With a sixth interest rate hike en route this week, some economists are sounding the alarm that the Fed will hike the US economy straight into a recession. However, with persistent inflation continuously rearing its ugly head each month, Fed Chair Jerome Powell may have to maintain a hawkish stance to undo the central bank’s unprecedented money-printing spree.

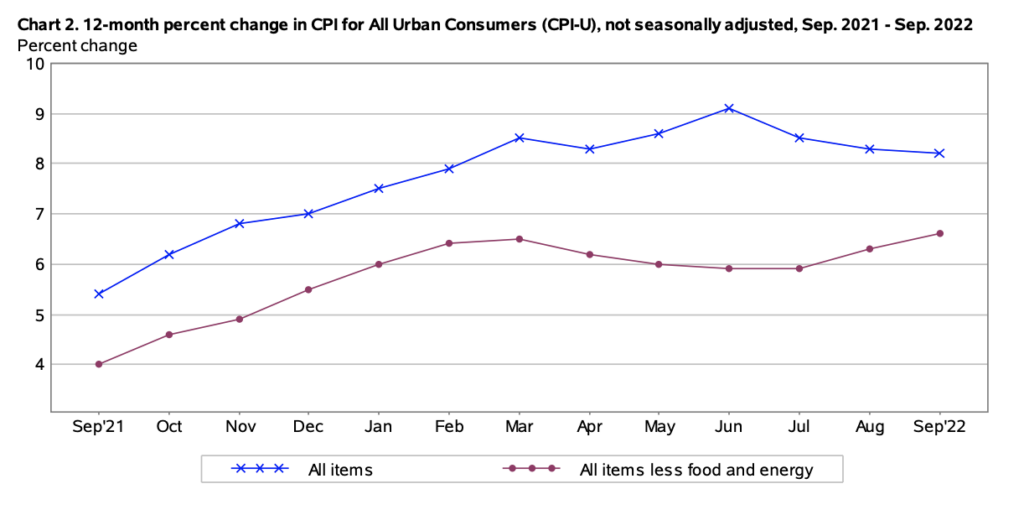

Consensus among economists calls for a fourth consecutive 75 basis-point hike come Wednesday, bringing the federal funds rate to a range of 3.75% and 4% and cementing the central bank’s aggressive stance to fight 40 year-high inflation. Core measures from September’s CPI data once again printed higher than expected, rising 6.6% year-over-year as policy makers fear price pressures could become entrenched should they relax their monetary policy stance prematurely.

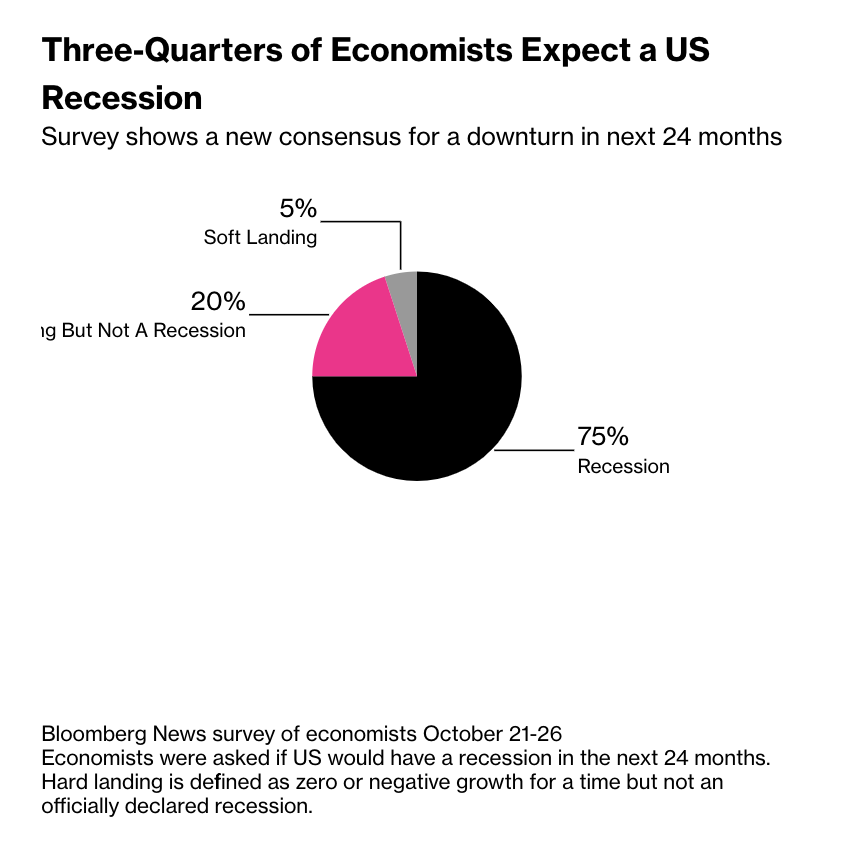

Back in August, Powell insisted the Fed will strongly adhere to restoring price stability, warning consumers and markets of impending slower economic growth and a weakened labour market. According to pre-FOMC meeting surveys cited by Bloomberg, at least 75% of the economists surveyed anticipate the US economy is headed towards a recession within the next two years, while the remainder of respondents foresee a hard landing accompanied with a period of negative GDP growth.

