FULL DISCLOSURE: Goliath Resources is a sponsor of theDeepDive.ca.

We’re back in British Columbia’s Golden Triangle for another episode of DD on the Go. But rather than be on the hunt for silver like recent episodes, this time we’re after the metal that has given this region of the province its moniker.

Gold.

And while there are many claims to fame that have been made in this region of the world, we wanted to bring you the best of the best. So we called up Goliath Resources (TSXV: GOT), one of the hottest exploration stage names in the market right now, to get the low down on exactly what was going on in their corner of the world.

Welcome back. Lets dive in.

Mining In British Columbia

British Columbia is no stranger to gold. The yellow metal is essentially responsible for the creation of what we now know as BC. Following a discovery in modern day British Columbia in 1857 within the Fraser River region, the region was subjected to a gold rush that brought many American explorers to the area.

As prospectors traveled further inland in the years to come, more gold rushes ensued, including the Cariboo Rush of the 1860’s which is credited with the development of British Columbia’s interior.

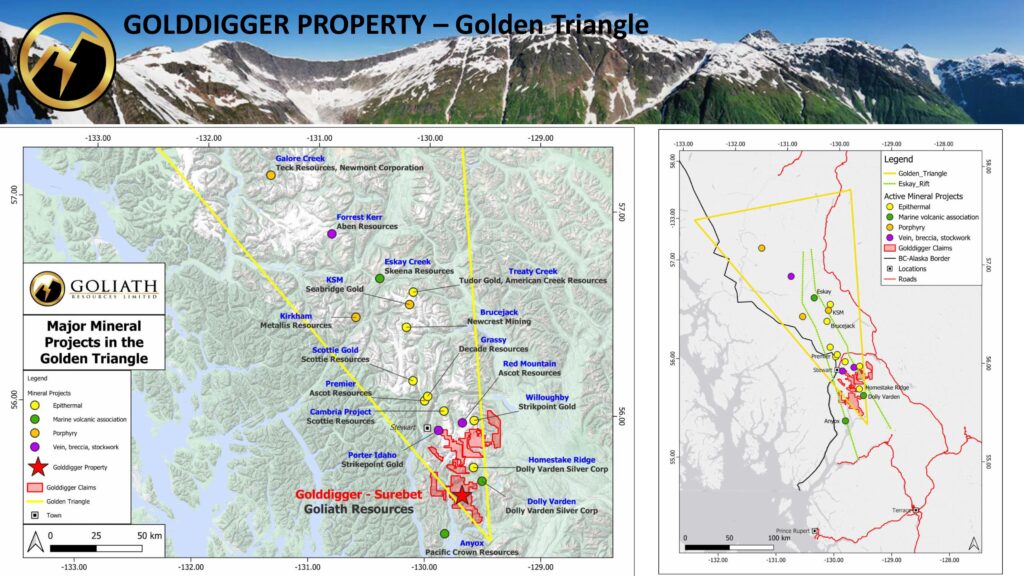

Since the initial discovery of gold in the area over a century and a half ago, more than 150 mines have operated within this coveted region. Today, the production of gold is ongoing from Newmont’s Red Chris and Brucejack mines, while Ascot Resources has had the Premier and Red Mountain mines in and out of production in recent years.

Others too, such as Scottie Resources, are nearing production through unique methods, while late stage development projects such as Seabridge Gold’s KSM project and Skeena Gold and Silver’s Eskay Creek project promise vast riches should production be achieved.

All of this is to say that exploration is alive and well in British Columbia. And we’re here to see one of the newest discoveries the region has to offer.

