Green Thumb Industries (CSE: GTII) reported its fourth-quarter and full-year financial results earlier this month. The company saw its revenues grow 60.5% year over year to $893.6 million while full-year earnings per share almost 5x to $0.34 per share, or a net income of $75.4 million. This is after paying $124.6 million in taxes for the year.

For the quarter, the company saw its growth slow as revenue, gross profits, and income before taxes grew 4.2%, 1.8%, and -14.3% this quarter respectively, compared to the 5.2%, 14.2%, and 10.5% growth it saw in the prior quarter. The company reported revenues of $243.6 million and a gross profit of $128.64 million for the fourth quarter.

A number of analysts slashed their 12-month price target, bringing the average down from C$55.41 to C$49.42, which represents a 145% upside to the current stock price. Green Thumb currently has 17 analysts covering it, with 5 having strong buy ratings and the other 12 having buy ratings. The street high sits at C$73, which represents a 262% upside.

In Stifel-GMP’s fourth-quarter review, they reiterate their buy rating but cut their 12-month price target from C$80 to C$73 saying that their view on the results are neutral and believes investors “may see a temporary period of muted growth as the company prepares for first harvests beginning in H2/22.” Combined with a number of states looking to be recreational in the near term, Stifel-GMP believes this will offer investors a “step-change” in the company’s growth profile.

For the quarterly results, Stifel expected revenues of $243 million, in line with the results. While gross profits of $129.5 million came in below their estimate of $133.4 million. Additionally, adjusted EBITDA of $81.2 million came in slightly lower than their $82.3 million estimates. Though, Green Thumb did beat on adjusted net income and earnings per share with the company almost doubling the estimate of $12.3 million and $0.05.

Stifel-GMP notes that management reported pricing pressures in both retail and wholesale across the board but mainly in Pennslyvania and Nevada. Stifel adds that basket sizes have also come down while the volume of purchases remains fairly stable. Stifel believes that the mid-to-low quality products have seen the most price compression as competitors continue to try and buy market share.

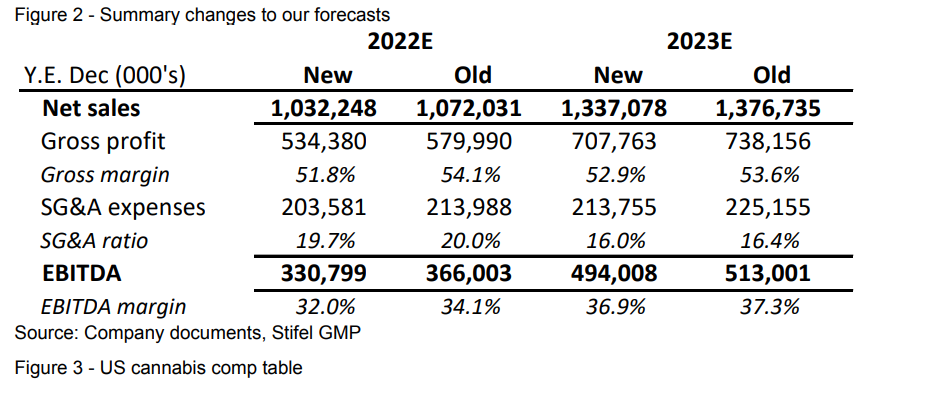

Lastly, you can see Stifel’s update estimates as they have lowered them off the back of “limited visibility to returning price competition and cost inflation, which flows through future quarters.” Though their estimates do not include any recreational sales from New Jersey, New York, or Connecticut.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.