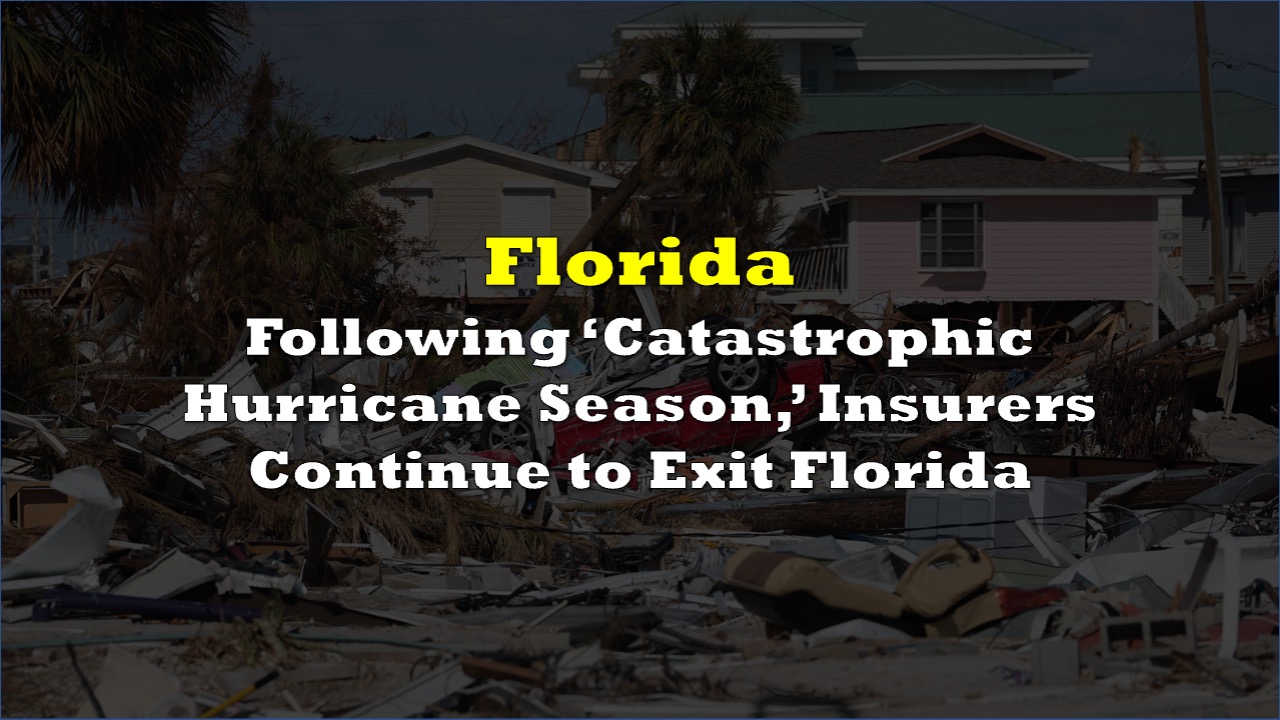

AAA has announced that it will not be renewing auto and home insurance policies for some customers in Florida.

The company cited the increasingly challenging insurance market in the state, with rising reinsurance rates as a result of the catastrophic hurricane season of the previous year. This move follows a trend among insurers reducing their presence in Florida due to the escalating risk of natural disasters.

“Unfortunately, Florida’s insurance market has become challenging in recent years,” AAA said in a statement. “Last year’s catastrophic hurricane season contributed to an unprecedented rise in reinsurance rates, making it more costly for insurance companies to operate.”

Although AAA did not disclose the exact number of affected policyholders, they stated that it would only impact a small percentage of their customers. This decision marks the fourth instance in the past year of an insurer stepping back from providing coverage to Floridians, highlighting the impact of extreme weather events attributed to climate change on the stability of the insurance market.

RELATED: Florida’s Housing Insurance Crisis Is About to Get Worse

Recently, Farmers Insurance announced its withdrawal from the state, affecting around 100,000 policyholders. Notably, this decision by Farmers only pertains to company-branded policies, which make up approximately 30% of their policies sold in Florida.

Last year, Bankers Insurance and Lexington Insurance, a subsidiary of AIG, also withdrew from the state, citing the high costs associated with insuring residents due to recent natural disasters, including Hurricanes Ian and Nicole, which caused significant damage and loss of life.

Florida’s homeowners already pay approximately three times the national average for insurance coverage, and rates are expected to surge by 40% this year.

Despite legislative efforts to stabilize the market, such as the passing of a law in December, which establishes a $1 billion reinsurance fund and introduces measures to discourage frivolous lawsuits, insurance companies continue to exit the state.

AAA acknowledged the positive impact of the new legislation but emphasized that it would take time for the improvements to fully materialize, leaving providers with difficult choices to manage risk and catastrophe exposure.

Similarly in California, insurers like AIG and State Farm have stopped writing new home policies as the state grapples with increased risk from wildfires. The US Forest Service estimated the aggregate value at risk to wildfires to be at $300 billion.

The implications of this trend extend to the broader conversation surrounding climate change, underscoring the urgency of addressing environmental concerns and their far-reaching economic consequences.

Information for this story was found via CBS News, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.