The Goliath Discovery

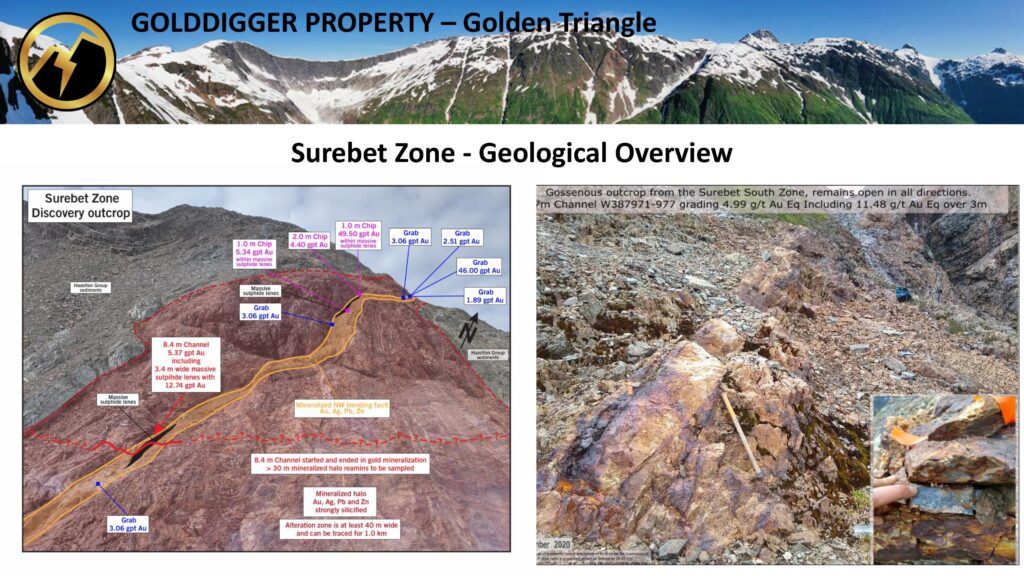

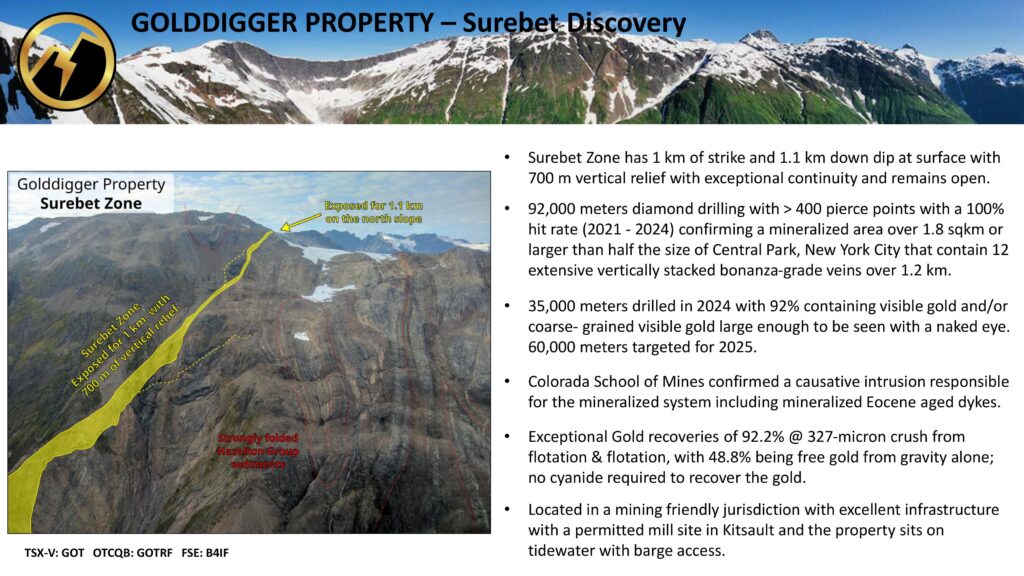

One of the freshest discoveries in the triangle dates back to 2020, when Goliath Resources collected channel samples at a small property known as Golddigger, which is found to the northwest of Kitsault, BC.

That sampling program saw assays come in at 5.37 g/t gold over 8.4 metres, including 12.74 g/t gold over 3.4 metres. Other samples collected in the vicinity meanwhile included a 2.0 metre chip sample that assayed 4.40 g/t gold, and a 1.0 metre chip sample that assayed out at 49.50 g/t gold within massive sulphide lenses.

That discovery was referred to as the Surebet Zone. And while they may have not known it at the time, that discovery set them on a path of exploration success within the southern portion of the golden triangle.

“From the original channel cutting program it was quite exciting. You know, we had a high-grade gold over, you know, double digit gold numbers over double digit widths and the fact that we had two kilometers of mineralization wrapping around this mountain with 700 meters of vertical relief,” commented Roger Rosmus, CEO of Goliath Resources.

An inaugural drill program was undertaken in 2021 following that discovery, which marked the first holes to drill test a mountain that previously was inaccessible due to glacial cover. A 5,332 metre drill program was undertaken, which had highlight intercepts of 6.37 g/t gold equivalent over 35.72 metres in hole 21-03, alongside 12.6 g/t gold equivalent over 6.38 metres in hole 21-05.

