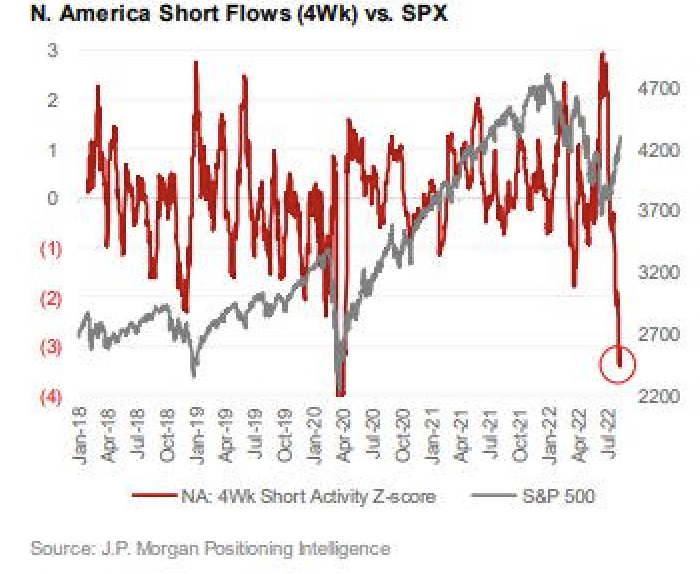

The S&P 500 Index and the NASDAQ Composite have rallied more than 11% and 14%, respectively, since June 16, 2022. Hedge funds’ first dramatically reducing short selling activity, and then covering shorts has played a significant role in this rousing recovery. The below graph shows that hedge fund shorting activity plunged to approximate four-year lows this summer (the red line in the graph).

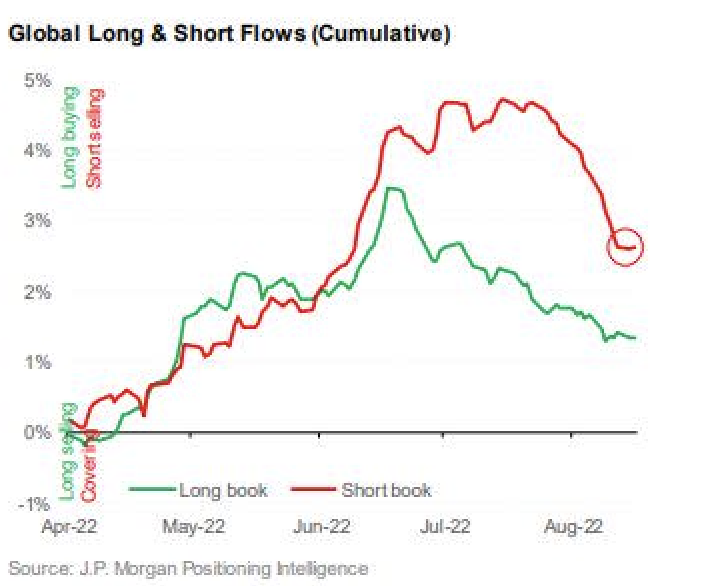

Now, it appears this crucial short covering demand element has slowed dramatically, which in turn could make achieving further market gains more difficult. According to JP Morgan, short covering slowed to a relative snail’s pace in the week ended August 19 (see the green line in the below figure). Perhaps more concerning: Bloomberg reports Goldman Sachs’ hedge fund clients may be starting to initiate or add to short positions. On August 17, hedge funds’ short bets against exchange-traded funds rose the most in more than two months.

