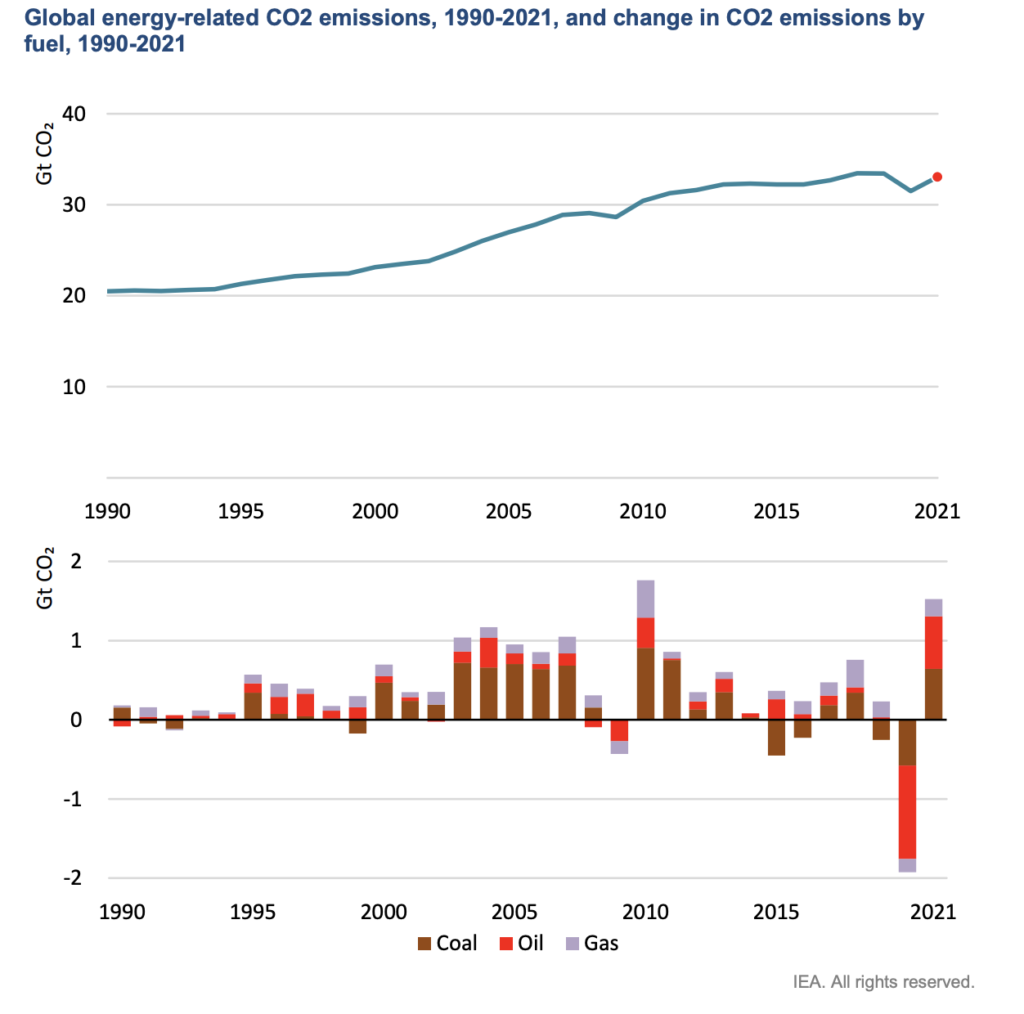

The global economy is set to record the second-highest increase in carbon emissions this year, largely driven by a rebound in coal use across Asia.

According to the latest International Energy Agency (IEA) forecast, global energy-related CO2 emissions are expected to surge anywhere between 1.5 billion to 33 million tonnes in 2021, marking the largest annual increase since 2010. The forecasted jump in emissions would reverse up to 80% of the decrease witnessed in 2020, when the Covid-19 crisis suppressed demand and forced emissions to remain below 2019 peak levels.

At the height of the Covid-19 pandemic, global carbon emissions fell by as much as 6% from 2019 levels. However, that trend soon reversed, especially once economies began to reopen. The IEA said the use of fossil fuels will significantly increase in 2021, as both coal and gas are expected to undergo an even greater resurgence in demand relative to 2019. Overall, the demand for energy products is forecast to grow by 4.6% this year— compared to a decline of 4% in 2020— largely driven by developing economies.

A strong rebound in coal-generated electricity demand in Asia is anticipated to be the main driving factor behind this year’s increase. Demand for coal is expected to rise by 4.5% this year, nearly reaching its 2014 peak, as consumption remains high in Asia, and particularly China. Coal use in the EU and the US is also on a trajectory to increase in 2021, but will likely remain below pre-pandemic levels for the time being, the IEA said.

The forecasted increase in global fossil fuel use in 2021 is also not expected to be offset by renewable energy, despite a record rise in the amount of energy generated from both solar and wind sources, the IEA warned. It is anticipated that renewable sources of energy will produce approximately one-third of the world’s electricity this year.

Information for this briefing was found via the IEA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.