On top of that, the average intersection across the entire 24 hole program was 6.29 g/t gold equivalent over 5.87 metres, while an extension target was found 500 metres to the southeast. The drill program was a massive success – especially for a maiden program – cementing the fact that a new major discovery had been made in the triangle.

“Yeah, I think our last hole that we drilled because initially we were drilling quite close to the outcropping mineralized zone of Surebet and then we stepped out 1.1 kilometers to the west and that hole hit as well. So once obviously that happened and which delivered you know decent results that was pretty exciting moment for sure,” Rosmus continued.

The success of that program enabled the company to raise $14.6 million from the public markets to fuel further exploration, while Crescat Capital nearly doubled their stake in the company to 19.9%, after initially taking a stake in late 2020.

Continued Exploration

But Goliath was just getting started. The following year they drilled 60 holes across 24,074 metres. In 2023 they drilled a further 28,665 metres across 98 holes, followed by 33,929 metres across 67 holes last year. And now this year they are planning for a massive 60,000 metres of drilling, of which, as of us being here on site, was at 28,000 metres of completion. The program is so big that we had to repeatedly pause recording because helicopters kept bringing in more core to be processed, drowning out our interviewees.

As of the end of last season, a total of 92,000 metres of drilling had occurred within 249 drill holes. Impressively – and which is almost hard to believe because it’s an insane statistic – of those 249 holes, each and every hole has intersected mineralization. A 100% hit rate. And of all those metres drilled in 2024, 94% had visible gold that could be seen by the naked eye.

“Oh, you can see the mineralization for two kilometers like I mean you know you think if you’re prospecting somewhere on a flatter type terrain where you have no idea what’s happening below. You’re drilling a geophysical fantasy target. Sometimes the magic works, sometimes it doesn’t. We could actually see the mineralization and the elevation parted part and parcel. So, we’re, you know, extremely lucky to have found this because this is a grassroots discovery, never been drilled before until we came along,” said Rosmus.

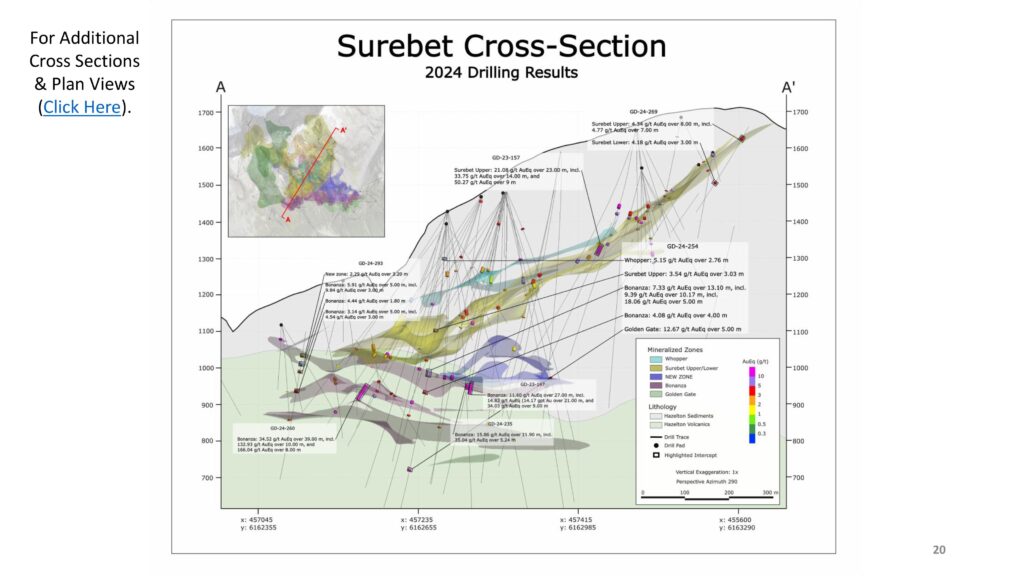

As it currently stands, gold mineralization has confirmed a mineralized area that measures over 1.8 square kilometres in size, which contains 12 extensive vertically stacked bonanza grade veins that have been traced over 1.2 kilometres. The mineralized area remains open in all directions, with drilling having happened on 100 metre spacing throughout. A total of six zones have been identified at the Surebet discovery, including Surebet, Goldzilla, Bonanza, Eldorado, Whopper, and Golden Gate.

Talk about good marketing, right?

