In a bid to address economic inequality among Canada’s youth and give them “a fair chance at a middle class life,” the 2024 federal budget unveiled by Deputy Prime Minister and Finance Minister Chrystia Freeland is taking aim at the country’s top earners through new tax measures. The objective is to offset significant new spending aimed at bolstering the nation’s housing supply and social supports.

Outlined under the banner of “Fairness for Every Generation,” the budget allocates $39.2 billion towards net-new spending initiatives, emphasizing the government’s commitment to maintaining fiscal responsibility. Emphasizing the necessity of tax fairness, Freeland asserted that it would be irresponsible to burden future generations with increased debt by overlooking the fiscal anchors set last fall.

“Our renewed focus today is unlocking the door to the middle class for millions of younger Canadians,” Freeland wrote. “Because that is what you have earned, and that is what you deserve. And that is what your parents and grandparents want for you, too.”

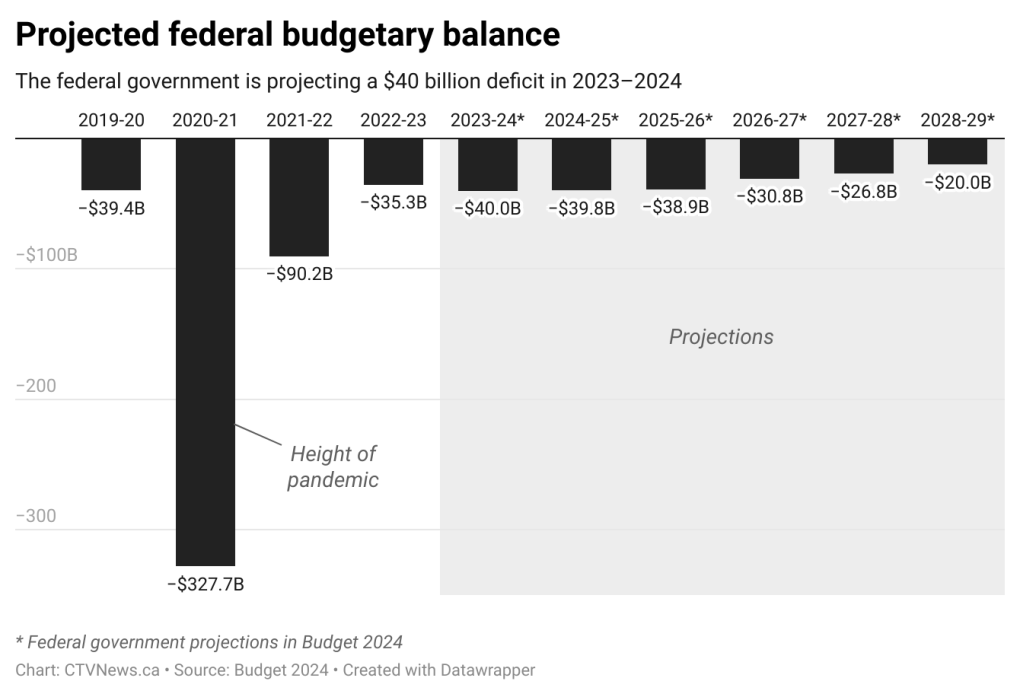

Despite projections of continued deficits in the coming years and mounting federal public debt charges, the budget asserts its dedication to mitigating financial burdens on younger Canadians by introducing measures aimed at ensuring a pathway to the middle class.

Among the key highlights of the budget are provisions for small businesses and entrepreneurs, including a new carbon rebate, and the allocation of funds for the initial phase of national pharmacare and a long-promised disability benefit.

The budget’s financial framework outlines $52.9 billion in new spending plans, partially financed through loans and dependent on provincial cooperation, alongside an estimated $20 billion in additional tax revenue, encompassing levies on tobacco and vaping products and new capital gains taxes.

