received a net 13,300 retail reservations and 700 fleet reservations for its SUV, even after reflecting 1,100 retail customers which canceled their places in line. A reservation costs US$250 and is fully refundable, minus a $25 cancellation fee.

Fisker has stated that over the medium term it expects to post gross margins of 19% – 25% on its models. If this gross margin percentage were to be realized, and factoring in the company’s unit sales projection of 200,000 – 250,000 by 2025 and an average sales price of perhaps US$55,000, Fisker’s cash gross margin in a few years could potentially reach the neighborhood of US$2.5 billion. By comparison, Fisker’s total enterprise value is currently around US$2.8 billion.

Strong Balance Sheet

As of year-end 2020, Fisker had US$991 million of cash and negligible debt. Its operating flow deficit was around US$30 million in 4Q 2020.

| (in thousands of US $, except for shares outstanding) | Quarter Ended December 31, 2020 |

| Operating Income | ($31,306) |

| Operating Cash Flow | ($30,064) |

| Cash – Period End | $991,158 |

| Debt – Period End | $2,567 |

| Shares Outstanding (Millions) | 277.3 |

If Fisker were to encounter difficulties in reaching its fall 2022 target of commencing Ocean SUV production, Fisker’s shares could be affected. In addition, investors currently are enthusiastic about the future sales prospects of EVs. If that attitude were to swing to a less optimistic one, Fisker’s stock could likewise suffer.

While a start-up, Fisker is well capitalized and is led by a well-known and well-respected auto designer. Its Ocean SUV model has received reservations from many retail and fleet customers. If it can begin production at around the time frame it has announced (fall of 2022) and realize its target gross margins, the company could generate significant cash flow in a few years.

Fisker Inc. last traded on the NYSE at US$13.12.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.