Flying Nickel To Acquire Nevada Vanadium, Months After Both Were Spun Out Of Silver Elephant Mining

It appears that certain executives within the Canadian junior mining space enjoy consuming shareholder dollars via lawyer fees.

Flying Nickel Mining Corp (TSXV: FLYN) this morning revealed that it has entered into a non-binding letter of agreement with Nevada Vanadium Mining Corp for the two firms to merge. The proposed merger follows the two assets being spun out from Silver Elephant Mining (TSX: ELEF) earlier this year on January 14.

The transaction will see shareholders of Nevada Vanadium, which remains private currently, receive one Flying Nickel share for each share held. The transaction represents a price per share of $0.155 based on the last trading price of the company. Notably, Nevada Vanadium in February announced a $4.0 million financing at $0.40 per unit, however its unclear if that transaction ever closed.

Current Flying Nickel shareholders are expected to own 54% of the resulting issuer, while Nevada Vanadium shareholders will own 46%.

“The Gibellini Vanadium project is an ideal complement to Flying Nickel’s Minago Nickel project. Nickel and vanadium are both key ingredients in batteries and classified as critical metals* by U.S. Geological Survey. Minago and Gibellini are both entering into the final environmental permitting stages and are located in mining friendly districts in North America. We believe the combined company will have one-of-a-kind mineral resource base and a dominant presence in the battery metals mining space,” said John Lee, CEO of Flying Nickel, despite being the CEO and Executive Chairman of Silver Elephant, whom separated the two assets just months ago.

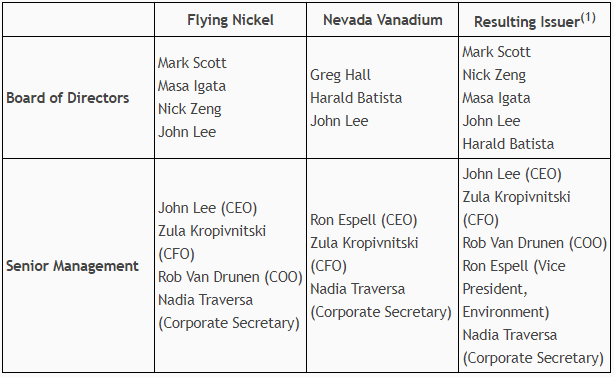

On the plus side, given that the two firms were recently separated from each other, on the topic of management, much of the members are the same, and will remain as such going forward. John Lee will remain CEO of the resulting issuer, with only one director, Greg Hall of Nevada Vanadium, not to remain with the company in an executive role on a post-transaction basis.

Nevada Vanadium currently holds the Gibellini vanadium project in the Battle Mountain district of Nevada, which consists of a proposed open pit heap leach mine focused on primarily producing vanadium. Flying Nickel meanwhile holds the Minago Nickel project, found in the Thompson nickel belt of Manitoba.

The proposed transaction remains subject to shareholder approval from both firms, as well as customary closing conditions.

Flying Nickel last traded at $0.155 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

As the founder of The Deep Dive, Jay is focused on all aspects of the firm. This includes operations, as well as acting as the primary writer for The Deep Dive’s stock analysis. In addition to The Deep Dive, Jay performs freelance writing for a number of firms and has been published on Stockhouse.com and CannaInvestor Magazine among others.