Federal Reserve officials have finally come to a consensus that inflation across America is too damn high, warranting action as early as March on interest rates and the central bank’s balance sheet.

“Participants remarked that recent inflation readings had continued to significantly exceed the Committee’s longer-run goal and elevated inflation was persisting longer than they had anticipated, reflecting supply and demand imbalances related to the pandemic and the reopening of the economy,” read the January 25-26 FOMC minutes, which were released on Wednesday.

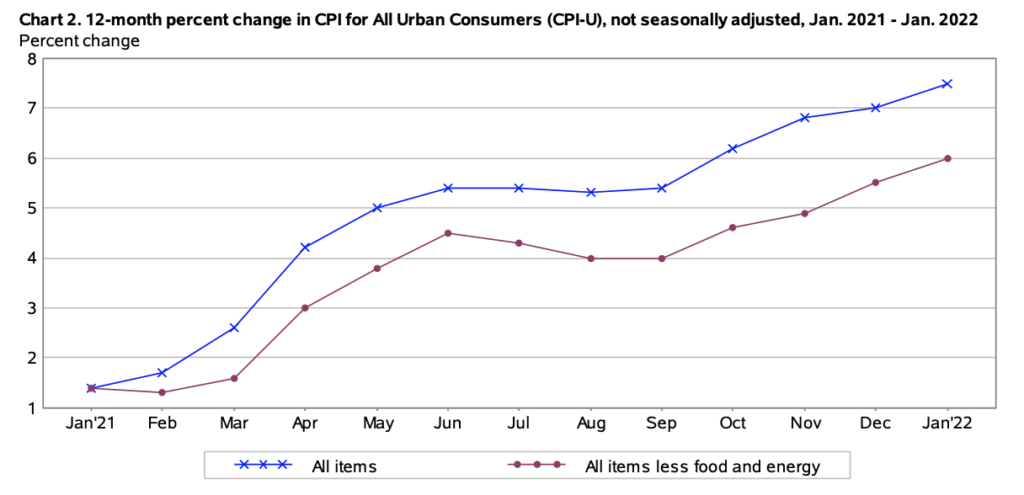

The latest CPI reading for January showed consumer prices soar to a spine-tingling 7.5%— the highest in 40 years and light-years away from the Fed’s wishful thinking inflation target of 2%. Indeed, minutes showed that inflation was the most-discussed during the meeting, with the term being brought up 73 times throughout the summary, with participants confirming price pressures were becoming broad-based across all sectors of the economy. “Participants acknowledged that elevated inflation was a burden on U.S. households, particularly those who were least able to pay higher prices for essential goods and services.”

Markets are fully pricing in an interest rate hike come the FOMC’s March meeting, with forecasts of an increase as much as 50 basis points. As cited by Bloomberg, investors are expecting borrowing costs will go up at least 150 basis before the end of 2022, up from an estimate of 75 basis points several weeks ago.

In response to scorching-hot inflation, Fed members are also speeding up the taper of their unprecedented quantitative easing program, which is slated to come to an end in March. In fact, the overheating economic situation is so dire, that Fed officials agreed it is time to aggressively unravel the central bank’s bond portfolio. “Participants observed that, in light of the current high level of the Federal Reserve’s securities holdings, a significant reduction in the size of the balance sheet would likely be appropriate,” said the minutes.

SIGNIFICANT balance sheet reduction. Fed officials do NOT use words like that lightly.

— Danielle DiMartino Booth (@DiMartinoBooth) February 16, 2022

Information for this briefing was found via the Federal Reserve and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.