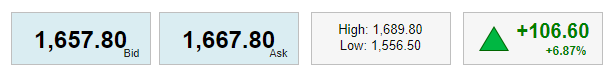

This morning Gold has rallied approaching 7 year highs.

We can see Gold is pushing for a breakout looking at the 10 Year:

Why? A simple news list might explain:

- US looking to send families of 5 cheques upto $7500.

- Goldman Sachs projecting a 24% decline in US GDP in Q2’20.

- The Federal Reserve Bank offers open ended QE, starting with $125B of purchases a day.

- The Federal Reserve announcing they are now directly buying Corporate Debt.

- Canadian PM Justin Trudeau looks to give sweeping powers to Finance Minister Morneau to tax and spend without MP opposition.

- ECB Announces €750 billion Stimulus, Declares No Limits on Policy

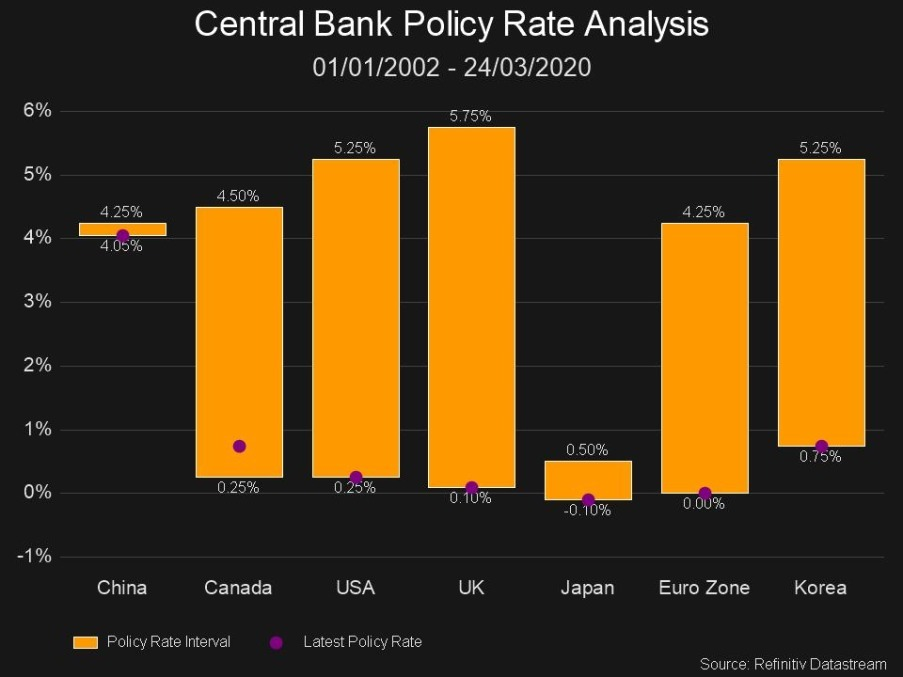

Where are the discount rates? With the exception of China, everyone is near zero:

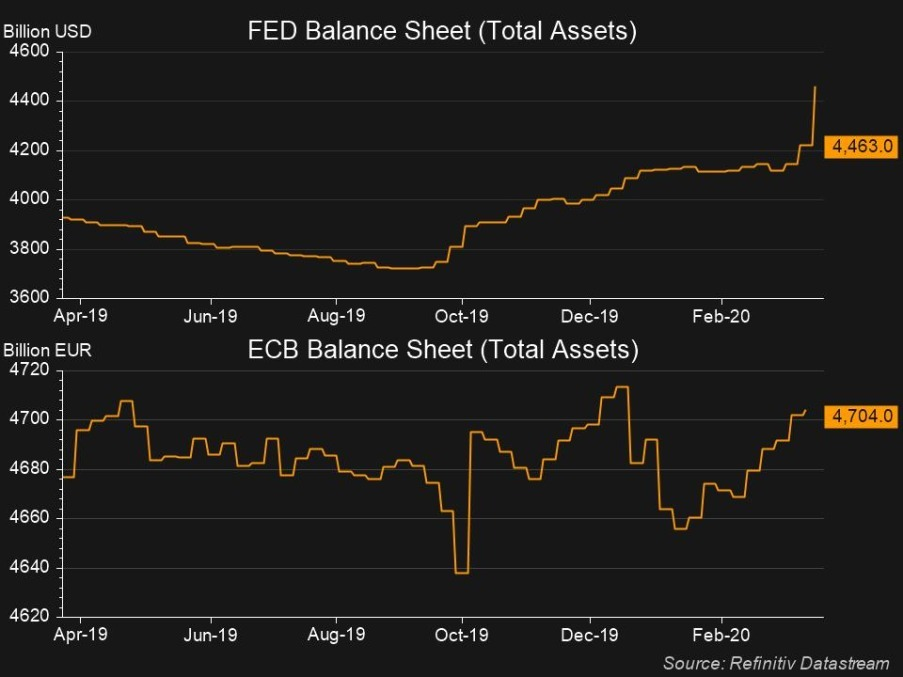

And of course, the expansion of Central Banks balance sheets:

In a letter on March 23, Goldman Sachs reaffirmed their 12-month target for gold to advance to $1,800 an ounce, which would bring us to 2011 levels.

We believe this will likely lead to debasement concerns similar to the post-GFC period…. Accordingly, we are likely at an inflection point where ‘fear’-driven purchases will begin to dominate liquidity-driven selling pressure, as it did in November 2008.”

Goldman Sachs March 23 Note

Peter Schiff, one of the largest champions of Gold says this is just the beginning, expect an all time high before year end:

At its 2009 financial crisis low, the Dow Jones was worth about 7.5 ounces of #gold. Right now, the Dow is worth about 11.5 ounces. So while the Dow is up 123% in dollars, it's only up 53% in gold. It likely that before 2020 ends, the Dow will take out its 2009 gold price low!

— Peter Schiff (@PeterSchiff) March 24, 2020

At the time of publishing, Silver has ran 6.7% to over $14. Platinum rose 6.8%. Palladium jumped as much as 16%, showing the largest intraday increase since 1998. South Africa said it will close its mines for 21 days as part of a nationwide lockdown; accounting for 75% of the world’s platinum and 38% of palladium supply.

Information for this briefing was found via Reuters, Kitco, Twitter and Refinity Datastream. Not a recommendation to buy or sell any securities. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.