Thanks to the all-encompassing “Helicopter Money” that is Modern Monetary Theory, global debt has soared to yet another record-high in the second quarter, as governments and consumers piled on the deficits.

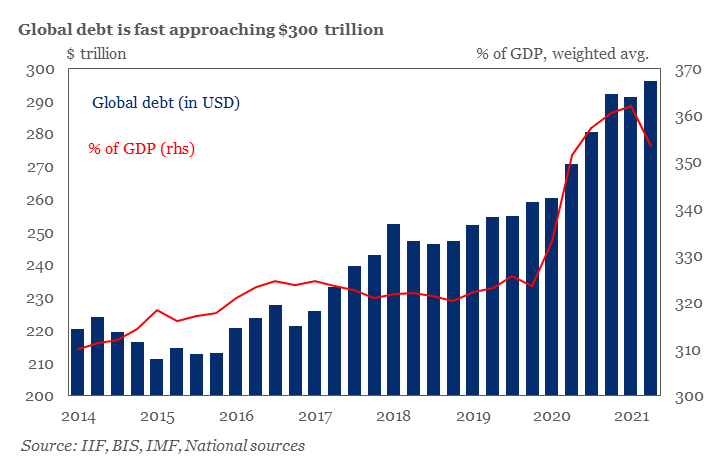

According to data published by the Institute of International Finance (IIF), global debt— which accounts for government, bank, corporate, and household debt— hit an outstanding $296 trillion in the second quarter, up by $4.8 trillion since the first three months of the year, and more than $36 trillion since the beginning of the pandemic.

But the debt pile doesn’t stop there! with the unprecedented pace of borrowing, the IIF is now expecting global debt to soar past $300 trillion— which is likely a no-brainer because as per the famous realization by Cady Heron, the limit does not exist! Undoubtedly, thanks to MMT, not only will we surpass $300 trillion, but will also skyrocket past $400 trillion, catapult past $500 trillion, etc., until— well, infinity!

Among the countries reporting the highest levels of debt is China at the top of the list, with debt levels jumping by $3.5 trillion from the first quarter to a total of nearly $92 trillion between April and June. On the other hand, the US surprisingly noted a debt deceleration, with a total of approximately $490 billion— the slowest since the onset of the pandemic.

Also on the bright side, the IIF said that the debt-to-GDP ratio slumped for the first time since the Covid-19 crisis. The institute found that 51 of the 61 countries observed have seen their debt-to-GDP ratio fall in the second quarter, as economic activity has been on a strong rebound since the beginning of the year. This caused overall debt as a share of GDP to decline from a record-high of 362% to around 353% in the second quarter.

But, all good things must eventually come to an end, because according to hot-off-the-press projections published by Fitch Ratings, global GDP is set to grow by only 6% in 2021, down from a previous June forecast of 6.3%. “Supply constraints are limiting the pace of recovery,” the report explained, adding that, “a greater share of demand growth is being reflected in price increases and US inflation forecasts have been revised up again.”

As such, Fitch downgraded its 2021 forecast for China from 8.4% to 8.1% growth, and trimmed growth expectations for the US economy from 6.8% to 6.2%. The Eurozone, on the other hand, had its growth forecast for the current year boosted to 5.2%, up from 5% in June.

Information for this briefing was found via the IIF and Fitch Ratings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.