Many investors in the equity, bond and commodities markets expect the U.S. Federal Reserve to pivot fairly soon toward a more accommodative interest rate policy. Phrased differently, the central bank may potentially bow to political pressure and not impose many additional interest rate hikes which could cause a significant slowdown in the economy.

The Fed is skipping a meeting in August; its next scheduled meeting is September 20-21. Analysts are broadly split between expectations of a 50-basis point (bp) or 75-bp hike to the current rate 2.50% rate at the conclusion of the September meeting.

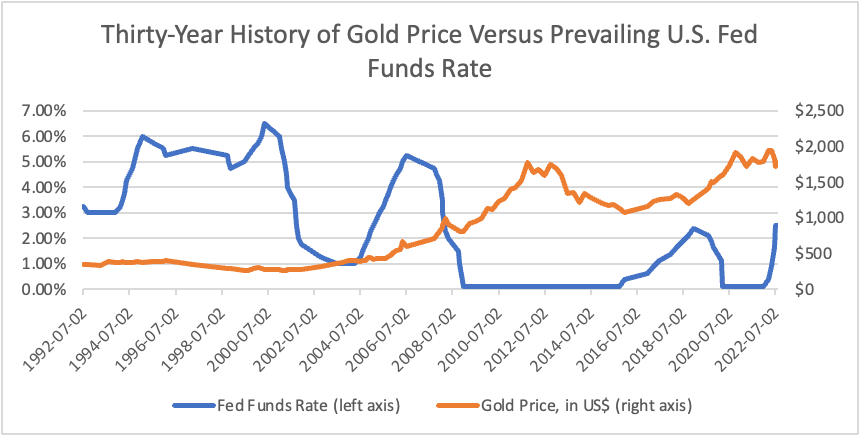

To prepare for any change in Fed interest rate policy, we examine the historical relationship of gold prices between both the level of and changes in the U.S. Fed funds rate. The graph below shows that relationship over the last thirty years.

Key observations from the data sequences are as follows.

While it would make logical sense that when the Fed cuts interest rates, usually because of sluggish or even recessionary economic conditions, gold reacts positively, the data shows only a loose linkage between the two. Gold generally increases in price when interest rates are cut, but it has also performed well when rates were rising.

Particularly since the turn of the century, gold has risen in price when the Fed funds rate is quite low. For instance, gold soared in the 2009-2011 period when the Fed fund rate was set to near zero to counteract some of the effects of the Great Financial Crisis.

Factoring in a gold price of US$353 per troy ounce in July 1992 and the current price of about US$1,712, the precious metal’s compounded annual growth rate (CAGR) over the last thirty years is about 5.5%.

The Fed funds rate was reset many times from the early 1990s through the onset of the 2007-2008 financial crisis. Since then, changes have been much less frequent.

Information for this briefing was found via the St Louis Fed and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.