Green Thumb Industries (CSE: GTII) reported their second-quarter results last week, with the company generating U$119.6 million in revenue. Revenues featured 16.6% growth quarter over quarter, and 167.5% year over year versus Refinitiv’s consensus estimate of U$102.5 million. Gross margins increased to 53.2% while adjusted operating EBITDA came in at U$35.4 million, up 38.6% quarter over quarter.

Currently, six analysts upgraded their 12-month price target while reiterating their buy ratings on Green Thumb.

- Benchmark raises price target to $17

- Alliance Global Partners raises price target to C$28 from C$23

- Haywood Capital raises target price to C$27 from C$20.50

- Cormark Securities raises price target to C$23 from C$20

- Eight Capital raises price target to C$26 from C$24

- Stifel GMP raises price target to C$42.50 from C$34

Thirteen analysts have a rating and a 12-month price target on Green Thumb. Two analysts hold a strong buy rating while the remaining 11 hold buy ratings. The mean 12-month price target is C$26.6 or a 35% upside, and the highest price target comes from Andrew Partheniou at Stifel with a C$42.50 price target, or 116% upside, while the lowest price target comes from Andrew Semple at Echelon Wealth Partners with a C$20 price target.

Canaccord’s Matt Bottomley reiterated their speculative buy rating on Green Thumb while increasing their price target to C$27 from C$22. They say that the company grew in all 12 of its markets with its branded products growing by ~22% while retail revenue were up 15.2%. Revenue came in above their forecast of $106.2 million. Gross Margin also came in above their estimate of 50%, and adjusted operating EBITDA was above the $26 million estimate. Adjusted EBITDA coming in at U$35.4 million makes it the second-highest adjusted EBITDA run-rate between all the multi-state operators, but Matt Bottomley states that GTII has. “a portfolio of assets with the optionality that could see it potentially take the #1 spot in the coming quarters.”

Bottomley also says Green Thumb has one of the most favorable balance sheets over many multi-state operators. Green Thumb has $83 million in cash on hand and a $33 million cash flow from operations, with the analyst stating that he believes Green Thumb is in a great spot to have no hiccups in continuing their initiatives. He also says that Illinois is the most material state, as it has the most value for Green Thumb at this time. Canaccord estimates that Green Thumb is currently competing with Cresco Labs for the #1 spot in the market and has a >20% market share, while forecasting that Illinois alone could reach $3.5 billion in annual sales.

Bottomley updated his full-year 2020 estimates for revenue, adjusted EBITDA and earnings per share to $508.4 million, $142.9 million, and $0.25, respectively, versus prior estimates of $456.4 million, $119.2 million and $0.20 per share.

Stifel’s Andrew Partheniou upgraded Green Thumbs’ 12-month price target to a new high of C$42.50 while reiterating Stifel’s buy rating. He says, “Resounding Q2 beat fortifies best operator status.” Just like Canaccord, Green Thumb beat all of Stifel’s forecasts. Revenue was forecasted at $103 million, adjusted EBITDA at $24 million, and gross margin was forecasted at 50.6%.

Andrew goes on to say, “better store productivity, and stronger wholesale drove higher margins.” Even though Massachusetts recreational sales were closed for two thirds of the quarter and had limited sales fulfillment in Nevada, curbside pickup and deals throughout the company’s platforms alongside highly profitable sales in Pennsylvania and Illinois helped drive the revenue beat.

Stifel, just like that of Canaccord, highlights Illinois as one of the more essential states for Green Thumb to be active in, with Illinois sales up 22% month over month and 50% since January. Partheniou states that there is currently, “substantial pent-up demand that once additional capacity comes online could catalyze significant acceleration in the growth of that market”

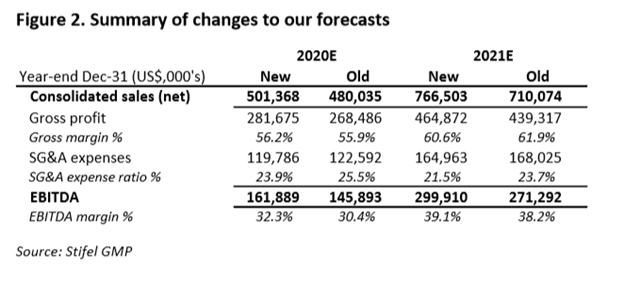

Stifel has adjusted full year 2020 and 2021 estimates for revenue and EBITDA, with forecasts now calling for revenues of $501.34 million and $766.5 million respectively, along with $161.9 million and $299.9 million in EBITDA.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.