No resource exists on the property just yet, but in talking to CEO Roger Rosmus the reason for that is simple. They’re still heavily exploring to see what is there, and when the time is right, they want to blow the doors off this thing with an absolutely massive resource.

Canadian Discovery Comparables

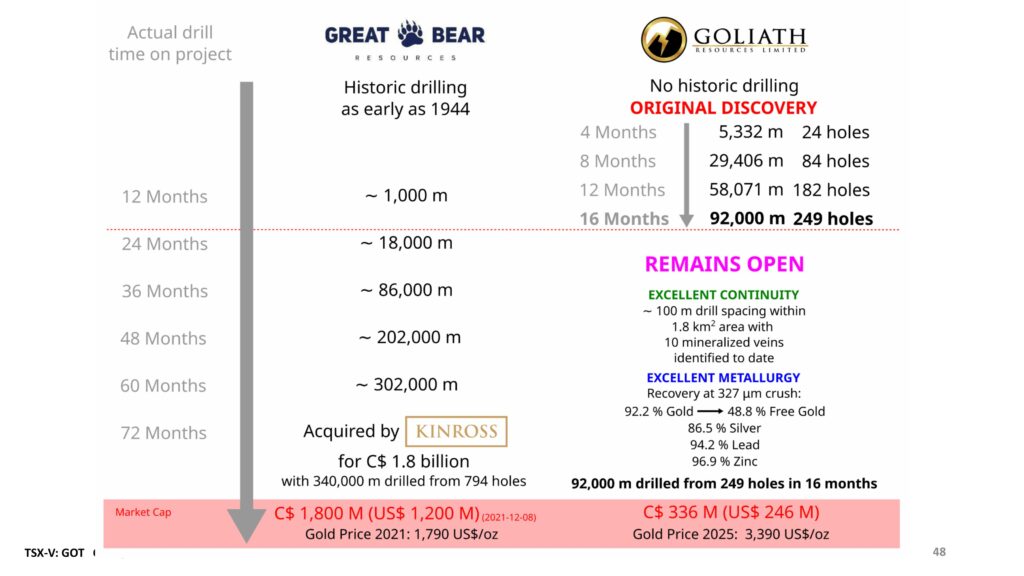

The obvious comparison here, in terms of massive exploration opportunity, is Great Bear. Who got taken out by Kinross in 2022 for C$1.8 billion. They were acquired after what basically amounted to five years of hard exploration. They were based in the Red Lake region, so exploration could happen year round, making things a bit easier than their golden triangle peers.

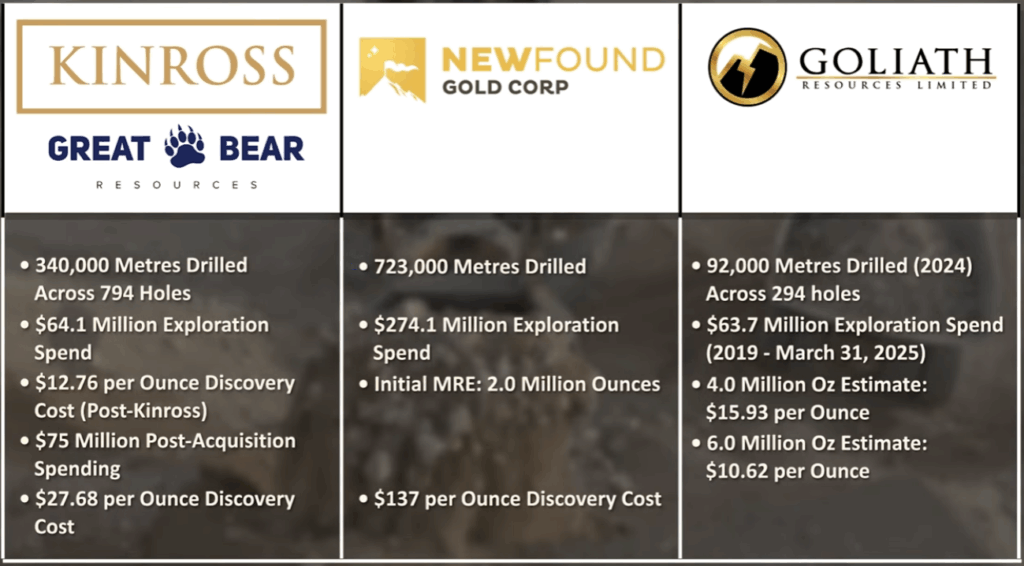

At the time of acquisition, a total of 340,000 metres had been drilled across 794 holes. Total exploration spend was in the area of $64.1 million based on our best estimates, which translated to $12.76 per ounce of gold that was reported as being in the ground post-Kinross takeover, although that figure doesn’t include $75 million in spend by Kinross in the following year, which takes that estimate up to about $27.68 an ounce.