Projected federal deficits for the upcoming years are slated to gradually decrease, with Freeland achieving her target of maintaining the 2023-24 deficit at $40.1 billion. Additionally, the budget aims to lower the debt-to-GDP ratio within the current fiscal year while reallocating government spending towards middle-class empowerment initiatives.

Addressing concerns regarding the impact of new tax measures, Freeland contends that they will ultimately reduce living expenses for millions of citizens, leveraging the country’s robust economic performance to facilitate further growth and job creation.

However, some economists have expressed reservations about the budget’s focus, particularly its perceived shortcomings in addressing productivity concerns. Fred O’Riordan of EY highlights the lack of measures aimed at enhancing capital investment and labor productivity, echoing sentiment by the Canadian Chamber of Commerce CEO Perrin Beatty, who calls for a clearer strategy to stimulate economic growth.

Taxes on capital gains

The centerpiece of Tuesday’s budget unveiling is a pivotal shift in taxation strategy, as the government introduces a new revenue source targeting Canada’s highest earners. The plan involves raising taxes on capital gains, projected to generate a substantial $19.3 billion over the next five years.

Canada Budget: Canada To Increase Capital Gains Tax On Firms, Individuals

— LiveSquawk (@LiveSquawk) April 16, 2024

– Projects C$39.8B Deficit This Year; Prev Est C$38.4B

– To Spend C$68B More Over 5 Yrs, Add C$10B To Deficits

– Projects C$228B In 2024-25 Bond Issuance, Up 12%

This tax adjustment, while not resembling the anticipated wealth or excess profit taxes, zeroes in on the wealthiest 0.13% of Canadians. Under this change, the capital gains inclusion rate – the portion of capital gains subject to tax – will rise from one-half to two-thirds for individuals with capital gains exceeding $250,000 annually.

The new rate will also apply to capital gains realized by corporations and trusts, impacting roughly 12% of Canada’s corporations. The implementation of this tax alteration will commence for capital gains realized on June 25, 2024.

In a bid to reassure the middle class, the Liberals emphasize that this change will not affect 99.87% of Canadians, aligning with their pledge not to increase taxes on this demographic. Freeland contends that this adjustment won’t undermine Canada’s business competitiveness, pointing out that most other countries subject corporations to corporate income tax on 100% of their capital gains.

Ahead of budget day, economic analysts cautioned against more direct wealth or excess profit taxes, citing potential counterproductive effects on productivity and growth. The chosen approach, focusing on capital gains, is perceived as a safer alternative.

Former Bank of Canada Governor David Dodge earlier called the 2024 federal budget a potential “worst budget in decades” ahead of its release.

A major concern for Dodge was the potential introduction of some form of wealth tax or excess profits tax, which he believes could slow economic growth rather than raise the funds needed to finance the government’s nearly $40 billion in new spending commitments.

“I think there is a very real possibility that they’ll do exactly the wrong thing and tax the very folks and the very corporations that are going to make the investments that will actually raise income over time,” Dodge said.

As discussed by this column before, there are critics of taxing unrealized gains who contend these should not be considered income, as they are neither spendable nor guaranteed until realized and taxed.

Digital services tax

Ottawa is also forging ahead with plans to introduce a digital services tax on large technology companies in a bid to address the challenges posed by taxing digital giants such as Google parent Alphabet and Amazon.com. The tax, outlined in the federal budget presented on Tuesday, is projected to generate $5.9 billion in revenue over the five years starting fiscal 2024/25.

The decision to implement the tax comes after a two-year delay, during which Canada awaited the conclusion of global negotiations on a treaty aimed at taxing multinational corporations. However, with negotiations on the treaty progressing slowly and Washington’s opposition to the plan due to concerns of unfair treatment towards U.S. firms, Canada is moving forward with its own approach to address the issue.

“In view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot afford to wait before taking action,” stated the finance ministry in its annual budget.

The proposed Digital Services Tax is set to take effect for the 2024 calendar year, with the first year covering taxable revenues earned since January 1, 2022. This tax aims to ensure that large technology companies pay their fair share of taxes, particularly in light of their ability to book profits in low-tax countries, thereby mitigating tax avoidance practices and enhancing tax fairness in the digital economy.

