On May 16, Equinox Gold (TSX: EQX) announced that they are temporarily suspending operations at their RDM Mine due to permit delays. The company has said that its permits for the tailing storage facility have been delayed, yet add that they are in active discussions with regulatory authorities.

Equinox Gold says that the tailings storage facility contractor is “ready to mobilize and commence work” and expects that full operations could restart, “as soon as two months from the receipt of regulatory approval,” which is expected during this month.

Equinox Gold currently has 12 analysts covering the stock with an average 12-month price target of C$12.75 or an upside of 80%. Out of the 12 analysts, 1 has a strong buy rating, 6 have buy ratings and the last 5 analysts have hold ratings on Equinox’s stock. The street high sits at C$17, which is an 140% upside to the current stock price.

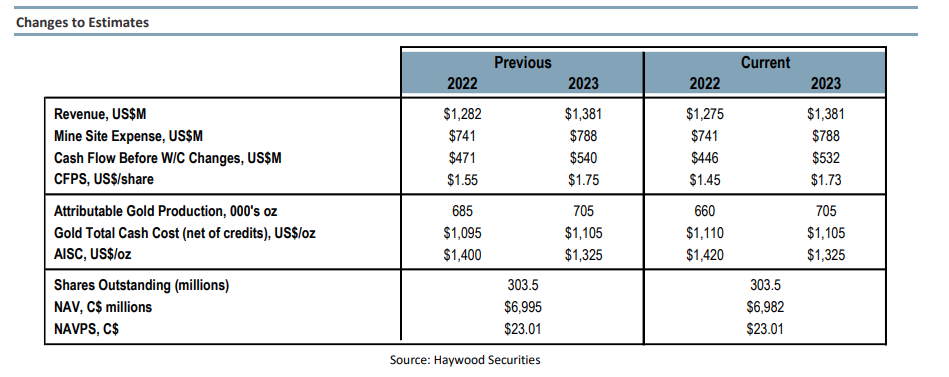

In Haywood Capital Markets’ note on the announcement, they reiterate their buy rating on the stock but lower their 12-month price target from C$17 to C$16, saying they have cut their full year production estimate by 3.6% to 660,000 ounces.

They believe that Equinox will see a resolution later this quarter as the company notes it’s in active discussions with the regulatory authorities. Though due to how long it takes to get the permit, they expect that the RDM mine will be closed for 3 months, which includes getting the operation back up and running.

Haywood has revised their estimates lower based on their timeline, though they note that management believes this could be resolved in about 2 months. Haywood comments that they will update their estimates again once the RDM mine is back and operational.

They now expect full-year production to be 660,000 ounces, down from 685,000 ounces. Additionally, they expect that cash costs will slightly come up, and are now estimating the figure at US$1,110 per ounce, up from US$1,095.

Lastly, Haywood remains bullish on the name and continues to recommend the firm “as one of the leading growth companies in the gold space.” They also believe that the company, despite the minor setbacks, currently has a pipeline of growth projects today and is “well on the way towards their goal of building a 1-million ounce producer by 2024.”

Below you can see Haywood’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.