In late March Fortuna Silver Mines Inc. (TSX: FVI) reported its fourth quarter and full-year financial results. The company announced sales of $198.9 million, up 92% year over year for the fourth quarter. Mine operating income grew from $46.9 million to $58.3 million, or 24%, while its operating income grew to $38.9 million, or 38%.

Even with a large revenue increase, the company saw it’s net income and earnings per share decrease year over year, as net income was $16.6 million compared to $18.6 million in the year ago period, down 11%. This resulted in their earnings per share halving on a year over year basis, dropping down to $0.05 per share from $0.10 per share last year.

The company saw its quarterly adjusted EBITDA grow 100% to $89.6 million, while its free cash flow from ongoing operations was down 10% year over year to $30.9 million.

For the year, the company reported sales of $599.9 million, up from $279 million for the full year 2020, up 115%, while mine operating income grew 86% year over year to $205.5 million. Operating income grew faster than the two, growing at 139% to $136.9 million for the year. The company reported adjusted EBITDA of $280.7 million for the year and free cash flow from ongoing operations of $147.1 million.

On the production side, the company reported full-year silver and gold production at 7,498,701 ounces and 207,192 ounces, respectively. This is up from 7,133,717 ounces and 55,349 ounces in 2020. The company had an all-in sustaining cost per ounce of gold of $1,116 and $1,317 at the Lindero and Yaramoko mines respectively, while the company had an all-in sustaining cost of $14.38 and $18.94 at the San Jose and Caylloma silver mines.

Fortuna Mines currently has 7 analysts covering the stock with an average 12-month price target of C$5.66, which represents a 22% upside to the current stock price. Out of the 7 analysts, 1 has a strong buy rating, 1 analyst has a buy rating and the other 5 have hold ratings. The street high sits at C$6.50, which is a 40% upside to the current stock price.

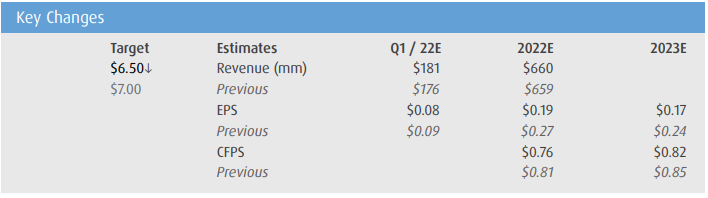

In BMO Capital Markets’ note on the results, they reiterate their outperform rating but lower their 12-month price target from C$7.00 to $6.50, saying that the results came in mixed, and because of this, they have trimmed their operating cash flow estimates.

On the results, BMO says the earnings per share came in lower than their $0.14 estimate while costs remained higher than expected than their $84 million estimates. Fair value write-down of inventory totaled $5.1 million this quarter for inventory at the Lindero and Yaramokmo mines, while higher depreciation and G&A expenses also weighed on the company’s results. These line items also contributed to the company missing cash flow estimates, which BMO was forecasting at $88.3 million for the quarter.

Lastly, BMO says that the all-in sustaining cost at Yaramoko remains elevated due to sequencing issues. These issues lead to lower grades, lower production, and higher costs in the fourth quarter. BMO says that this should not be a problem for the company during the first quarter and now the company is mining higher-grade stops.

Below you can see BMO’s updated first quarter, full-year 2022, and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.