In fact, the economists said the Fed might potentially even over-tighten into a peak target rate at around 4.75%, increasing the risk of causing unnecessary hardship as opposed to not raising borrowing costs enough and allowing inflation to run rampant. “Monetary-policy lags are still underestimated,” warned Pictet Wealth Management economist Thomas Costerg. “The full effect of current tightening may not be felt until mid-2023. By then, it could be too late. The risk of a policy mistake is high.”

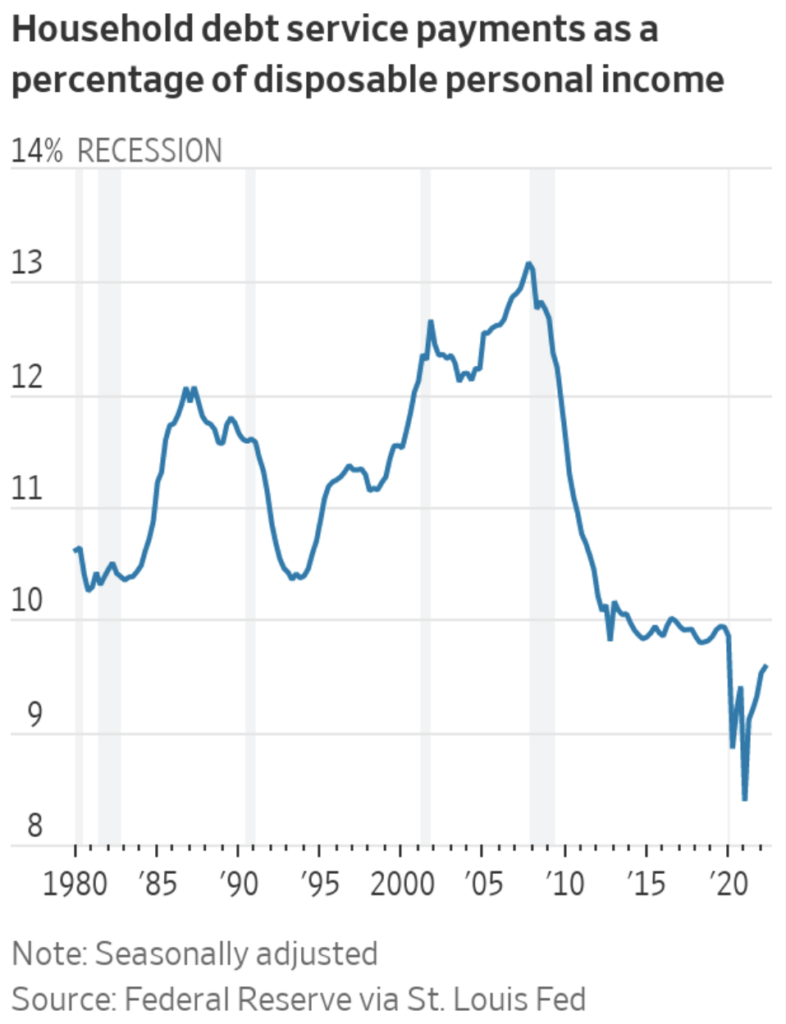

However, American consumers and businesses are still faring relatively well in terms of their financial positions, signaling that a higher interest rate environment could be endured longer. The unprecedented fiscal and monetary response to the pandemic ballooned households’ wallets and slashed borrowing costs, interrupting the traditional textbook recessionary effects such as higher unemployment; amplifying declining income and spending.

According to Goldman Sachs calculations, household, non-financial corporate and small-business sectors accumulated an excess of total income over total spending equivalent to 1.1% of GDP in the second quarter, which, when compared as a three-year average, is substantially better than any pre-recession period since the 1950s. In fact, Fed economists estimated that Americans still have about $1.7 trillion worth of savings left, which is significantly higher than the cash they would have saved if income and spending remained on par with the pre-pandemic economy. Around $350 billion of the surplus cash was held by households in the lower portion of the income distribution, which amounts to an average of $5,500 per household.

Likewise, stock markets are also faring relatively well, as investors continue to pour cash into equities. According to Bank of America strategists, it’s still too early for the Fed to transition into a more dovish stance “absent sudden collapse in inflation & payrolls,” as inflows into global equity funds reached $23 billion for the week of October 26, the biggest amount since March. Equity funds in the US alone enjoyed $21.4 billion in inflows, while cash inflows hit $28.4 billion for the period. The strategists pointed out that the central bank typically begins slashing rates once the unemployment rate surpasses 5.5%, which according to latest data, currently sits at 3.5%.

Still, according to Morgan Stanley strategist Michael Wilson, a Fed pivot is actually a lot closer than markets may be expecting. A number of indicators including the inverted yield curve, supports “a Fed pivot sooner rather than later,” Wilson wrote in a note seen by Bloomberg. “Therefore, this week’s Fed meeting is critical for the rally to continue, pause or even end completely.” Indeed, the US stock market has been sent rallying, as traders analyzed economic indicators that could be symptomatic to the Fed’s tightening cycle. “This kind of price action isn’t unusual toward the end of the cycle particularly as the Fed moves closer to the end of its tightening campaign, something we think is approaching,” he explained.

Information for this briefing was found via Bloomberg, the WSJ, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.