Green Thumb Industries Inc. (CSE: GTII) announced that they will be reporting their third-quarter financial results on Wednesday, November 10th, after the market closes. The average revenue estimate between 14 analysts is US$233.25 million, while EBITDA is expected to be US$82.76 million with 13 analyst estimates.

There are currently 16 analysts who cover Green Thumb Industries with an average 12-month price target of C$58.84, or a 110% upside. Out of the 16 analysts, 4 have strong buy ratings while the other 12 have buy ratings. The street high price target is C$75.04 while the lowest comes in at C$45.

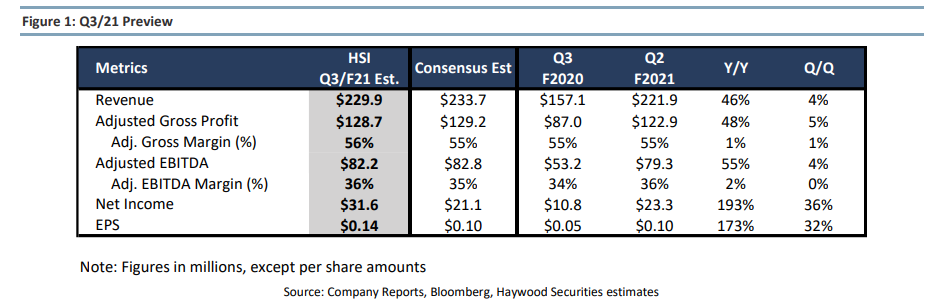

In Haywood Capital Markets earnings preview they reiterate their buy rating, but lower their 12-month price target to C$52 from C$56 as they lower overall growth expectations slightly.

For this quarter, Haywood’s revenue estimate is slightly below the consensus. They expect revenue to be US$229.9 million, or 4% growth sequentially and 46% year over year. They believe that gross margins and EBITDA margins will remain relatively flat and write, “we do expect continued margin expansion over the long-term,” but warn that current market conditions, as well as footprint expansions, will hit the companies margins.

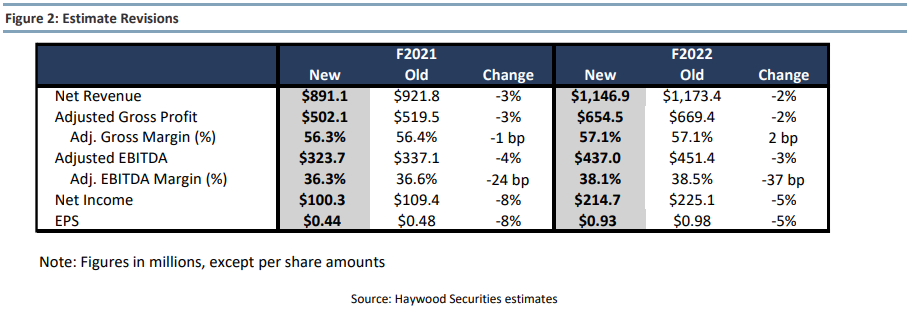

Below you can see Haywood’s updated 2021 and 2022 estimates, they say that the reason for the slight change is due to lower sales growth in some existing markets as well as sales in newly approved states.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.