Ocean carriers are ‘blanking’ sailings in what’s supposed to be their busiest period as consumer demand for imported products sinks.

A total of 40 scheduled sailings from Asia to the United States West Coast, and 21 sailings to the East Coast have been ‘blanked’ or canceled so far for the next two weeks from October 3, according to the Wall Street Journal. While cancelations aren’t unusual, the typical number for this period was only two to four sailings per week.

The cancelations mark a stark inverse of the situation from this time last year until earlier in the year when retailers were fighting for container space to cope with supply-chain disruptions, port backlogs, and a surge of cargo from the pandemic boom in consumer demand.

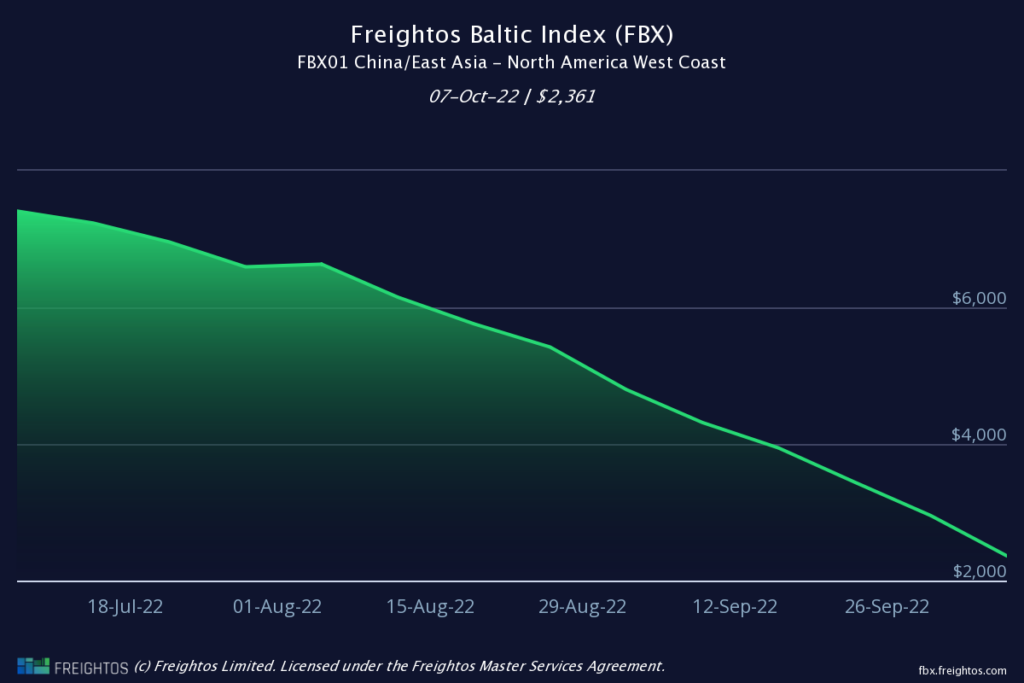

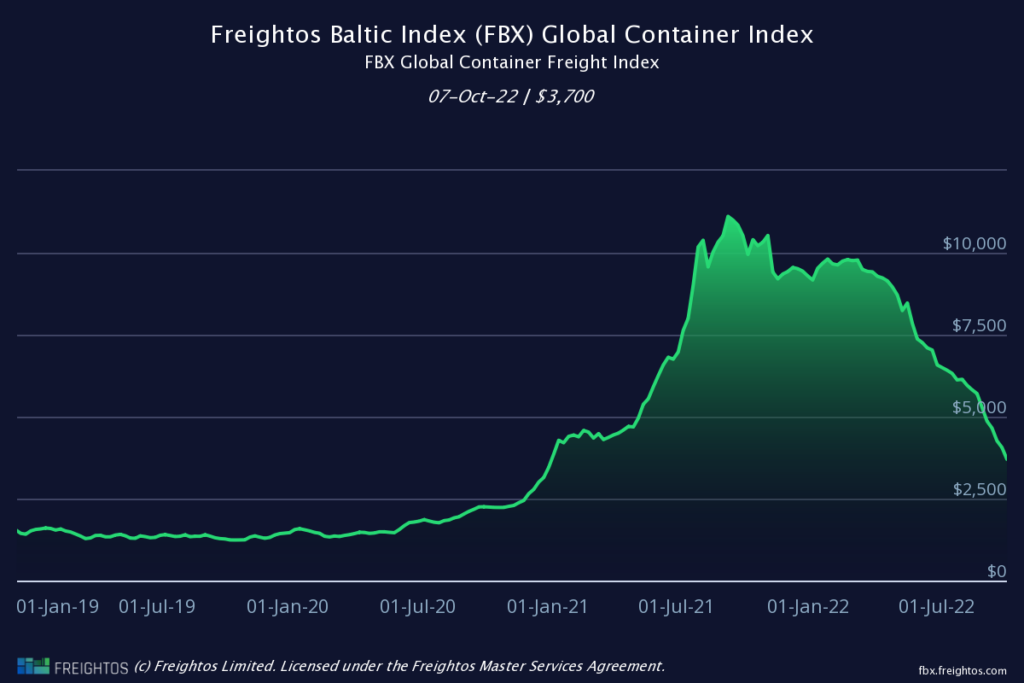

According to data from the Freightos Baltic Index (FBX), rates peaked in September last at over $20,000 to ship a 40-foot container from China to the US West Coast. In January it cost $14,977 for the same size container. In September this year, the rate was $4,797, and just a month later it’s down to $2,361.

Global weekly freight rates are now down to $3,700 a container, according to the FBX.

Consumer spending is changing. Bulky items like furniture from China were in hot demand during the period of the pandemic when people were spending much of their time at home. These days, consumers are going back to normal and shifting spending back from goods to services, with most also cutting back from inflation.

Some big retailers are reportedly canceling orders from vendors, while those who tried to maximize the surge in demand that did not materialize have to deal with overstock. Nike recently reported that it had 65% more inventory in North America compared to last year, and will need to cut profits from markdowns to move surplus.

Information for this briefing was found via the FBX, WSJ, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.