CANADIAN GOVERNMENT IS MOVING AHEAD WITH ITS PLAN TO ENACT A DIGITAL SERVICES TAX

— GURGAVIN (@gurgavin) April 16, 2024

WASHINGTON OPPOSES THE PLAN ON THE GROUNDS THAT IT UNFAIRLY SINGLES OUT U.S. FIRMS

Housing

Addressing the pressing issue of housing affordability, the 2024 budget presents an extensive array of housing policy initiatives, fulfilling promises made by Prime Minister Justin Trudeau’s administration. Central to this strategy is the commitment to construct 3.9 million homes by 2031, accompanied by $8.5 billion in additional spending for homebuilding initiatives, distributed over the coming years.

Key components of the housing plan include a $15 billion top-up to the Apartment Construction Loan Program, a $6 billion allocation for the Canada Housing Infrastructure Fund, and substantial investments in rental protection and homebuilding innovation efforts.

The budget also introduces measures to convert underutilized federal properties into residential land, aiming to unlock 250,000 new homes. Notably, $1.1 billion is earmarked over a decade to convert 50 percent of federal office space into housing, potentially yielding significant cost savings.

Additionally, the budget includes targeted measures benefiting Generation Z and millennials, such as a boost to the Student Work Placement Program and updates to student financial assistance formulas to reflect current housing costs.

Social programs

Within the intricate framework of the 2024 federal budget lie several chapters dedicated to expanding Canada’s social safety net and advancing key commitments in areas such as pharmacare, disability benefits, Indigenous reconciliation, and youth welfare.

Among the notable unveilings is a provision of $1.5 billion over five years for the launch of a new national universal pharmacare plan. Commencing this fiscal year, the initial phase will extend coverage to diabetes and contraception medications, representing a significant stride towards universal pharmacare according to Canadian Centre for Policy Alternatives senior economist David Macdonald.

Addressing a longstanding promise, the budget allocates $6.1 billion over six years, with $1.4 billion ongoing, towards the Canada Disability Benefit. Scheduled to commence in July 2025, this income supplement aims to assist low-income individuals with disabilities, complementing existing provincial and territorial benefits.

In line with commitments to Indigenous reconciliation, the budget earmarks substantial funding, including $927 million over five years for on-reserve income assistance and $1.8 billion to support Indigenous jurisdiction. Additionally, initiatives such as the “Red Dress Alert” initiative and investments in energy projects underscore the government’s dedication to Indigenous communities.

Another significant inclusion is the allocation of $1 billion over five years for a new national school food program, targeting an additional 400,000 children. The budget also addresses youth mental health with a $500 million fund and invests in child-care centers and student loan forgiveness for early childhood educators.

Small businesses and artificial intelligence

In line with the vision for stimulating business investment in Canada, the 2024 federal budget introduces a range of measures aimed at fostering innovation and productivity.

As part of a targeted small business-focused package, the budget allocates $200 million over two years, starting in 2026-27, to enhance access to venture capital for “equity-deserving entrepreneurs,” particularly those outside of major urban centers.

Additionally, the Liberals propose the implementation of a new “Canada Carbon Rebate for Small Businesses,” which pledges to expedite the return of proceeds from the federal pollution price collected between 2019-20 and 2023-24 to 600,000 small businesses with fewer than 500 employees. This refundable tax credit, estimated to cost $2.5 billion, seeks to alleviate financial burdens on small businesses while incentivizing environmentally responsible practices.

Furthermore, discussions revolve around the introduction of a Canadian Entrepreneurs’ Incentive, aimed at providing tax breaks and streamlining regulatory processes to facilitate business innovation and growth. Measures such as regulatory “sandboxes,” red tape reduction initiatives, and efforts to recognize foreign credentials are also on the agenda, signaling the government’s commitment to supporting entrepreneurial endeavors.

