FPX Nickel (TSXV: FPX) has completed a scoping study on establishing a refinery for awaruite in British Columbia in relation to their Baptiste Nickel Project. The study envisions the construction of a standalone refinery to refine awaruite into battery grade nickel sulphate.

The study has outlined an after tax net present value of $445 million and an IRR of 20%, which is based on a discount rate of 8%, $8.50 per pound nickel and a USD:CAD exchange ratio of 0.74. For reference, nickel last traded at $6.95 a pound.

The scoping study is based on the outfit having a 40 year operating life, producing 32,000 tonnes of nickel contained in battery grade nickel sulphate annually. The refinery would produce this nickel sulphate for the EV industry, alongside the by-products of 570 tonnes of cobalt, 240 tonnes of copper, and 87,400 tonnes of ammonium sulphate annually.

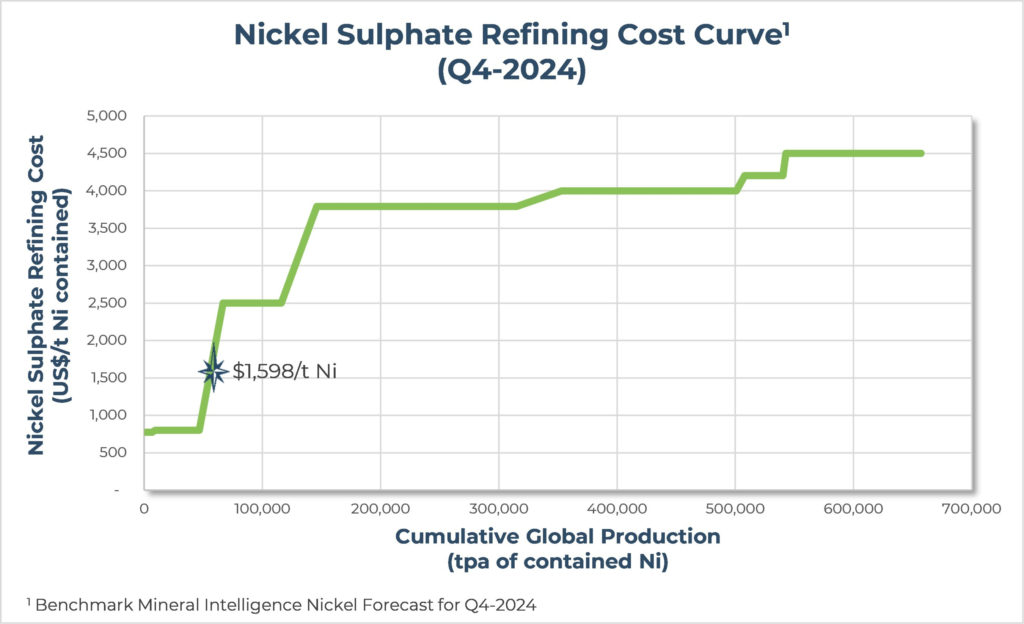

Initial capital costs are estimated at $424 million. Operating costs for the facility are estimated at $1,598 per tonne of nickel, or $133 per tonne on a by-product basis. All in production costs for nickel sulphate from awaruite mineralization, which includes the cost of mining, processing, and refining on a by-product basis, is estimated at $8,290 per tonne, or $3.76 per pound.

The payback period is estimated at 4.0 years.

“The Study reinforces the opportunity for the development of an integrated, made-in-Canada solution from mine-to-battery, utilizing awaruite concentrate as a lynchpin source of nickel, with conventional refining steps underpinning low-cost, low-carbon nickel production for use in domestic and allied country EV battery supply chains,” commented Martin Turenne, CEO of FPX Nickel.

FPX Nickel last traded at $0.235 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.