In 2023, that project was estimated to contain 5.03 million ounces, making it one of the largest discoveries in recent history, at least within Canada.

The other “major discovery” in recent years is New Found Gold and their Queensway project, which saw total exploration spend of $274.1 million for an initial MRE of 2.0 million ounces on the nose. That discovery translated to $137 in spend per ounce in the ground, with the MRE being based on something like 723,000 metres of drilling. [same data sheet as above]

So how does this compare to Goliath?

Well, through to the end of 2024, Goliath had drilled 92,000 metres across a total of 294 holes. But given the location, that basically translates to 16 months of exploration.. Versus 72 months at the time of Great Bear’s takeout, and roughly five years for New Found Gold to go from Discovery to MRE. In other words Goliath is on a bit of an accelerated pace here on a relative basis.

And while there is no MRE here, exploration spend is currently sitting at $63.7 million, which is from 2019 through to the nine months ended March 31, 2025. As we said, no MRE is out yet, so for this we’ll defer to junior mining analyst Taylor Combaluzier over at Red Cloud, who in March updated their inventory model, suggesting 4 to 6 million ounces of gold exists at the Surebet discovery. Taking the low end of that estimate puts Goliath at exploration spend of $15.93 per ounce, while the high end places them at $10.62 an ounce.

And, if you want to suggest as much as 8 million ounces exists here, which is what some analysts have previously suggested, well that would place the current cost of exploration at about $7.97 an ounce.

The Geology

One thing we should probably touch on here briefly, is the style of mineralization being found at the Golddigger property. Because it’s unique.

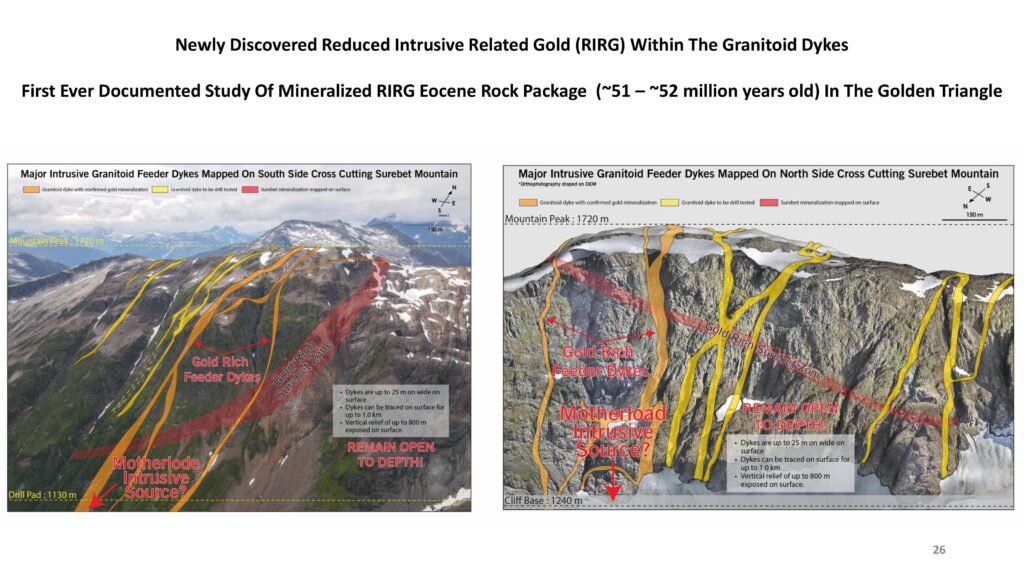

The Surebet Discovery consists of a large, gold rich layered system that is directly associated to a motherlode intrusive source and multiple gold rich feeder dykes. The Colorado School of Mines has confirmed that a causative intrusion is responsible for the mineralized system here, including Eocene aged dykes.

Which to the layman sounds.. Like a bunch of words with no meaning. You know I’m speaking English, but I might as well be speaking Mandarin. So we asked one of the geo’s on site, and this is what he had to say.