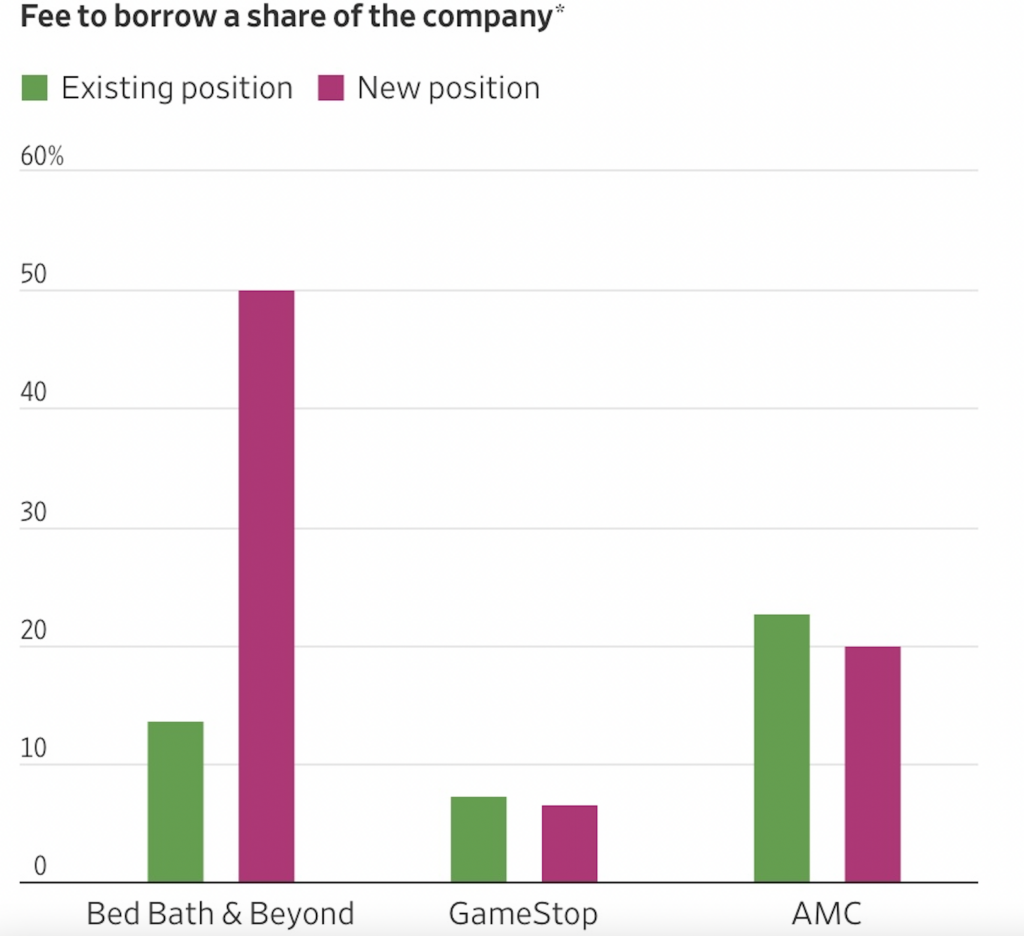

Shorting stocks which are already popular, or crowded, can be quite expensive, and a hedge fund which puts on such positions must be confident in its analysis. For example, initiating a new short position in AMC Entertainment Holdings, Inc. (NYSE: AMC) currently requires a 20% annualized “short locate” fee paid to a brokerage firm, according to S3 Partners. So, if a hedge fund holds on to a new AMC Entertainment short position for a year, it must believe that AMC will fall more than 20% during that period to earn a profit.

Note that short squeezes are not necessarily just short-term gains that are destined for a fairly rapid reversal lower. Indeed, many longer lasting market recoveries begin as short squeezes. For example, the rally off the post-Great Financial Crisis bottom in March 2009 began as a squeeze before transforming into a powerful move fueled by traditional buying of long positions.

It is worthwhile to know what hedge funds as a group are doing, but following their actions does not necessarily insure good performance. In July 2022, the average hedge fund gained 0.9%, according to PivotalPath, a leading hedge fund research and intelligence firm. This trailed the S&P 500’s 9.1% gain during the month by a large margin. For the seven months ended July 2022, the value of a typical hedge fund fell by 2.2% versus more than a 10% decline in the S&P 500.

Information for this briefing was found via Edgar, S3 Partners, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.