In the realm of research and development, the budget promises $3.5 billion for strategic research infrastructure, focusing on modernizing facilities and fostering homegrown talent through improved scholarships and fellowships. Of this amount, $2.4 billion is allocated for core research grants, aiming to bolster Canada’s research capabilities and drive innovation across various sectors.

Additionally, recognizing the pivotal role of artificial intelligence (AI) in driving economic growth and technological advancement, the budget earmarks $2.4 billion to build capacity in AI, with a primary focus on enhancing computing capabilities and technical infrastructure. This investment aims to position Canada as a global leader in AI research and development, fostering innovation and competitiveness in the digital economy.

Safety

As pledged, the budget includes billions in defence spending over the long term, alongside initiatives such as volunteer firefighter and search and rescue tax credits, aimed at recognizing the invaluable contributions of these frontline responders.

On the safety front, the government intends to introduce additional penalties under the Criminal Code for auto-theft related offenses, coupled with a $30.4 million allocation for the buyback of assault-style firearms, aligning with efforts to enhance public safety and reduce firearms-related risks.

Furthermore, the budget allocates $273.6 million towards Canada’s Action Plan on Combatting Hate, demonstrating the government’s commitment to addressing hate-related incidents and fostering inclusivity. Additionally, $16 million is earmarked to create a safer and more welcoming sports environment for all athletes, underscoring the importance of promoting safety and inclusivity within sporting communities.

In anticipation of forthcoming online harms legislation, the federal government proposes a $52 million allocation over five years to Canadian Heritage and the Royal Canadian Mounted Police. These funds will support efforts to protect children online, ensure compliance with new regulations by major online platforms, and establish the promised Digital Safety Commission, signaling a proactive stance towards mitigating online risks.

In further support of mental health and child protection, the budget allocates $7.5 million to the Public Health Agency of Canada to bolster the Kids Help Phone over the next three years. Additionally, Public Safety Canada receives $2.5 million to support the Canadian Centre for Child Protection, reinforcing efforts to safeguard children and provide vital support services.

“Not worth the cost”

Following the budget presentation in the House of Commons, Conservative Leader Pierre Poilievre wasted no time in criticizing the spending plans put forth by Trudeau’s government. Poilievre reiterated his call for a halt to spending until a Conservative government assumes power, asserting that Trudeau’s spending initiatives exacerbate problems and burden Canadians.

“Trudeau said the budget would balance itself. 9 budgets later, Canadians have their 9th deficit, nearly $40 billion in new spending & double the rent & mortgage payments. Not worth the cost,” he wrote on X.

Trudeau said the budget would balance itself.

— Pierre Poilievre (@PierrePoilievre) April 16, 2024

9 budgets later, Canadians have their 9th deficit, nearly $40 billion in new spending & double the rent & mortgage payments. Not worth the cost. pic.twitter.com/LnkRsm1CnC

In a subsequent exchange during the post-budget debate, Freeland challenged Poilievre on his stance regarding tax fairness, questioning whether he would oppose making the wealthiest individuals pay more while portraying himself as an advocate for working people.

Meanwhile, NDP Leader Jagmeet Singh refrained from expressing clear support for the budget, citing concerns over gaps in infrastructure and housing spending for Indigenous communities, as well as the adequacy of the proposed disability benefit. Singh emphasized the need for these concerns to be addressed before committing to support the spending plan.

The Bloc Quebecois criticized the budget, asserting that it primarily serves the electoral goals of Trudeau and falls short of expectations regarding support for seniors and asylum seekers. Bloc Leader Yves-François Blanchet also highlighted perceived encroachments on Quebec’s provincial jurisdiction, particularly regarding housing issues.

Green Party co-leader Elizabeth May characterized the budget as emblematic of “box-checking politics,” criticizing it for offering insufficient measures to address the challenges facing Canadians. Despite initial optimism about key demands being mentioned in the budget, May expressed disappointment with the lack of systemic changes and deemed the Liberals to have failed the test posed by the country’s current challenges.

Information for this briefing was found via Bloomberg, Reuters, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.