“And you crack the top the bubbles come out of the beer right well an intrusion is sort of like that where it rises out of the earth the pressure changes and now you have bubbles coming up but instead of in your beer where it’s carbon dioxide it’s a mix of water, acid, carbon dioxide, and dissolved metals,” said Randall Karcher, geologist and a PhD student at the Colorado School of Mines.

The other interesting part here is that mineralization is being found in the Eocene rock package, meaning it is 51 to 52 million year old rock. Which previously was believed to contain no gold mineralization, at least across British Columbia. So Goliath is breaking new ground in that regard.

There’s some other bits here that we could get into related to the host rock, but that’s the high level. Oh, and there’s VG. Lots of VG.

The Majors Circle

By now, you’re probably thinking to yourself, “but Steve, if this asset is so good, why have no majors bought in?” And my answer to that is well, they seem to be circling. Or at least high net worth investors are, which implies that this thing has captured a lot of attention from all the right people.

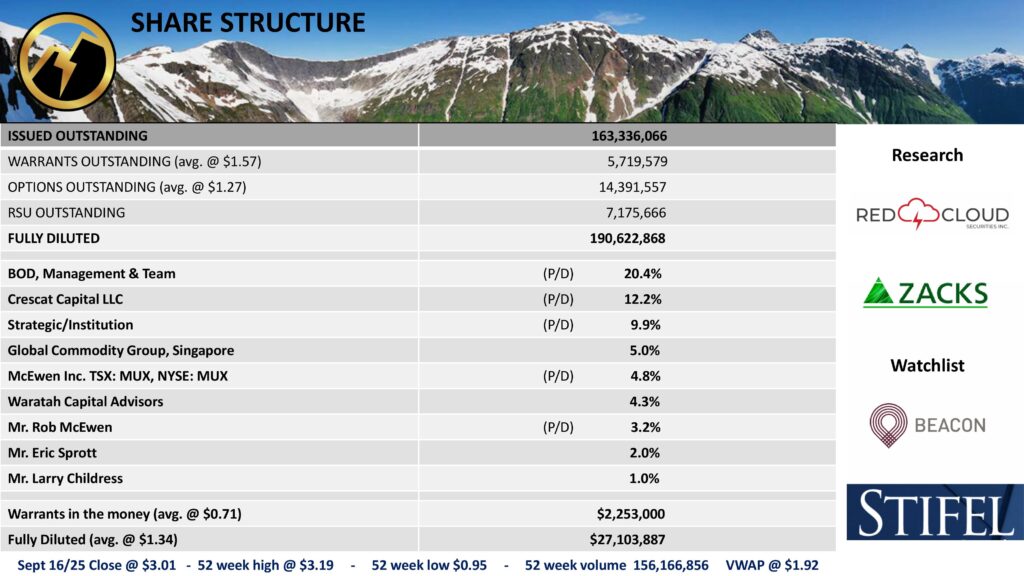

As of the time of recording, Goliath has about 163 million shares outstanding after having just raised about $27 million bucks. Aside from management owning a little over 20% of the company, major investors include Crescat Capital at 12.2%, some strategics at 9.9%, Global Commodity Group at 5%, McEwen Mining at 4.8%, and Waratah Capital Advisors at 4.3%.

Goliath has also lured Rob McEwen to personally invest, who holds 3.2%, while Eric Sprott holds a 2% interest and Larry Childress holds 1.0%. Which leaves a little over 37% of the total shares outstanding for retail investors which in the junior markets, is not a lot.

And as far as analysts go, both Beacon and Stifel have Goliath on their watch list, with analysts from the latter actually joining us for our site visit, to give you a sense about how serious they are here. As it stands, both Red Cloud and Zacks currently cover the company, though we imagine that list will grow fairly soon here.

The Hidden Asset

But these analysts and major investors are a bit different than retail. They often are able to see the bigger picture – partially as a result of experience, and partially because, lets face it, they have better access to talk to people in the know.

And in the case of Goliath, there is one major “bigger picture” aspect that sets them apart from pretty well any other explorer out there. And that is the town of Kitsault.

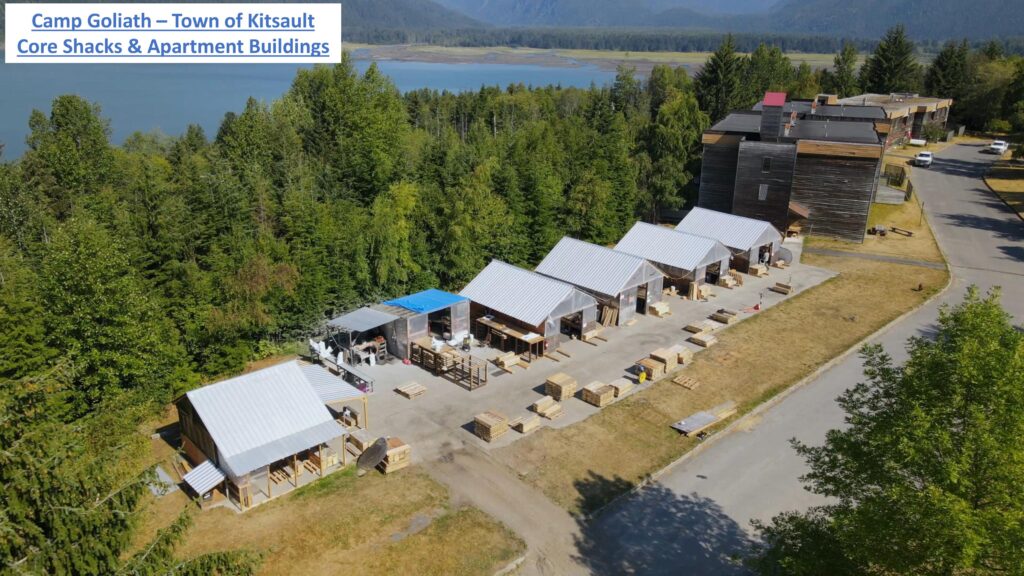

Our long time followers may recognize the name of this town, because we’ve addressed it in some of our other content. But Kitsault, BC, is perhaps one of the weirdest footnotes in the history of Canadian mining.

It’s a company town that was established in the late 1970’s to serve a molybdenum mine that three years later went broke when the price of moly crashed.

It was bought up by an investor in the early 2000’s who, to our understanding, was basically betting on the future of the region as a whole, and has been maintaining it ever since. And Goliath rents out a sizeable portion of it – creating, quite literally, one of the most comfortable exploration camps on the planet. For our stay we had our own apartment rooms. Where else do you get that?

“Yeah. Most of them they’re like tent camp, and they’re nice. It’s just that we have been given an unlimited budget to give the very best to the fuel the clients so that the all the guys and the girls that are working here are getting the best food that they can so that they can have the energy to fuel themselves. Right,” commented Shelly Wright, camp cook for Goliath Resources.

“Oh this is five stars for drilling. This is five stars. This is, this is amazing. The accommodations at this place are topnotch. Like you don’t get this anywhere else in any other [camp]. This is the best camp we ever been in and drilling in what 20 plus years, Brian? Like really, this is this is amazing accommodations,” said Mike Varney, Owner and Operator for Touchstone Diamond Drilling.

Anyways, our assumption is that when Surebet finally gets turned into a mine, this entire town, filled with infrastructure, will be bought out for pennies on the dollar relative to what it would take to recreate it. Saving Goliath – or whoever buys them out – tens of millions in the process. Not to mention there is a permitted mill site in the area, and the town itself sits on tidewater with barge access.

In Closing

All right, lets wrap things up here.

Goliath is proof that discovery is alive and well in the mining sector, particularly in the Golden Triangle. On top of Surebet, they’ve also got plenty of further targets to explore, whether you’re talking Treasure Island way in the north of the Golddigger property that has grown to 91,518 hectares, or the Blue Origin target that is found 4.5 kilometres to the south of Surebet, which is believed to be related in some way.

From what we can tell, Goliath’s going about things the right way here. 2025’s drill program of 60,000 metres is focused entirely on Surebet, where Goliath is looking to prove out a high grade zone. That zone, while again, no resource exists, is intended to show to majors, “hey, there’s an opportunity to quickly repay initial capex should you choose to build a mine here.”

“The idea is [let’s see] if we can possibly prove out maybe a million ounces or more essentially on the back of the envelope with, you know, greater certainty or certainly higher confidence. And every senior minor is looking for that first million ounces of high-grade material that will pay for the capex out of the gate.”

Which, at least to me, demonstrates there’s a larger strategy going on here, and that this isn’t a case of the “never never” program that some peers seem to be on. Something that the mining sector at large is in sore need of.

Thanks for watching.

FULL DISCLOSURE: Goliath Resources is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Goliath Resources. The author has been compensated to cover Goliath Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.